Down 9.81 points from the second quarter, the third quarter of China's shipping climate index 112.23 points

Recently, Shanghai International Shipping Research Center released the report on China's shipping boom in the third quarter of 2024.

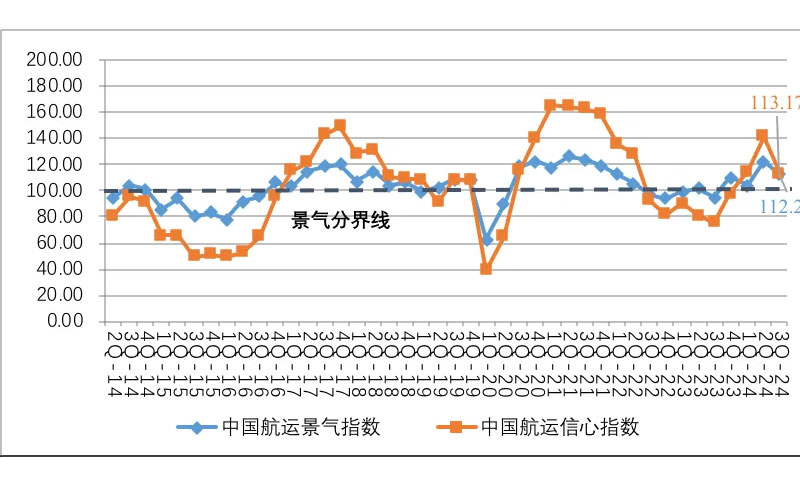

The report shows that in the third quarter of 2024, China's shipping climate index was 112.23 points, down 9.81 points from the second quarter, entering the relative prosperity range; China's shipping confidence index was 113.17 points, a significant decline of 28.72 points compared with the second quarter, from the more prosperous zone to the relatively prosperous zone, but all business confidence indexes have declined to varying degrees.

Overall, the third quarter of the shipping industry heat down, but still remain in the boom range.

Shipping enterprises enter the relative boom zone

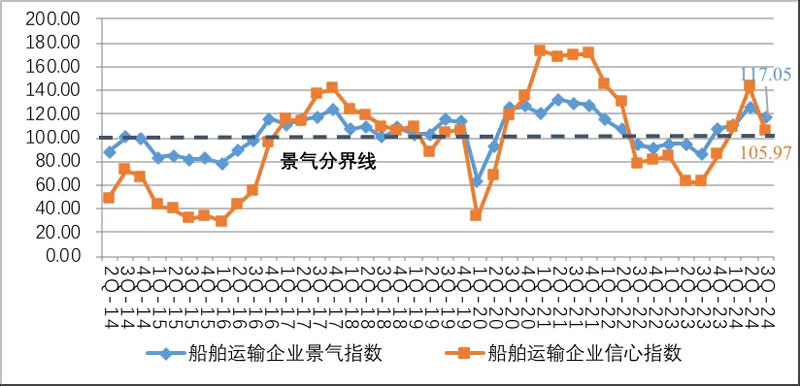

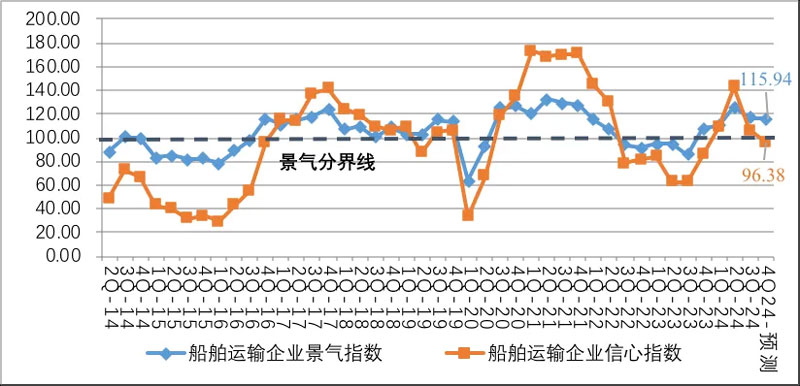

In the third quarter of 2024, the climate index of ship transportation enterprises was 117.05 points, down 9.07 points from the second quarter, entering the relative prosperity range; The confidence index of shipping enterprises was 105.97 points, a sharp decline of 36.70 points from the second quarter, falling from the more prosperous zone to the micro-prosperous zone.

