Ship prices are up 60% in six months and MSC is still buying second-hand vessels

In the first half of 2024, the global container ship trading volume surged, and MSC in particular performed actively in the ship trading market and continued to expand its fleet. Despite a 60% increase in ship prices in the past six months, MSC's enthusiasm for buying ships has continued, with the latest deal reaching a staggering price.

According to the latest news, the world's largest container shipping lines are still searching the market for second-hand vessels to buy.

The company is in final negotiations to buy two used Panamax containers, and based on current conditions, the deal is close to being completed, and the final transaction price could be very dramatic.

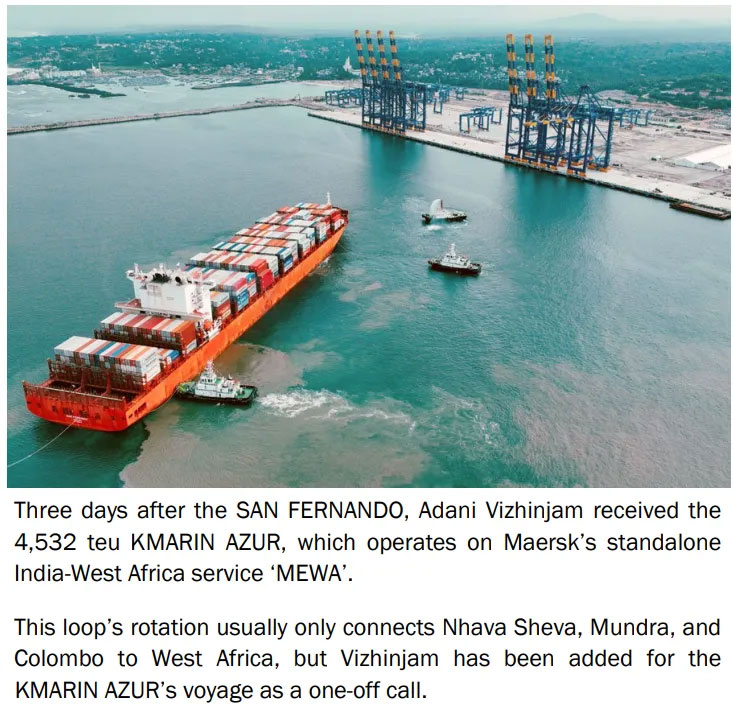

Specifically, the two ships involved in this transaction are the sister ships Kmarin Atlantica and Kmarin Azur (both built in 2013 and both of 4,582TEU).

Currently MSC is said to be willing to pay $53 million per unit for the two vessels, and MSC is already in the lead.

If this price is finally confirmed, it means that the market price of this type of vessel has risen wildly in half a year. Some analysts put the six-month rise at 60%.

In fact, according to Clarkson's latest data, the current price of a 10-year-old 4500TEU container ship is about $35 million, an increase of 30% in the last three months.

Container ship sales surged in the first half of 2024

In fact, according to the latest data provided by Alphaliner, the global container ship trading volume increased significantly in the first half of 2024.

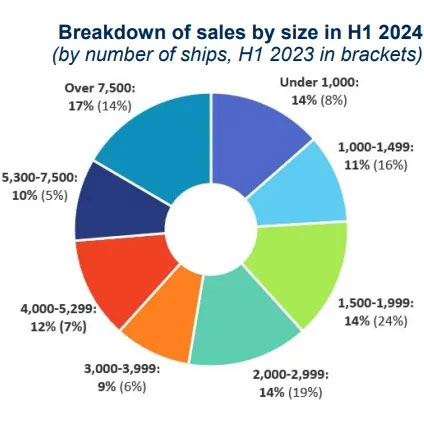

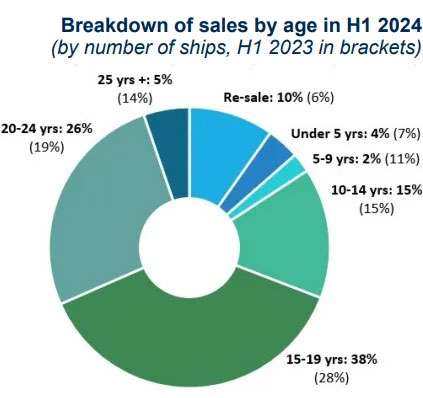

Alphaliner data shows that in the first half of 2024, a total of 141 vessels (572,600 TEU) with a total capacity of more than 500,000 TEU were bought and sold, which equates to an average of 23 vessels traded per month. By comparison, the average monthly transaction volume in the second half of 2023 was only 15.

The consultancy said the surge in transactions reflected a strong rebound in demand for vessels.

