European and American route freight fell for 10 weeks, the traditional peak season has an early end trend

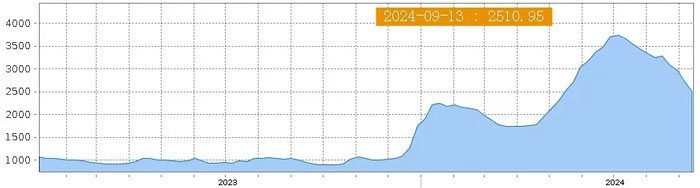

The Shanghai Composite Container Freight Index (SCFI) for export has fallen for 10 consecutive weeks since July 5, when it hit a year high of 3,733.8 points. As of Sept. 13, the SCFI stood at 2,511.0 points, down 7.9 percent from a week earlier and 32.7 percent from early July.

Freight rates on major markets in Europe and the United States fell sharply.

On September 13, the freight rate (sea freight and sea surcharge) for exports from Shanghai port to the European basic port market was 2,841 US dollars /TEU, down 17.9% from a week ago, and sharply down 41.5% from the beginning of July. The freight rate (sea freight and sea surcharge) for exports from Shanghai port to the Mediterranean basic port market was $3,365 /TEU, down 12.0% from a week ago and 38.1% from the beginning of July.

In addition, the freight rates (sea freight and sea surcharge) for exports from the port of Shanghai to the basic port market of the West and East of the United States were 5,494 US dollars /FEU and 6,838 US dollars /FEU, respectively, down 2.0% and 9.0% from a week ago, and down 32.2% and 31.2% from the beginning of July.

For the recent freight market trend, Shanghai Shipping Exchange analysts believe that the current European route capacity is at a high level, the traditional peak season has an early end trend. With the decline in market volume, most shipping companies have opened the strategy of lowering prices, and market competition has intensified. At the same time, the transportation demand in the US market lacks growth momentum and the supply and demand fundamentals lack support.

The above analysts further said that there are more risk factors in the current container market, including the tense geopolitical situation, the threat of strikes in the eastern port of the United States, Sino-European and Sino-US trade relations, etc., and will still face greater uncertainty in the coming period.

According to past experience, every year before China's "National Day" golden Week, the market will see a wave of peak shipments, but this year's peak does not seem to have arrived, and may not come. Some foreign industry analysts said that this year's transportation season has ended ahead of schedule.

Delury said that affected by the threat of strikes in the eastern ports of the United States, the cargo originally destined for the eastern ports of the United States is being transferred to the western ports of the United States, which makes the eastern routes of the United States freight rates fell sharply. The agency also believes that due to the weak demand for east-west main routes, freight rates will fall further in the next few weeks.

Freightos chief analyst Judah Levine said that there are still large differences between the labor and capital of the United States East terminal on issues such as wages and port automation, and with the suspension of negotiations, the possibility of workers striking is becoming more and more likely, and the freight rate of the United States East route may soon drop significantly.

According to a statement released by the Office of the US Trade Representative, on September 13 local time, the US Biden administration said that the United States has finalized the increase of tariffs on some Chinese-made products.

Starting September 27, tariffs on Chinese-made electric vehicles will rise to 100 percent, solar cells to 50 percent, and electric vehicle batteries, key minerals, steel, aluminum, masks and shore container cranes to 25 percent. In addition, tariff increases on other products, including semiconductor chips, will also take effect over the next two years.

This policy will undoubtedly greatly affect Sino-US trade, and the outlook for the quantity of goods is not optimistic.

Shanghai export container comprehensive freight index chart

Freight rates on major markets in Europe and the United States fell sharply.

On September 13, the freight rate (sea freight and sea surcharge) for exports from Shanghai port to the European basic port market was 2,841 US dollars /TEU, down 17.9% from a week ago, and sharply down 41.5% from the beginning of July. The freight rate (sea freight and sea surcharge) for exports from Shanghai port to the Mediterranean basic port market was $3,365 /TEU, down 12.0% from a week ago and 38.1% from the beginning of July.

In addition, the freight rates (sea freight and sea surcharge) for exports from the port of Shanghai to the basic port market of the West and East of the United States were 5,494 US dollars /FEU and 6,838 US dollars /FEU, respectively, down 2.0% and 9.0% from a week ago, and down 32.2% and 31.2% from the beginning of July.

For the recent freight market trend, Shanghai Shipping Exchange analysts believe that the current European route capacity is at a high level, the traditional peak season has an early end trend. With the decline in market volume, most shipping companies have opened the strategy of lowering prices, and market competition has intensified. At the same time, the transportation demand in the US market lacks growth momentum and the supply and demand fundamentals lack support.

The above analysts further said that there are more risk factors in the current container market, including the tense geopolitical situation, the threat of strikes in the eastern port of the United States, Sino-European and Sino-US trade relations, etc., and will still face greater uncertainty in the coming period.

According to past experience, every year before China's "National Day" golden Week, the market will see a wave of peak shipments, but this year's peak does not seem to have arrived, and may not come. Some foreign industry analysts said that this year's transportation season has ended ahead of schedule.

Delury said that affected by the threat of strikes in the eastern ports of the United States, the cargo originally destined for the eastern ports of the United States is being transferred to the western ports of the United States, which makes the eastern routes of the United States freight rates fell sharply. The agency also believes that due to the weak demand for east-west main routes, freight rates will fall further in the next few weeks.

Freightos chief analyst Judah Levine said that there are still large differences between the labor and capital of the United States East terminal on issues such as wages and port automation, and with the suspension of negotiations, the possibility of workers striking is becoming more and more likely, and the freight rate of the United States East route may soon drop significantly.

According to a statement released by the Office of the US Trade Representative, on September 13 local time, the US Biden administration said that the United States has finalized the increase of tariffs on some Chinese-made products.

Starting September 27, tariffs on Chinese-made electric vehicles will rise to 100 percent, solar cells to 50 percent, and electric vehicle batteries, key minerals, steel, aluminum, masks and shore container cranes to 25 percent. In addition, tariff increases on other products, including semiconductor chips, will also take effect over the next two years.

This policy will undoubtedly greatly affect Sino-US trade, and the outlook for the quantity of goods is not optimistic.