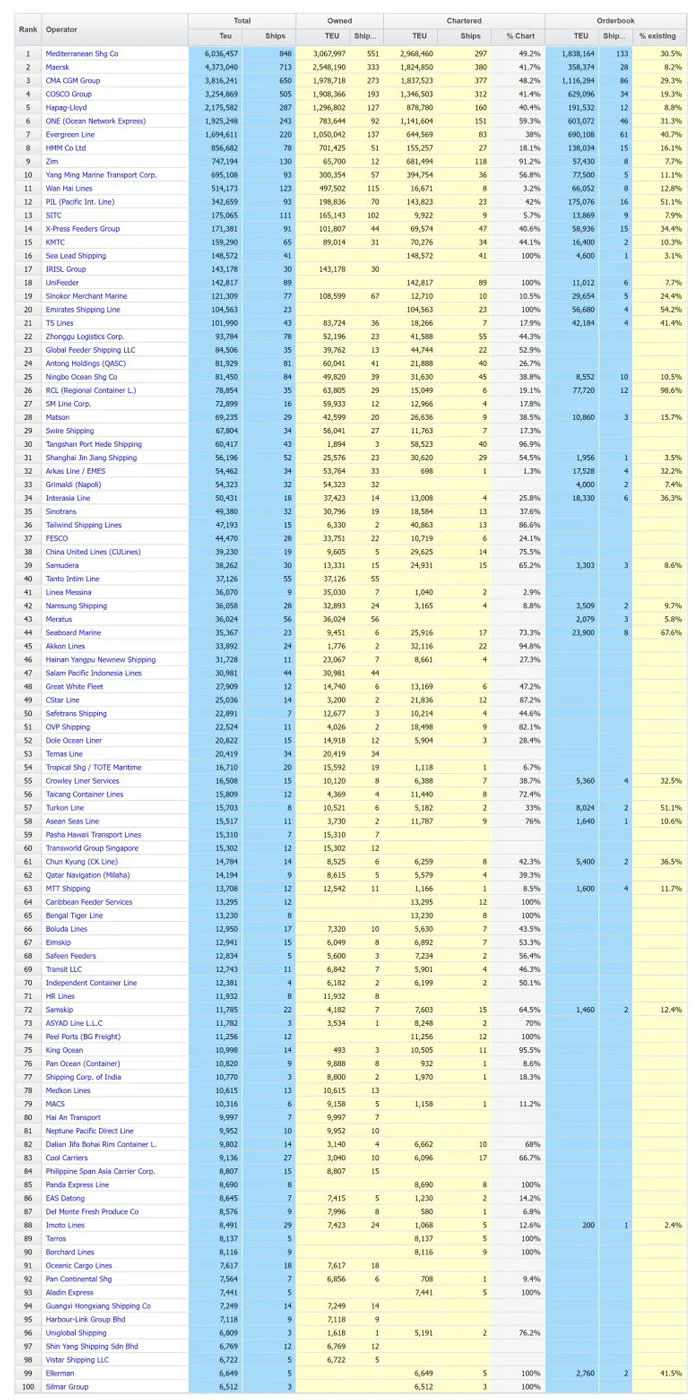

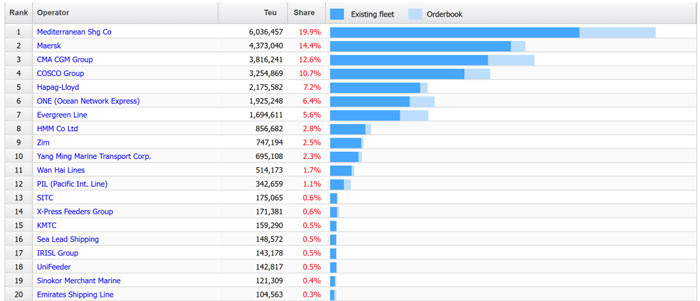

Ranking the world's top 100 container liner companies by capacity, 16 Chinese liner companies made the list

According to the latest data, as of August 20, 2024, the number of container ships in operation worldwide totaled 7,049 (of which 6,260 are pure container ships and others are multi-purpose vessels), with a total capacity of 30.4936 million TEU, equivalent to about 361 million deadweight tons.

Although the Clarkson container ship new build price index hit a 16-year high, between July 1 and August 12, MSC ordered 24 new ships with a total capacity of 480,000 TEU, CMA CGM ordered 12, ONE ordered 10, and Wan Hai Shipping also ordered 20. In less than a month and a half, shipping companies have placed orders for more than one million TEU of new vessels, and in June, Seaspan ordered 27 new vessels. These orders are not small ships, starting at 8,000 TEU, and MB Brokers forecasts that new container ship orders will reach 2.2 million TEU this year. In a new wave of orders, there are even rumors that Rongsheng Heavy Industry is about to revive.