The overall operating conditions of shipping enterprises continue to improve, and entrepreneurs are confident about the future.

From the perspective of various business indicators, although the utilization rate of shipping space has declined and the operating cost has increased, the freight income has continued to increase and the shipping capacity of enterprises has increased, which has made the profitability of enterprises continue to improve.

At the same time, corporate labor demand is rising, loan liabilities are reduced, working capital is abundant, and corporate financing is relatively easy. Based on confidence in the future market, shipping companies continue to increase capacity investment willingness.

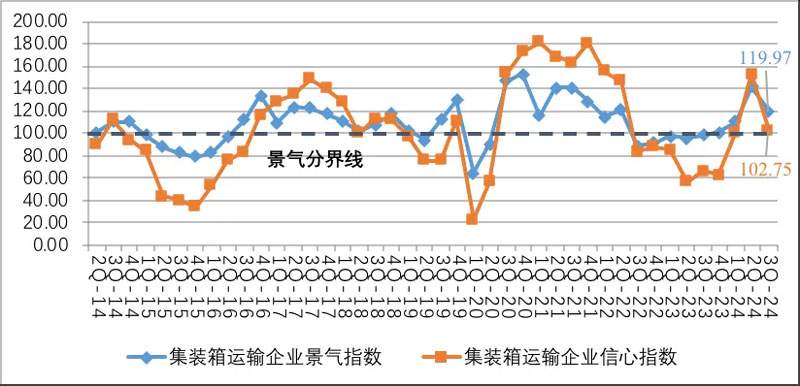

In the third quarter of 2024, the climate index of container transportation enterprises was 119.97 points, down 21.72 points from the second quarter, entering the relative prosperity range; The confidence index of container shipping companies fell to 102.75 points, a sharp drop of 50.25 points from the second quarter, falling into the small business zone.

The overall operation of container transport enterprises is good, and entrepreneurs are still confident about the overall development of the industry.

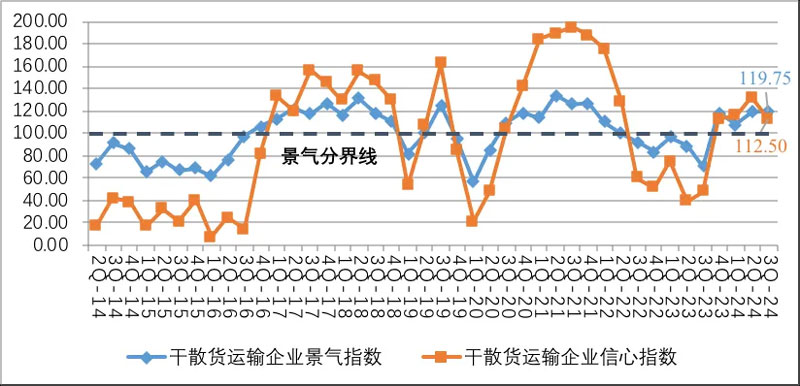

In the same period, the climate index of dry bulk cargo transportation enterprises was 119.75 points, up 1.07 points from the second quarter, maintaining in the relative prosperity range; Dry bulk cargo transportation business confidence index was 112.5 points, down 19.86 points from the second quarter, entering the relative boom range. The overall operation of dry bulk cargo transportation enterprises is stable, and entrepreneurs are optimistic about the market.

From the perspective of various operating indicators, the operating costs of dry bulk cargo transportation enterprises decreased in the third quarter, the turnover rate of ships increased, the freight income continued to increase, the enterprises continued to increase the investment in transportation capacity, and the corporate profitability maintained a good trend.

