Growth in US container imports remains strong

Strong container import demand

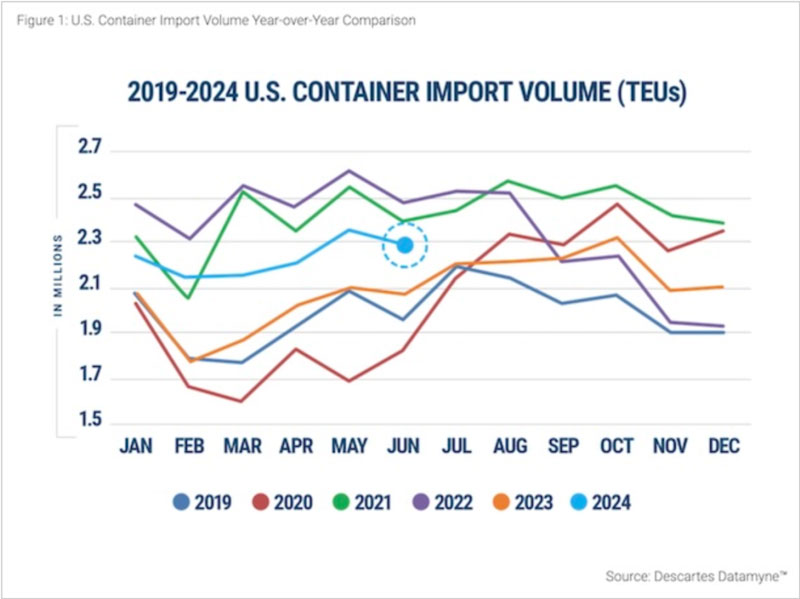

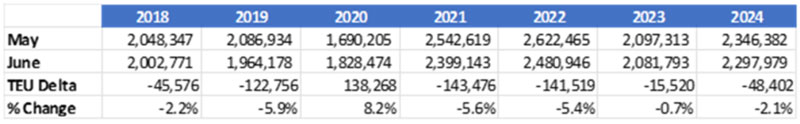

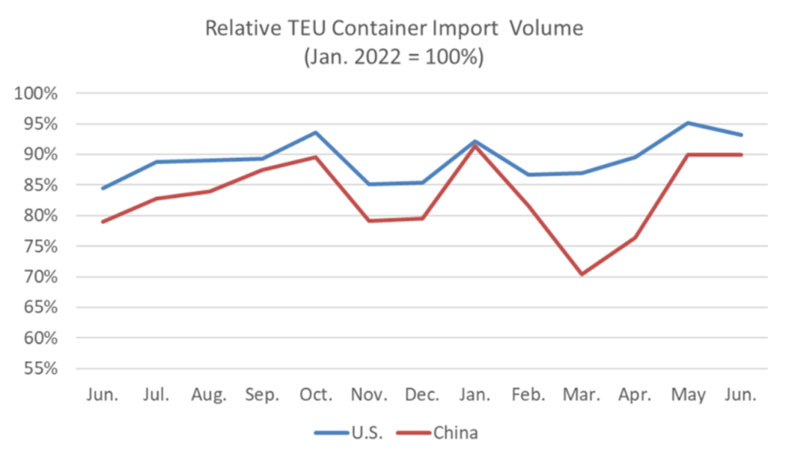

Despite early signs of weakness in container spot market prices, container imports at U.S. ports remain strong. According to Descartes, U.S. container imports in June 2024 fell 2.1% month-on-month from May, but increased 10.4% compared to the same period last year to 2.298 million TEU.

Descartes noted that despite strong imports of containerized goods into the United States, the risk of disruptions to global supply chains remains high due to conflicts in the Middle East and stalled labor negotiations at ports in the East and Gulf of Mexico affecting the stability of global trade.