Analysts have always warned of the risk of overcapacity, but shipping companies that have experienced two black swan events, the epidemic and the Red Sea crisis, believe that with a ship in hand, the heart is not panicked, the pocket will not be empty. Maersk, which did not aggressively expand capacity, earned much less and needed high-priced charters to maintain service after the Red Sea crisis. The CEO of Hapag-Lloyd bluntly said that it is good to have some idle capacity, and it is difficult to accurately predict changes in supply and demand.

Maersk's transformation of full-service logistics services to get rid of the shipping cycle has not been successful, because of this, shipping companies are still accustomed to the old road, through self-owned vessels to reduce operating costs and seize more market share to resist the cycle. Shipping alliance reshuffle, ship carbon tax requirements and other factors have also made shipping companies more willing to take the initiative in their own hands.

In addition, Maersk, which has been leading the industry, also acknowledged another reality, green methanol is expensive, there is a gap in supply capacity, and it can not be large-scale application in a short time, and Maersk, which is firmly on the methanol fuel route, began to order new ships driven by biological LNG fuel. Some environmentalists see this as a step backwards, but Maersk's customers are not unhappy, suggesting that the market encourages or acquiesces in a more robust approach.

There is a new name in the top 20 - Emirates Shipping Line (ESL). The shipping company is also a product of the previous cycle. In 2006 Vikas Khan founded Emirates Shipping, a Dubai-based shipping company that saw its business grow by 30% in a year and entered the American market. However, after the financial crisis, the United Arab Emirates shipping in trouble, withdraw from the United States line, Vikas Khan resigned as chairman, once by the founder of Desxiang Shipping Chen Desheng took over, in the low ebb of the liner industry cycle, the two shipping companies "stay warm", cooperation to cut costs. Today, Emirates Shipping focuses on a number of regional markets, covering East Asia, South Asia, the Middle East and East Africa, and still shares some branch services with regional shipping companies such as Desxiang Shipping.

The resurgence of UAE shipping also points to a new development in the liner industry. In recent years, the presence of Ports and carriers in the Middle East, including AD Ports' Global Feeder Shipping, Safeen Feeders, and CStar Line, founded by former Maersk executives, has increased, indicating that demand is growing in the relevant regional markets. Terminal operators such as AD Ports, Red Sea Gateway Terminals (RSGT) and Qterminals are also looking overseas for growth. The growth of port and shipping power in the Middle East and even the Indian Ocean region (such as Turkey's Yilport, Adani Port Group, Indian National Shipping Company) is worth observing.

A total of 16 mainland Chinese shipping companies (some registered in Hong Kong) made the list, They are COSCO Shipping (4th), Haifeng International (13th), China Cereals Flow (22nd), Antong Holdings (24th), Ningbo COSCO (25th), Tangshan Port Hede Shipping (30th), Shanghai Jinjiang Shipping (33rd), Sinotrans Shipping (35th), China United Shipping (38th), Hainan Yangpu Xinxin Shipping (46th) and Anfu Shipping (50th) ), Haiyitong Shipping (No. 51), Taicang Port Container Shipping (No. 56), Dalian Jifa Huan Bohai Container Transportation Co., LTD. (No. 82), Datong International Shipping (No. 86), Guangxi Hongxiang Shipping (No. 94).

Since the first half of 2022, the new capacity of the domestic trade consolidation market has been close to 300,000 TEU, and due to the continuous delivery of a large number of new ship capacity, the market freight rate has fallen sharply in the first half of this year, which is close to a historic low. Some shipping companies will turn their eyes to the foreign trade market, or charter ships to foreign trade shipping companies to collect rent, or further out of the East Asia region, to develop overseas business, such as the launch of the US-West e-commerce express line of Hede Shipping, directly connected to the Middle East Ningbo Ocean. However, if the foreign trade market returns to normal and the capacity returns, the capacity of the domestic trade market will be more difficult to digest, and domestic trade shipping companies need to explore more ways such as alliance to get out of the inner volume.

Although the Clarkson container ship new build price index hit a 16-year high, between July 1 and August 12, MSC ordered 24 new ships with a total capacity of 480,000 TEU, CMA CGM ordered 12, ONE ordered 10, and Wan Hai Shipping also ordered 20. In less than a month and a half, shipping companies have placed orders for more than one million TEU of new vessels, and in June, Seaspan ordered 27 new vessels. These orders are not small ships, starting at 8,000 TEU, and MB Brokers forecasts that new container ship orders will reach 2.2 million TEU this year. In a new wave of orders, there are even rumors that Rongsheng Heavy Industry is about to revive.