At the same time, the working capital of enterprises is abundant, the loan liabilities continue to decrease, the financing is relatively easy, and the anti-risk ability is strengthened. Companies' willingness to invest in capacity has increased, as has demand for Labour.

Port enterprises enter the relative boom zone

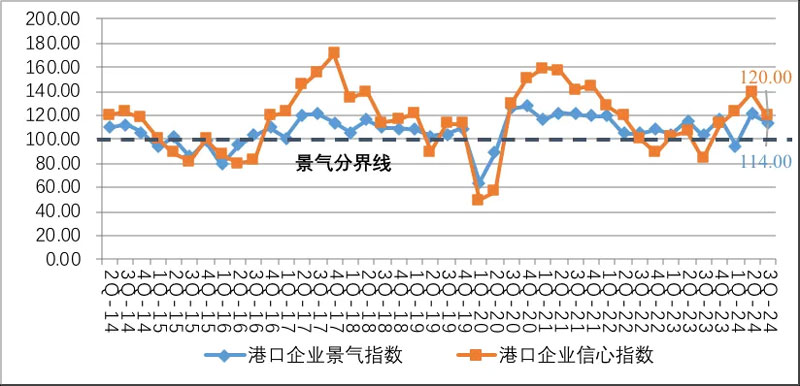

In the third quarter of 2024, the prosperity index of China's port enterprises was 114.0 points, down 7.46 points from the second quarter, entering the relative prosperity range; The port business confidence index was 120.0 points, down 18.89 points from the second quarter, entering the relative boom range.

The overall operation of Chinese port enterprises is stable, and port entrepreneurs have full confidence in the future development of the market.

From the perspective of various operating indicators, the operating costs of port enterprises in the third quarter were still high, but port charges began to rise, port throughput and berth utilization rate rose sharply, making corporate profits continue to improve.

At the same time, corporate assets and liabilities have decreased, labor demand has increased, working capital is abundant, financing difficulty continues to decrease, and new berths and machinery investment of port enterprises have increased.

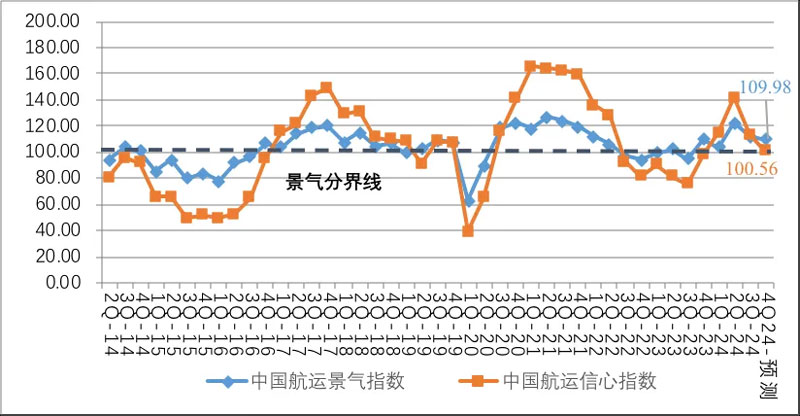

According to the China Shipping climate survey, in the fourth quarter of 2024, China's shipping climate index is expected to be 109.98 points, down 2.26 points from the third quarter, entering the micro boom range; China's shipping confidence index is expected to be 100.56 points, down 12.61 points from the third quarter, falling into the micro boom range.

Overall, it is expected that the climate index and confidence index of all types of shipping enterprises in the fourth quarter will decline to varying degrees, but still remain in the boom range, and the market remains generally stable.

According to the China Shipping climate Survey, in the fourth quarter of 2024, the climate index of shipping enterprises is expected to be 115.94 points, down 1.1 points from the third quarter, and maintained in the relative prosperity range; The shipping business confidence index is expected to be 96.38 points, down 9.59 points from the third quarter, falling from the micro-boom zone to the weak depression zone.

