The freight rate of the western line of the United States soared 21.6%, and the shipment tide will be ushered in before the festival!

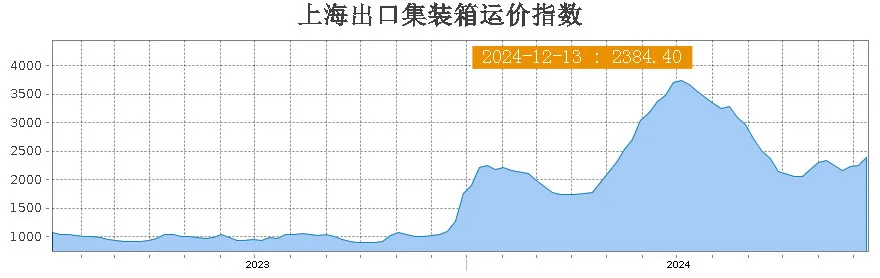

Shanghai Shipping Exchange released the Shanghai export container comprehensive freight index (SCFI) for three consecutive weeks showed an upward trend, as of December 13, the index has climbed to 2384.4 points, an increase of 5.7% from the previous week, this trend is mainly due to the recovery of freight rates in North America, especially the West and East routes of the United States significantly rebound.

Specifically, the freight rate of the North American route recovered significantly, and the freight rate of the western route rose by 21.6% to 4023 US dollars /FEU, an increase of 714 US dollars from the previous week; U.S. East Line rates also rose 11.6% to $5,494 /FEU, up $570 from the previous week. This change not only reflects the shipping enterprises' strategy of flexible adjustment of freight rates, but also reflects the relatively stable demand for Chinese export commodities in the North American market.

However, analysts pointed out that despite the rise in freight rates, the market supply and demand relationship has not changed substantially, so the continued rise in freight rates faces challenges.

In addition, the Persian Gulf route and Australia and New Zealand route freight rates have also risen in the past week. The increase in freight rates on Persian Gulf routes and Australia and New Zealand routes shows the continued growth of demand for Chinese exports in these regions, especially the tension in the Persian Gulf region, and the improvement of supply and demand fundamentals in Australia and New Zealand, which has promoted the rebound in freight rates.

Shanghai Shipping Exchange analysts said that the overall demand for North American shipping routes is stable, in the fourth quarter of the market freight continued to decline in the context of some shipping companies to book freight technical increase, spot market booking prices rose sharply.

However, the analyst stressed that because the market reflects that the supply and demand relationship of transport capacity has not changed, the sharp rise in freight rates is difficult to substantially support.

On the other hand, tensions in Sino-US trade relations are also having an impact on freight rates. The Biden administration announced new tariffs on a variety of key materials exported from China, a move that not only ratchets up trade tensions between China and the United States, but could also trigger Chinese countermeasures against U.S. exports. These tariffs will officially take effect on January 1, 2025, when the Sino-US trade relationship will face greater uncertainty, which in turn will have an impact on freight rates.

The industry believes that the freight rate situation of the global shipping market before the Spring Festival will be affected by multiple factors. Although the freight rate of North American routes has rebounded, the market supply and demand relationship has not changed substantially, and the continued rise of freight rates is facing challenges. At the same time, factors such as tensions in Sino-US trade relations, a surge in demand ahead of the Lunar New Year, and the risk of port strikes will have an impact on freight rates.

Freight forwarders pointed out that in the coming period of time, the global shipping market will show a complex and changeable situation, and freight fluctuations will be more frequent.

Photo: Shanghai Shipping Exchange

Specifically, the freight rate of the North American route recovered significantly, and the freight rate of the western route rose by 21.6% to 4023 US dollars /FEU, an increase of 714 US dollars from the previous week; U.S. East Line rates also rose 11.6% to $5,494 /FEU, up $570 from the previous week. This change not only reflects the shipping enterprises' strategy of flexible adjustment of freight rates, but also reflects the relatively stable demand for Chinese export commodities in the North American market.

However, analysts pointed out that despite the rise in freight rates, the market supply and demand relationship has not changed substantially, so the continued rise in freight rates faces challenges.

In addition, the Persian Gulf route and Australia and New Zealand route freight rates have also risen in the past week. The increase in freight rates on Persian Gulf routes and Australia and New Zealand routes shows the continued growth of demand for Chinese exports in these regions, especially the tension in the Persian Gulf region, and the improvement of supply and demand fundamentals in Australia and New Zealand, which has promoted the rebound in freight rates.

Shanghai Shipping Exchange analysts said that the overall demand for North American shipping routes is stable, in the fourth quarter of the market freight continued to decline in the context of some shipping companies to book freight technical increase, spot market booking prices rose sharply.

However, the analyst stressed that because the market reflects that the supply and demand relationship of transport capacity has not changed, the sharp rise in freight rates is difficult to substantially support.

On the other hand, tensions in Sino-US trade relations are also having an impact on freight rates. The Biden administration announced new tariffs on a variety of key materials exported from China, a move that not only ratchets up trade tensions between China and the United States, but could also trigger Chinese countermeasures against U.S. exports. These tariffs will officially take effect on January 1, 2025, when the Sino-US trade relationship will face greater uncertainty, which in turn will have an impact on freight rates.

The industry believes that the freight rate situation of the global shipping market before the Spring Festival will be affected by multiple factors. Although the freight rate of North American routes has rebounded, the market supply and demand relationship has not changed substantially, and the continued rise of freight rates is facing challenges. At the same time, factors such as tensions in Sino-US trade relations, a surge in demand ahead of the Lunar New Year, and the risk of port strikes will have an impact on freight rates.

Freight forwarders pointed out that in the coming period of time, the global shipping market will show a complex and changeable situation, and freight fluctuations will be more frequent.

Sungreen Logistics reminds the majority of shippers that they should pay close attention to market dynamics and policy changes and make shipment plans as soon as possible. Shun Xin Logistics will be happy to provide you with professional logistics services and customized solutions to meet your cargo transportation needs.