Analysts have always warned of the risk of overcapacity, but shipping companies that have experienced two black swan events, the epidemic and the Red Sea crisis, believe that with a ship in hand, the heart is not panicked, the pocket will not be empty. Maersk, which did not aggressively expand capacity, earned much less and needed high-priced charters to maintain service after the Red Sea crisis. The CEO of Hapag-Lloyd bluntly said that it is good to have some idle capacity, and it is difficult to accurately predict changes in supply and demand.

Maersk's transformation of full-service logistics services to get rid of the shipping cycle has not been successful, because of this, shipping companies are still accustomed to the old road, through self-owned vessels to reduce operating costs and seize more market share to resist the cycle. Shipping alliance reshuffle, ship carbon tax requirements and other factors have also made shipping companies more willing to take the initiative in their own hands.

In addition, Maersk, which has been leading the industry, also acknowledged another reality, green methanol is expensive, there is a gap in supply capacity, and it can not be large-scale application in a short time, and Maersk, which is firmly on the methanol fuel route, began to order new ships driven by biological LNG fuel. Some environmentalists see this as a step backwards, but Maersk's customers are not unhappy, suggesting that the market encourages or acquiesces in a more robust approach.

There is a new name in the top 20 - Emirates Shipping Line (ESL). The shipping company is also a product of the previous cycle. In 2006 Vikas Khan founded Emirates Shipping, a Dubai-based shipping company that saw its business grow by 30% in a year and entered the American market. However, after the financial crisis, the United Arab Emirates shipping in trouble, withdraw from the United States line, Vikas Khan resigned as chairman, once by the founder of Desxiang Shipping Chen Desheng took over, in the low ebb of the liner industry cycle, the two shipping companies "stay warm", cooperation to cut costs. Today, Emirates Shipping focuses on a number of regional markets, covering East Asia, South Asia, the Middle East and East Africa, and still shares some branch services with regional shipping companies such as Desxiang Shipping.

The resurgence of UAE shipping also points to a new development in the liner industry. In recent years, the presence of Ports and carriers in the Middle East, including AD Ports' Global Feeder Shipping, Safeen Feeders, and CStar Line, founded by former Maersk executives, has increased, indicating that demand is growing in the relevant regional markets. Terminal operators such as AD Ports, Red Sea Gateway Terminals (RSGT) and Qterminals are also looking overseas for growth. The growth of port and shipping power in the Middle East and even the Indian Ocean region (such as Turkey's Yilport, Adani Port Group, Indian National Shipping Company) is worth observing.

A total of 16 mainland Chinese shipping companies (some registered in Hong Kong) made the list, They are COSCO Shipping (4th), Haifeng International (13th), China Cereals Flow (22nd), Antong Holdings (24th), Ningbo COSCO (25th), Tangshan Port Hede Shipping (30th), Shanghai Jinjiang Shipping (33rd), Sinotrans Shipping (35th), China United Shipping (38th), Hainan Yangpu Xinxin Shipping (46th) and Anfu Shipping (50th) ), Haiyitong Shipping (No. 51), Taicang Port Container Shipping (No. 56), Dalian Jifa Huan Bohai Container Transportation Co., LTD. (No. 82), Datong International Shipping (No. 86), Guangxi Hongxiang Shipping (No. 94).

Since the first half of 2022, the new capacity of the domestic trade consolidation market has been close to 300,000 TEU, and due to the continuous delivery of a large number of new ship capacity, the market freight rate has fallen sharply in the first half of this year, which is close to a historic low. Some shipping companies will turn their eyes to the foreign trade market, or charter ships to foreign trade shipping companies to collect rent, or further out of the East Asia region, to develop overseas business, such as the launch of the US-West e-commerce express line of Hede Shipping, directly connected to the Middle East Ningbo Ocean. However, if the foreign trade market returns to normal and the capacity returns, the capacity of the domestic trade market will be more difficult to digest, and domestic trade shipping companies need to explore more ways such as alliance to get out of the inner volume.

gangkouquan believes that whether foreign trade or domestic trade, the practice of shipping companies is still quite traditional or even boring, through the expansion of capacity to win market share, new players or new attempts can not escape the theme of "volume". In an industry where conservatives are more successful and innovators lack positive feedback, it is not just the ship companies that are to blame.