Among them, the container transportation business climate index is expected to be 114.25 points, down 5.71 points from the third quarter, to maintain in the relative prosperity range; The confidence index of container transport companies is expected to be 102.63 points, down 0.12 points from the third quarter, maintaining in the micro boom range.

Dry bulk cargo transportation business climate index is expected to be 114.82 points, down 4.94 points from the third quarter, to maintain in the relative prosperity range; The dry bulk transportation business confidence index is expected to be 94.38 points, down 18.12 points from the third quarter, falling to the weak depression range. Entrepreneurs are less confident.

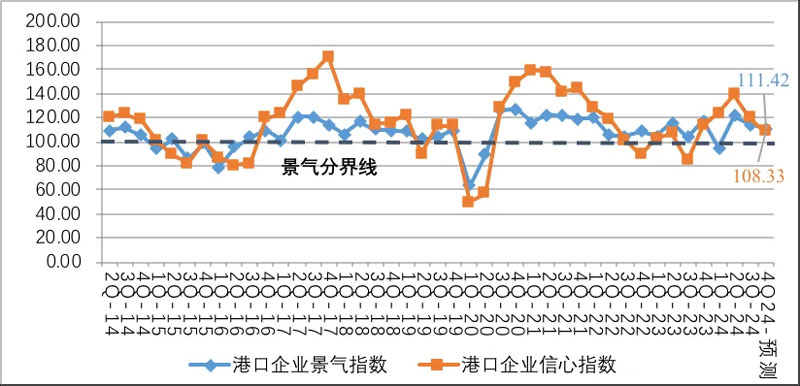

In addition, in the fourth quarter of 2024, the port enterprise climate index is expected to be 111.42 points, down 2.58 points from the third quarter, and still maintained in the relative prosperity range; The port business confidence index is expected to be 108.33 points, down 11.67 points from the third quarter, which will enter the micro boom zone.

On the whole, the operation of Chinese port enterprises is more optimistic, and port entrepreneurs maintain an optimistic attitude towards the development of the industry.

China shipping prosperity index and confidence index chart

The report shows that in the third quarter of 2024, China's shipping climate index was 112.23 points, down 9.81 points from the second quarter, entering the relative prosperity range; China's shipping confidence index was 113.17 points, a significant decline of 28.72 points compared with the second quarter, from the more prosperous zone to the relatively prosperous zone, but all business confidence indexes have declined to varying degrees.

Overall, the third quarter of the shipping industry heat down, but still remain in the boom range.

Shipping enterprises enter the relative boom zone

In the third quarter of 2024, the climate index of ship transportation enterprises was 117.05 points, down 9.07 points from the second quarter, entering the relative prosperity range; The confidence index of shipping enterprises was 105.97 points, a sharp decline of 36.70 points from the second quarter, falling from the more prosperous zone to the micro-prosperous zone.

The overall operating conditions of shipping enterprises continue to improve, and entrepreneurs are confident about the future.

Ship transportation enterprise prosperity index and confidence index chart

From the perspective of various business indicators, although the utilization rate of shipping space has declined and the operating cost has increased, the freight income has continued to increase and the shipping capacity of enterprises has increased, which has made the profitability of enterprises continue to improve.

At the same time, corporate labor demand is rising, loan liabilities are reduced, working capital is abundant, and corporate financing is relatively easy. Based on confidence in the future market, shipping companies continue to increase capacity investment willingness.

In the third quarter of 2024, the climate index of container transportation enterprises was 119.97 points, down 21.72 points from the second quarter, entering the relative prosperity range; The confidence index of container shipping companies fell to 102.75 points, a sharp drop of 50.25 points from the second quarter, falling into the small business zone.

The overall operation of container transport enterprises is good, and entrepreneurs are still confident about the overall development of the industry.

