Oversupply in the container shipping market has accelerated the decline in freight rates

The United States East strike officially ended on the 4th of this month, and industry analysts pointed out that with the arrival of the off-season and the use of a large number of new ships, freight rates are expected to accelerate the decline. The person in charge of a large freight forwarding company agrees with this, that the freight rate is difficult to maintain, and the decline is an inevitable trend.

However, shipping companies may stabilize freight rates by adjusting shipping space, so freight rates will not necessarily drop sharply immediately, and we need to wait until after the Golden Week holiday to further observe.

Industry officials also mentioned that because of fears of a possible strike in the East of the United States, American importers have brought forward their purchases this year, which could lead to an even quieter off-season in the fourth quarter. Although some of China's shipments to the United States are dispersed to Southeast Asia, China still accounts for nearly 60 percent of Asian shipments to the United States. Therefore, after the October holiday will be the main time to observe the market changes.

However, there is another view that due to poor market conditions, rates may fall quickly to a level that will allow non-alliance vessels with higher operating costs to exit the U.S. market. But the price will remain above the level at which Alliance ships can make a profit, for example, the rate on the American West Line is likely to be between $2,000 and $2,500 per large (40-foot) container. In addition, for the new alliance layout next year, the shipping company may also cut prices to win more customer support.

The latest edition of the Delury Container Freight Index (WCI) shows a weekly decline of 5 per cent in composite rates. Even in the face of the strike of the eastern port of the United States, which started on October 1, the freight rate of the Eastern line of the United States released on the 3rd still showed a downward trend. With the end of the strike in the East of the United States on April 4, the rate drop is likely to accelerate further.

At the same time, the European and Mediterranean routes were also affected by the Red Sea crisis, which required ships to circumnavigate, resulting in a drop in freight rates of 8% and 9% respectively. It was down 4 percent in the West and 2 percent in the East. The impact of the end of the strike will be reflected in freight rates to be published next Thursday, October 10.

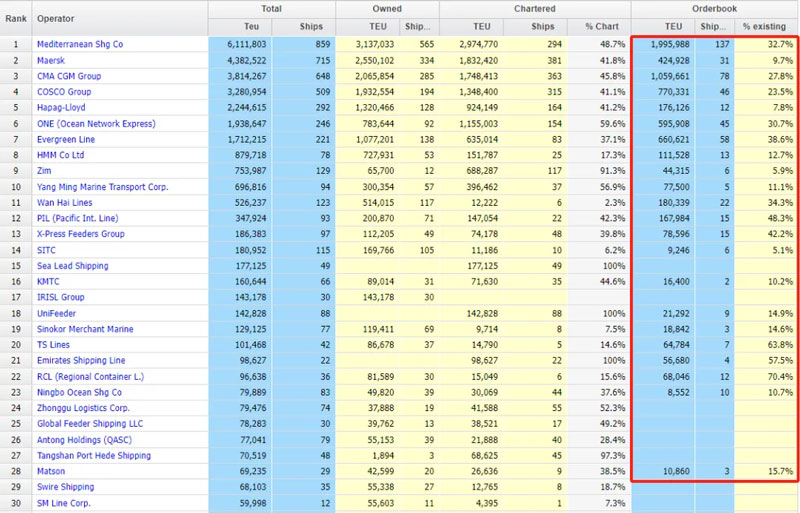

On the whole, the container shipping market is facing huge oversupply pressure.

The current backlog of new ships will increase the global supply of container ships by 22%, and this pressure will continue to rise. New ship deliveries are also continuing to hit new highs, with 2.3 million container ships delivered in the full year of 2023, compared with 2.14 million in the first eight months of 2024.

However, shipping companies may stabilize freight rates by adjusting shipping space, so freight rates will not necessarily drop sharply immediately, and we need to wait until after the Golden Week holiday to further observe.

Industry officials also mentioned that because of fears of a possible strike in the East of the United States, American importers have brought forward their purchases this year, which could lead to an even quieter off-season in the fourth quarter. Although some of China's shipments to the United States are dispersed to Southeast Asia, China still accounts for nearly 60 percent of Asian shipments to the United States. Therefore, after the October holiday will be the main time to observe the market changes.

However, there is another view that due to poor market conditions, rates may fall quickly to a level that will allow non-alliance vessels with higher operating costs to exit the U.S. market. But the price will remain above the level at which Alliance ships can make a profit, for example, the rate on the American West Line is likely to be between $2,000 and $2,500 per large (40-foot) container. In addition, for the new alliance layout next year, the shipping company may also cut prices to win more customer support.

The latest edition of the Delury Container Freight Index (WCI) shows a weekly decline of 5 per cent in composite rates. Even in the face of the strike of the eastern port of the United States, which started on October 1, the freight rate of the Eastern line of the United States released on the 3rd still showed a downward trend. With the end of the strike in the East of the United States on April 4, the rate drop is likely to accelerate further.

At the same time, the European and Mediterranean routes were also affected by the Red Sea crisis, which required ships to circumnavigate, resulting in a drop in freight rates of 8% and 9% respectively. It was down 4 percent in the West and 2 percent in the East. The impact of the end of the strike will be reflected in freight rates to be published next Thursday, October 10.

On the whole, the container shipping market is facing huge oversupply pressure.

The current backlog of new ships will increase the global supply of container ships by 22%, and this pressure will continue to rise. New ship deliveries are also continuing to hit new highs, with 2.3 million container ships delivered in the full year of 2023, compared with 2.14 million in the first eight months of 2024.