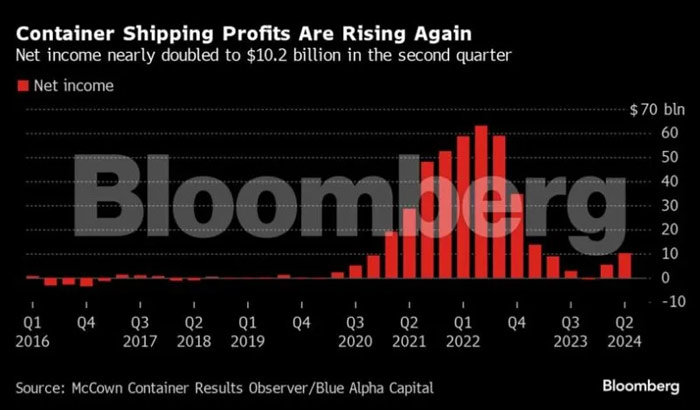

Profits in the global container shipping industry surged by more than $10 billion in the second quarter

Recently, the global container shipping industry soared more than $10 billion in profits in the second quarter, causing concern in the industry. According to industry experts, the industry is expected to achieve further growth in the coming quarters.

Recently, the world's well-known shipping consulting agency Container Trades Statistics Ltd released the latest research report, announced the global container shipping industry in the second quarter achieved amazing results. According to the report, the world's major container carriers such as Denmark's A.P. Moller-Maersk A/S and China's COsco Shipping Holdings Co., Ltd. have significantly surpassed the level of net profit in the first three months of this year, more than doubling from the same period last year to a staggering more than $10 billion.

Notably, this figure not only set a new record for the second quarter of this year, but also surpassed the $8.88 billion recorded in the second quarter of 2023. John McCown, an industry expert, said profits were expected to continue to show "substantial growth" in the current quarter, given the strong performance of the international goods trade market.

Now, with the diversion of the Red Sea forcing ships to bypass southern Africa, capacity constraints are increasing, pushing up spot container rates and causing congestion at some major ports. Despite the challenges, global 20-foot container throughput reached a record high of 46.4 million in the first half of the year, surpassing the previous record of 46.2 million set in the second quarter of 2021.

"Strike action in coastal areas, and even at key ports, would have a severe impact on the container networks of major carriers and would quickly ripple out to routes outside the United States," McCown said in the report.

Recently, the world's well-known shipping consulting agency Container Trades Statistics Ltd released the latest research report, announced the global container shipping industry in the second quarter achieved amazing results. According to the report, the world's major container carriers such as Denmark's A.P. Moller-Maersk A/S and China's COsco Shipping Holdings Co., Ltd. have significantly surpassed the level of net profit in the first three months of this year, more than doubling from the same period last year to a staggering more than $10 billion.

Notably, this figure not only set a new record for the second quarter of this year, but also surpassed the $8.88 billion recorded in the second quarter of 2023. John McCown, an industry expert, said profits were expected to continue to show "substantial growth" in the current quarter, given the strong performance of the international goods trade market.

Now, with the diversion of the Red Sea forcing ships to bypass southern Africa, capacity constraints are increasing, pushing up spot container rates and causing congestion at some major ports. Despite the challenges, global 20-foot container throughput reached a record high of 46.4 million in the first half of the year, surpassing the previous record of 46.2 million set in the second quarter of 2021.

"Strike action in coastal areas, and even at key ports, would have a severe impact on the container networks of major carriers and would quickly ripple out to routes outside the United States," McCown said in the report.