Shares of shipping companies tumbled after a port strike in the eastern United States ended early

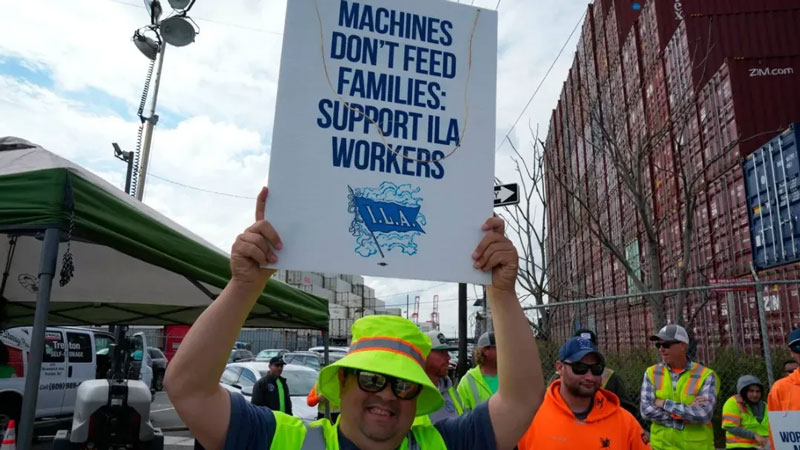

On October 3, the International Longshoremen's Association (ILA) and the United States Maritime Union (USMX) reached a preliminary agreement on wages and decided to extend the main contract until January 15, 2025, in order to continue negotiations on other outstanding issues in the meantime. The agreement also confirms the immediate cessation of all strike action and the resumption of work covered by the main contract.

In response to the risk of strikes, a number of shipping companies have announced that they will introduce surcharges in October, which has caused dissatisfaction across the shipping market, arguing that shipping companies should not take advantage of the looting at this time.

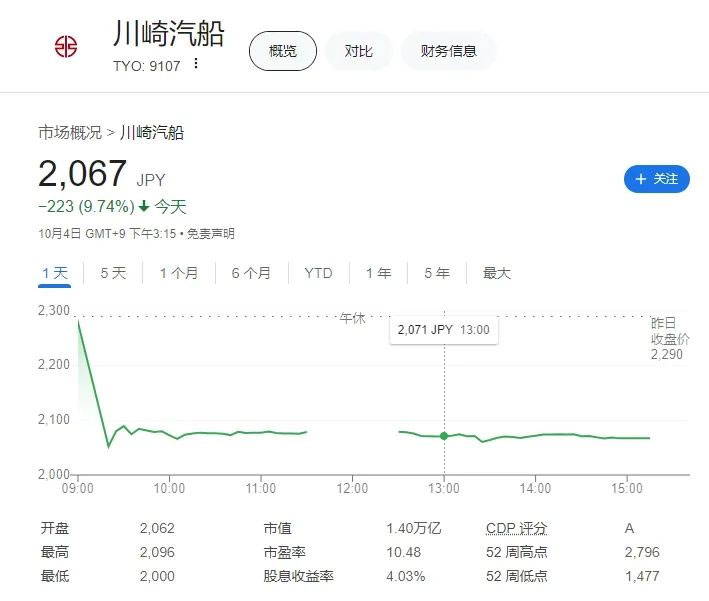

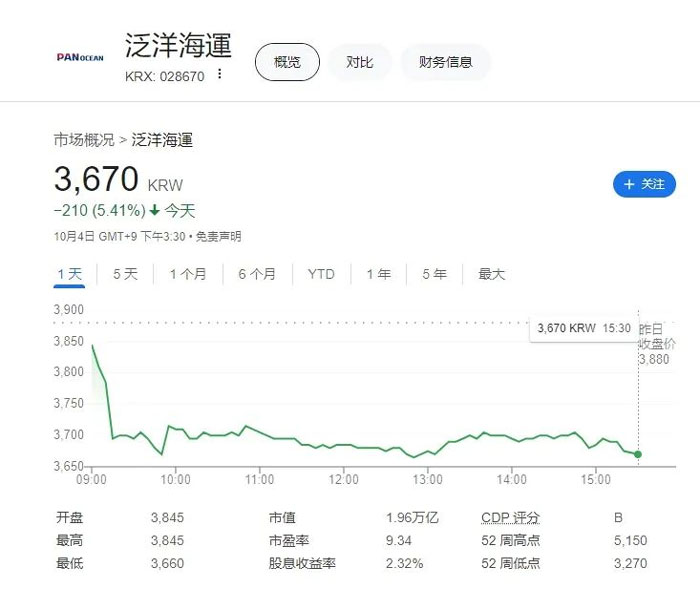

But in a dramatic twist, the strike ended after just three days, surprising the shipping companies that had proposed the surcharge before the strike. Shipping stocks in Asia plunged after longshoremen at US East Coast and Gulf Coast ports agreed to suspend a strike, dampening expectations of a sharp rise in container rates due to reduced supply.

