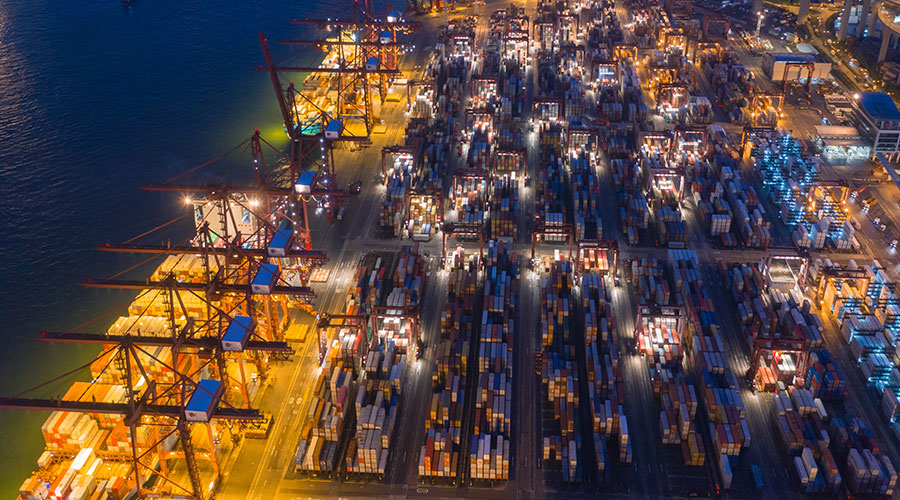

The surge in cargo volume in 2024 has led to high sea container rates on trans-Pacific routes to the United States.

Freight rates on routes from Asia to both the West and east coasts of the United States rose slightly in the week ended Dec. 20, up about 15 percent from early December, as airlines raised general rates mid-month, according to shipping data analysis firm Freightos.

Freight rates from Asia to the U.S. West Coast rose 4 percent this week to $4,452 per 40-foot TEU. Shipping rates from Asia to the U.S. East Coast rose 2% to $5,932 per 40-foot TEU.

Judah Levine, head of research at Freightos, wrote in a weekly update: "Reports of higher freight rates and full ships ahead of the Chinese New Year may reflect shippers continuing to advance shipments ahead of President-elect Trump's promise to raise tariffs next year." Mr. Trump proposed this week that the United States take back the Panama Canal in response to China's growing influence there."

Levin noted that liner operators are hoping for increased demand ahead of the Lunar New Year in January to support a further increase in freight rates for GRI at the start of the New Year to $1,000 to $3,000 per FEU.

"Despite heavy volumes and some signs of strain in rail traffic, operations at US ports remain smooth, with operators reporting that they are well positioned to increase volumes further," Levin wrote.

The prospect of a strike at U.S. East Coast ports in January could push up rates on transatlantic routes, which have held steady since mid-October.

"Some carriers have announced mid-month interruption surcharges in response to the International Longshoremen's Association strike," Levin wrote. "Some carriers also expected some disruption from the alliance restructuring in February, with MSC announcing an interruption fee of $2,000 per FEU for transatlantic containers from January 18."

Asia-europe and Mediterranean container rates were down 3 to 7 per cent from the GRI in early December, and despite the recent disruption of flight schedules due to bad weather, which caused moderate congestion at some European hubs, there was no significant increase in mid-month rates.

Prices on Asia-Northern Europe routes fell 2% to $4,971 per FEU, while prices on Asia-Mediterranean routes fell 1% to $5,721 per FEU. "However, for all of these routes, the Red Sea diversion remains the biggest factor causing rates to at least double from a year ago," Levine added. "While the military intervention has not yet succeeded in restoring safety to passing ships, both Israel and the United States have increased their direct strikes on Houthi positions in recent days."