Port strike risk intensifies, shipping companies announced the imposition of a variety of special surcharges!

2024 will be a year of uncertainty for the shipping market, with the global shipping situation experiencing unprecedented turbulence. During the year, the shipping market faced tensions in the Red Sea region, port strikes in many countries, complicated international political factors, especially a series of tax increases imposed by the United States on China, and steep price increases by shipping companies. While the market had hoped for a bit of calm at the end of 2024, it has repeatedly exceeded expectations.

Especially in October, the United States trade unions launched a three-day strike, resulting in a serious halt in port stacking, although the subsequent rapid resumption of operations, but has caused a small impact on the entire supply chain, making the overall atmosphere of the shipping industry tends to be tense. Now, with the January 15 deadline for a strike at ports in the East and Gulf Coast of the United States approaching, there is widespread concern about possible operational disruptions and cost spikes.

Analysts note that while another port strike is likely, it is expected to be short-lived. It is worth noting that although Trump has recently expressed his opposition to automation, he has released signals of support for ILA workers. Trump's style is often changeable, but the market widely believes he is likely to adopt a flexible strategy, believing that it is possible to go both ways and intervene during a strike lasting a week or less to broker a deal. Under that deal, the union could accept a watered-down proposal aimed at testing automation in exchange for the promise of more jobs.

However, amid the speculation, a number of shipping companies, including Hapag-Lloyd, Evergreen Shipping, Star Shipping and Yangming Shipping, have announced plans to impose additional charges such as work interruption surcharges and port congestion surcharges to deal with potential risks.

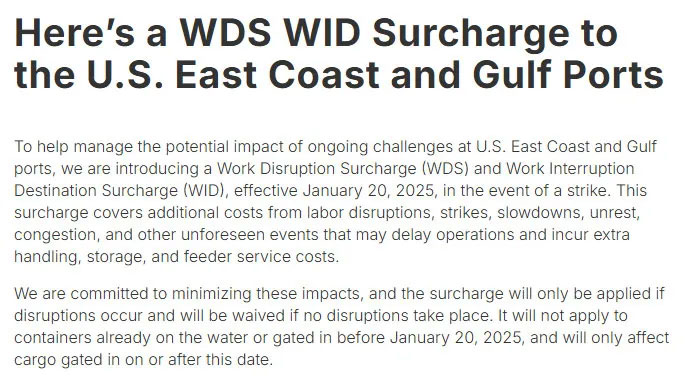

Hapag-lloyd charges WDS and WID surcharges

Hapag-lloyd announced on December 24, 2024 that it will charge a stoppage surcharge (WDS) and a stoppage surcharge (WID) at the port of destination, emphasizing that the surcharge will only be charged in the event of supply chain disruptions, and will take effect from January 20, 2025.

Cost: $850/20-foot case and $1700/40-foot case

Device type: All device types.

Scope of application: Imported from all ports in Northern Europe, the Mediterranean, Africa, the Middle East, the Indian subcontinent, Oceania and Latin America to U.S. East Coast and Gulf Coast ports.

Valid: for shipments on or after January 20, 2025, in the event of a strike, until further notice.

Work Interruption Destination Surcharge (WID) :

Cost: $850/20-foot case and $1700/40-foot case

Device type: All device types.

Application: Imported from all ports in East Asia - Japan, South Korea, China, Taiwan, Hong Kong, Macau, Vietnam, Laos, Cambodia, Thailand, Myanmar, Malaysia, Singapore, Brunei, Indonesia and the Philippines to U.S. East Coast and Gulf Coast ports.

Valid: for shipments on or after January 20, 2025, in the event of a strike, until further notice.

ZIM imposes a strike surcharge

ZIM recently announced that it will impose a Strike Surcharge on all shipments to and from terminals on the US East Coast and Gulf of Mexico, effective January 10, 2025 (port of entry date).