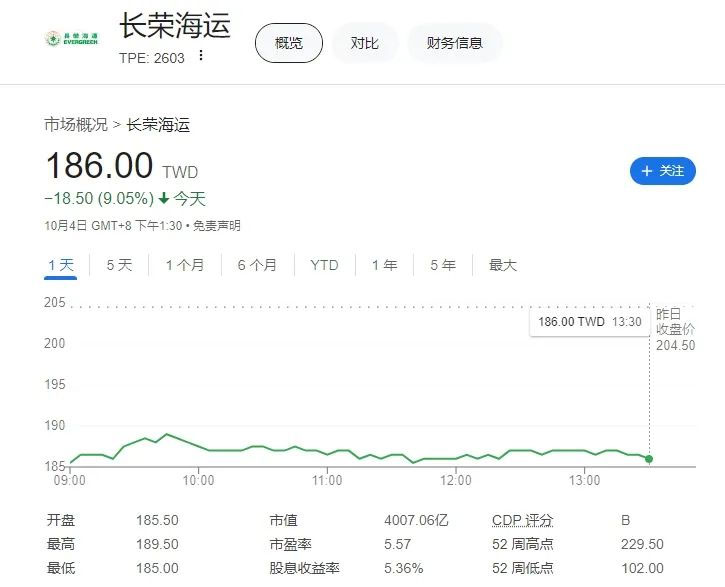

In terms of share prices, shares of Evergreen Shipping, Wan Hai Shipping and Yangming Shipping fell 8.8 to 10 per cent in Taiwan, the biggest drop in months.

Tsuyoshi Hori, an analyst at Mito Securities, said: "Stocks related to the container shipping market have continued due to the ongoing strike, however, the suspension of the strike means that bullish hopes have been dashed and short-term traders have reversed the trading trend."

Affected by multiple factors, the stock prices of shipping companies such as Maersk and Hapag-Lloyd fell sharply after the strike in the East of the United States. Copenhagen-listed Maersk fell 8.6 per cent, the biggest drop in eight months. Hapag-lloyd's shares fell 12.8 per cent in Frankfurt.

Although the labor and management have reached a preliminary agreement on the salary increase, the 61.5% level is still a gap with the 77% proposed by the labor side, and the possibility of further salary increases cannot be ruled out in the formal negotiations.

According to the Wall Street Journal, the additional cost of salary increases will be shared by shippers and shipping companies, and shipping companies are "under great pressure."

In response to the risk of strikes, a number of shipping companies have announced that they will introduce surcharges in October, which has caused dissatisfaction across the shipping market, arguing that shipping companies should not take advantage of the looting at this time.

But in a dramatic twist, the strike ended after just three days, surprising the shipping companies that had proposed the surcharge before the strike. Shipping stocks in Asia plunged after longshoremen at US East Coast and Gulf Coast ports agreed to suspend a strike, dampening expectations of a sharp rise in container rates due to reduced supply.

In terms of share prices, shares of Evergreen Shipping, Wan Hai Shipping and Yangming Shipping fell 8.8 to 10 per cent in Taiwan, the biggest drop in months.

Tsuyoshi Hori, an analyst at Mito Securities, said: "Stocks related to the container shipping market have continued due to the ongoing strike, however, the suspension of the strike means that bullish hopes have been dashed and short-term traders have reversed the trading trend."

Affected by multiple factors, the stock prices of shipping companies such as Maersk and Hapag-Lloyd fell sharply after the strike in the East of the United States. Copenhagen-listed Maersk fell 8.6 per cent, the biggest drop in eight months. Hapag-lloyd's shares fell 12.8 per cent in Frankfurt.

Although the labor and management have reached a preliminary agreement on the salary increase, the 61.5% level is still a gap with the 77% proposed by the labor side, and the possibility of further salary increases cannot be ruled out in the formal negotiations.

According to the Wall Street Journal, the additional cost of salary increases will be shared by shippers and shipping companies, and shipping companies are "under great pressure."