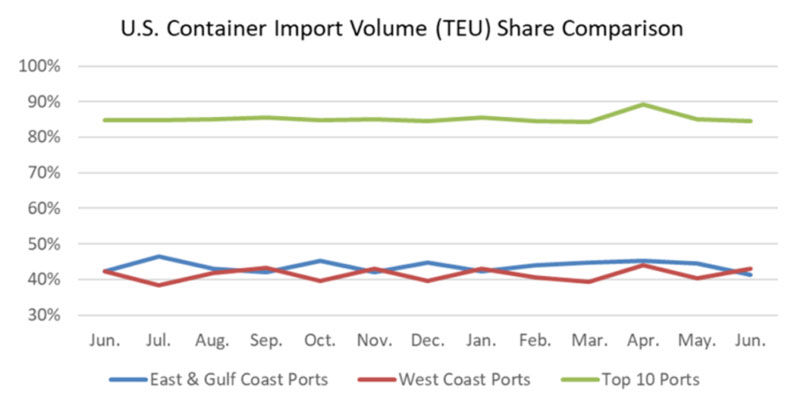

American and Western ports regain market share

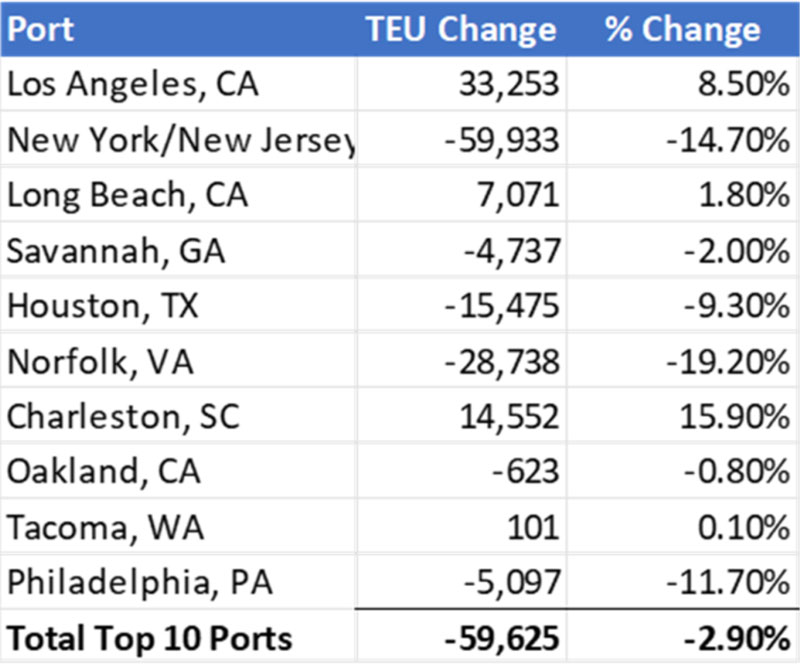

As the share of ports in the East and Gulf of Mexico declined, the share of ports in the West began to increase in May. In June 2024, the proportion of imported containers in the top five ports in the West of the United States increased to 44.6% of the total import container volume in the United States, and the top five ports in the East of the United States and the Gulf of Mexico decreased to 41.4%. Compared to smaller ports, the share of the top 10 U.S. ports remained at 86.1% in June 2024, a slight decline.

Despite early signs of weakness in container spot market prices, container imports at U.S. ports remain strong. According to Descartes, U.S. container imports in June 2024 fell 2.1% month-on-month from May, but increased 10.4% compared to the same period last year to 2.298 million TEU.

Descartes noted that despite strong imports of containerized goods into the United States, the risk of disruptions to global supply chains remains high due to conflicts in the Middle East and stalled labor negotiations at ports in the East and Gulf of Mexico affecting the stability of global trade.

American and Western ports regain market share

As the share of ports in the East and Gulf of Mexico declined, the share of ports in the West began to increase in May. In June 2024, the proportion of imported containers in the top five ports in the West of the United States increased to 44.6% of the total import container volume in the United States, and the top five ports in the East of the United States and the Gulf of Mexico decreased to 41.4%. Compared to smaller ports, the share of the top 10 U.S. ports remained at 86.1% in June 2024, a slight decline.