Alphaliner also said that the surge in container ship transactions in the first half of this year was mainly due to the increase in freight rates in the second half of 2023 and the hot charter market in the first half of 2024. Despite an increase in freight rates in the second half of 2023, the market's response to second-hand vessels was lagging and did not begin to show significant changes until January 2024.

The main market for buyers and sellers

In this wave of deals in the first six months of the year, MSC (Mediterranean Shipping) was once again the largest buyer, acquiring 33 vessels. In contrast, CMA CGM's purchase activity in the first half of 2024 was relatively muted, with the purchase of just five vessels. Major sellers include Maersk (8 Ships), V Ships Hamburg (8 ships), NSB Niederelbe (7 ships), Capital Ship Management (6 ships) and Shoei Kisen (5 ships).

Alphaliner also cited notable deals such as Yangming Shipping's purchase of three 11,714 TEU vessels from Shoei Kisen for a total of $297 million. Meanwhile, Peter Doehle bought the 9,954 TEU ARISTOMENIS for $51 million and three 9,954 TEU vessels from Capital Ship Management for a total of about $153 million. In addition, NOO MPC Container Ships acquired five vessels from related companies V Ships Hamburg, including two 4,256 TEU and three 3,700 TEU vessels.

Analysts at Alphaliner said S&P (ship buying and selling) prices continued to rise into July, which could lead to a reduction in market activity as shipping lines preferred to tap the charter market rather than sell assets.

Overall, the surge in global container ship buying and selling transactions in the first half of 2024 reflects the strong rebound in demand for vessels and the aggressive strategies of shipping lines in response to high rates and the boom in the charter market. In the future, as market dynamics change, trading volume and price movements still need to be closely watched.

According to the latest news, the world's largest container shipping lines are still searching the market for second-hand vessels to buy.

The company is in final negotiations to buy two used Panamax containers, and based on current conditions, the deal is close to being completed, and the final transaction price could be very dramatic.

Specifically, the two ships involved in this transaction are the sister ships Kmarin Atlantica and Kmarin Azur (both built in 2013 and both of 4,582TEU).

Currently MSC is said to be willing to pay $53 million per unit for the two vessels, and MSC is already in the lead.

If this price is finally confirmed, it means that the market price of this type of vessel has risen wildly in half a year. Some analysts put the six-month rise at 60%.

In fact, according to Clarkson's latest data, the current price of a 10-year-old 4500TEU container ship is about $35 million, an increase of 30% in the last three months.

Container ship sales surged in the first half of 2024

In fact, according to the latest data provided by Alphaliner, the global container ship trading volume increased significantly in the first half of 2024.

Alphaliner data shows that in the first half of 2024, a total of 141 vessels (572,600 TEU) with a total capacity of more than 500,000 TEU were bought and sold, which equates to an average of 23 vessels traded per month. By comparison, the average monthly transaction volume in the second half of 2023 was only 15.

The consultancy said the surge in transactions reflected a strong rebound in demand for vessels.

Alphaliner also said that the surge in container ship transactions in the first half of this year was mainly due to the increase in freight rates in the second half of 2023 and the hot charter market in the first half of 2024. Despite an increase in freight rates in the second half of 2023, the market's response to second-hand vessels was lagging and did not begin to show significant changes until January 2024.

The main market for buyers and sellers

In this wave of deals in the first six months of the year, MSC (Mediterranean Shipping) was once again the largest buyer, acquiring 33 vessels. In contrast, CMA CGM's purchase activity in the first half of 2024 was relatively muted, with the purchase of just five vessels. Major sellers include Maersk (8 Ships), V Ships Hamburg (8 ships), NSB Niederelbe (7 ships), Capital Ship Management (6 ships) and Shoei Kisen (5 ships).

Alphaliner also cited notable deals such as Yangming Shipping's purchase of three 11,714 TEU vessels from Shoei Kisen for a total of $297 million. Meanwhile, Peter Doehle bought the 9,954 TEU ARISTOMENIS for $51 million and three 9,954 TEU vessels from Capital Ship Management for a total of about $153 million. In addition, NOO MPC Container Ships acquired five vessels from related companies V Ships Hamburg, including two 4,256 TEU and three 3,700 TEU vessels.

Analysts at Alphaliner said S&P (ship buying and selling) prices continued to rise into July, which could lead to a reduction in market activity as shipping lines preferred to tap the charter market rather than sell assets.

Overall, the surge in global container ship buying and selling transactions in the first half of 2024 reflects the strong rebound in demand for vessels and the aggressive strategies of shipping lines in response to high rates and the boom in the charter market. In the future, as market dynamics change, trading volume and price movements still need to be closely watched.