New ship orders continue to soar, the industry market good?

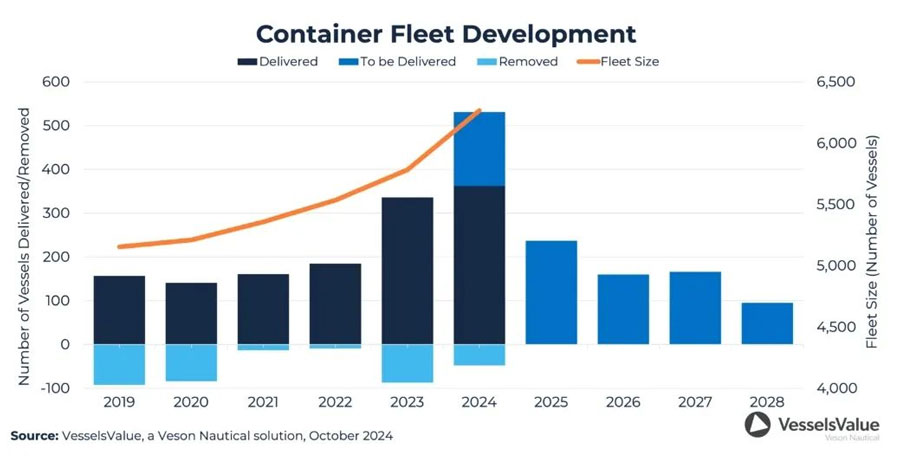

In 2024, the number of new orders for container ships worldwide is expected to set a new record. According to the latest data from Veson Nautical, container ship orders have surged by about 52% so far this year, with 254 container ship construction contracts now signed, up from 167 in the same period last year.

Such strong ordering momentum is mainly driven by the boom in the post-pandemic container market and high rental rates. In its latest report, Veson Nautical noted that Neo-Panamax ship types accounted for 41% of orders this year, Post-Panamax accounted for 27%, and very large container ships (ULCV) accounted for about 22%.

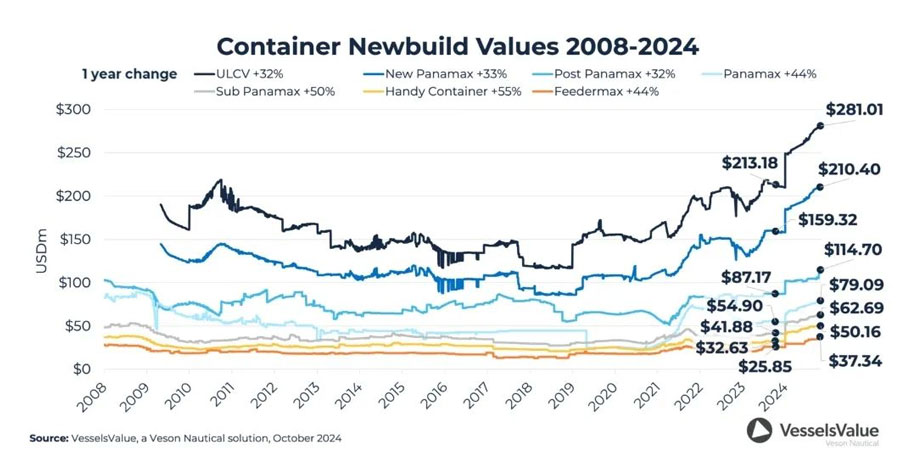

In October, Maersk ordered 10 16,000 TEU LNG dual-fuel container ships from Hanwha Marine at a cost of $209.6 million each, while VesselsValue estimated their market value to have reached $225 million.

The institute estimates that the value of new construction of very large container ships is currently $281 million, compared with $213.2 million in the same period last year, a 32 percent surge in a year; New-build prices for the Neo-Panamax model increased 33% in a year from $158.5 million to $210.5 million; The Post-Panamax new-build price also rose from $87.03 million to $114.7 million, an increase of 32%.

In addition to the surge in deliveries, geopolitical factors are also driving up rents in 2024. The conflict in the Red Sea region has forced ships to bypass the Cape of Good Hope, and this extra voyage demand has pushed up global capacity demand, as well as strikes in Canada and the GRI, which came into effect in mid-November, have pushed up charter rates. The Post-Panamax model's earnings nearly doubled from the same period last year, and the market is showing signs of prosperity.

But is the picture really bright? The latest election results could pose a major challenge for the container shipping industry. The re-election of Donald Trump as US President has raised concerns about tariff policy. He has proposed tariffs of up to 20 percent on all U.S. imports and additional tariffs of 60-100 percent on goods from China. This potential trade war would deal a blow to the shipping industry, especially the container shipping industry, which is most vulnerable to changes in US import tariffs.

But analysts worry that the adjustment will not be easy. Trump's tariff policies may hit the US economy, while the reduction in US consumer spending will affect the global economy, weakening the demand base of the shipping industry. Even so, Galanopoulos pointed out that the average age of the current container fleet is 12 years, and there are still plenty of older vessels in the market. If revenues fall in the future, operators still have some room to reduce fleet size through dismantling and maintain market balance.

Such strong ordering momentum is mainly driven by the boom in the post-pandemic container market and high rental rates. In its latest report, Veson Nautical noted that Neo-Panamax ship types accounted for 41% of orders this year, Post-Panamax accounted for 27%, and very large container ships (ULCV) accounted for about 22%.

In October, Maersk ordered 10 16,000 TEU LNG dual-fuel container ships from Hanwha Marine at a cost of $209.6 million each, while VesselsValue estimated their market value to have reached $225 million.

The institute estimates that the value of new construction of very large container ships is currently $281 million, compared with $213.2 million in the same period last year, a 32 percent surge in a year; New-build prices for the Neo-Panamax model increased 33% in a year from $158.5 million to $210.5 million; The Post-Panamax new-build price also rose from $87.03 million to $114.7 million, an increase of 32%.

In addition to the surge in deliveries, geopolitical factors are also driving up rents in 2024. The conflict in the Red Sea region has forced ships to bypass the Cape of Good Hope, and this extra voyage demand has pushed up global capacity demand, as well as strikes in Canada and the GRI, which came into effect in mid-November, have pushed up charter rates. The Post-Panamax model's earnings nearly doubled from the same period last year, and the market is showing signs of prosperity.

But is the picture really bright? The latest election results could pose a major challenge for the container shipping industry. The re-election of Donald Trump as US President has raised concerns about tariff policy. He has proposed tariffs of up to 20 percent on all U.S. imports and additional tariffs of 60-100 percent on goods from China. This potential trade war would deal a blow to the shipping industry, especially the container shipping industry, which is most vulnerable to changes in US import tariffs.

But analysts worry that the adjustment will not be easy. Trump's tariff policies may hit the US economy, while the reduction in US consumer spending will affect the global economy, weakening the demand base of the shipping industry. Even so, Galanopoulos pointed out that the average age of the current container fleet is 12 years, and there are still plenty of older vessels in the market. If revenues fall in the future, operators still have some room to reduce fleet size through dismantling and maintain market balance.