Container transport enterprise prosperity and confidence index chart

From the perspective of various operating indicators, the operating costs of container transportation enterprises continued to rise in the third quarter, freight income fell sharply, and fell below the landscape line, while the delivery of capacity continued to increase, and the utilization rate of shipping space rose sharply, making the profitability of enterprises significantly improved.

In the same period, the climate index of dry bulk cargo transportation enterprises was 119.75 points, up 1.07 points from the second quarter, maintaining in the relative prosperity range; Dry bulk cargo transportation business confidence index was 112.5 points, down 19.86 points from the second quarter, entering the relative boom range. The overall operation of dry bulk cargo transportation enterprises is stable, and entrepreneurs are optimistic about the market.

Dry bulk cargo transportation enterprise prosperity index and confidence index chart

From the perspective of various operating indicators, the operating costs of dry bulk cargo transportation enterprises decreased in the third quarter, the turnover rate of ships increased, the freight income continued to increase, the enterprises continued to increase the investment in transportation capacity, and the corporate profitability maintained a good trend.

At the same time, the working capital of enterprises is abundant, the loan liabilities continue to decrease, the financing is relatively easy, and the anti-risk ability is strengthened. Companies' willingness to invest in capacity has increased, as has demand for Labour.

Port enterprises enter the relative boom zone

In the third quarter of 2024, the prosperity index of China's port enterprises was 114.0 points, down 7.46 points from the second quarter, entering the relative prosperity range; The port business confidence index was 120.0 points, down 18.89 points from the second quarter, entering the relative boom range.

The overall operation of Chinese port enterprises is stable, and port entrepreneurs have full confidence in the future development of the market.

Port enterprise prosperity index and confidence index chart

From the perspective of various operating indicators, the operating costs of port enterprises in the third quarter were still high, but port charges began to rise, port throughput and berth utilization rate rose sharply, making corporate profits continue to improve.

At the same time, corporate assets and liabilities have decreased, labor demand has increased, working capital is abundant, financing difficulty continues to decrease, and new berths and machinery investment of port enterprises have increased.

According to the China Shipping climate survey, in the fourth quarter of 2024, China's shipping climate index is expected to be 109.98 points, down 2.26 points from the third quarter, entering the micro boom range; China's shipping confidence index is expected to be 100.56 points, down 12.61 points from the third quarter, falling into the micro boom range.

China shipping boom index and confidence index trend forecast chart

Overall, it is expected that the climate index and confidence index of all types of shipping enterprises in the fourth quarter will decline to varying degrees, but still remain in the boom range, and the market remains generally stable.

According to the China Shipping climate Survey, in the fourth quarter of 2024, the climate index of shipping enterprises is expected to be 115.94 points, down 1.1 points from the third quarter, and maintained in the relative prosperity range; The shipping business confidence index is expected to be 96.38 points, down 9.59 points from the third quarter, falling from the micro-boom zone to the weak depression zone.

Shipping enterprise prosperity index and confidence index trend forecast chart

Among them, the container transportation business climate index is expected to be 114.25 points, down 5.71 points from the third quarter, to maintain in the relative prosperity range; The confidence index of container transport companies is expected to be 102.63 points, down 0.12 points from the third quarter, maintaining in the micro boom range.

Dry bulk cargo transportation business climate index is expected to be 114.82 points, down 4.94 points from the third quarter, to maintain in the relative prosperity range; The dry bulk transportation business confidence index is expected to be 94.38 points, down 18.12 points from the third quarter, falling to the weak depression range. Entrepreneurs are less confident.

In addition, in the fourth quarter of 2024, the port enterprise climate index is expected to be 111.42 points, down 2.58 points from the third quarter, and still maintained in the relative prosperity range; The port business confidence index is expected to be 108.33 points, down 11.67 points from the third quarter, which will enter the micro boom zone.

On the whole, the operation of Chinese port enterprises is more optimistic, and port entrepreneurs maintain an optimistic attitude towards the development of the industry.

Chinese port enterprise prosperity index and confidence index trend forecast chart