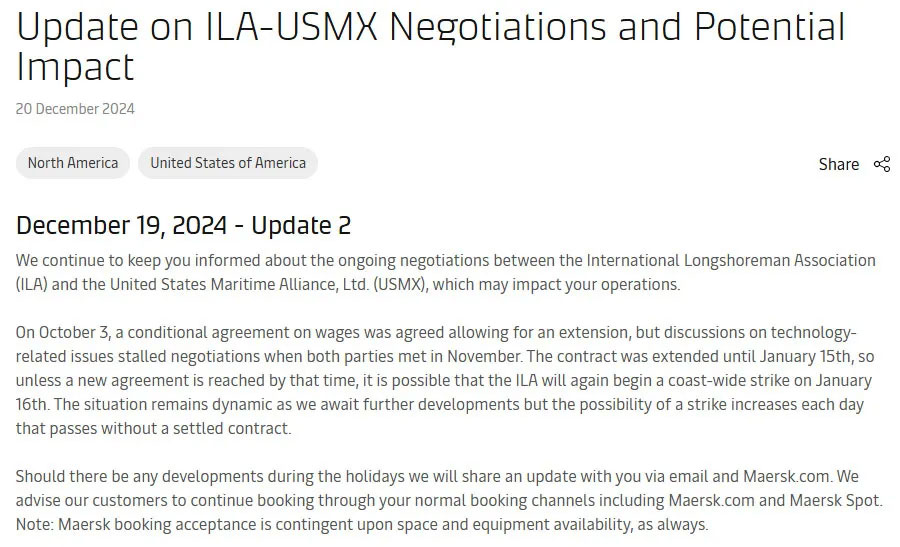

On Dec. 19, Maersk issued a related alert "regarding an update on the status of the ILA-USMX negotiations and their potential impact," and claimed that the team continues to develop contingency plans to reduce the potential impact in the event of a workforce disruption.

From January 18, 2025, the NWC Northern Europe (including from the United Kingdom and "ScanBaltic") to the United States, the Bahamas and Puerto Rico Emergency Operations Surcharge (EOS) will be increased until further notice.

In addition, Trump will take office as president of the United States in January next year, and its trade policy against China, especially the tariff issue, has attracted much attention, which also makes the shipping market in 2025 doomed to be difficult to calm, and the global shipping market will still face a complex and volatile situation for some time to come.

Especially in October, the United States trade unions launched a three-day strike, resulting in a serious halt in port stacking, although the subsequent rapid resumption of operations, but has caused a small impact on the entire supply chain, making the overall atmosphere of the shipping industry tends to be tense. Now, with the January 15 deadline for a strike at ports in the East and Gulf Coast of the United States approaching, there is widespread concern about possible operational disruptions and cost spikes.

Analysts note that while another port strike is likely, it is expected to be short-lived. It is worth noting that although Trump has recently expressed his opposition to automation, he has released signals of support for ILA workers. Trump's style is often changeable, but the market widely believes he is likely to adopt a flexible strategy, believing that it is possible to go both ways and intervene during a strike lasting a week or less to broker a deal. Under that deal, the union could accept a watered-down proposal aimed at testing automation in exchange for the promise of more jobs.

However, amid the speculation, a number of shipping companies, including Hapag-Lloyd, Evergreen Shipping, Star Shipping and Yangming Shipping, have announced plans to impose additional charges such as work interruption surcharges and port congestion surcharges to deal with potential risks.

Hapag-lloyd charges WDS and WID surcharges

Hapag-lloyd announced on December 24, 2024 that it will charge a stoppage surcharge (WDS) and a stoppage surcharge (WID) at the port of destination, emphasizing that the surcharge will only be charged in the event of supply chain disruptions, and will take effect from January 20, 2025.

Cost: $850/20-foot case and $1700/40-foot case

Device type: All device types.

Scope of application: Imported from all ports in Northern Europe, the Mediterranean, Africa, the Middle East, the Indian subcontinent, Oceania and Latin America to U.S. East Coast and Gulf Coast ports.

Valid: for shipments on or after January 20, 2025, in the event of a strike, until further notice.

Work Interruption Destination Surcharge (WID) :

Cost: $850/20-foot case and $1700/40-foot case

Device type: All device types.

Application: Imported from all ports in East Asia - Japan, South Korea, China, Taiwan, Hong Kong, Macau, Vietnam, Laos, Cambodia, Thailand, Myanmar, Malaysia, Singapore, Brunei, Indonesia and the Philippines to U.S. East Coast and Gulf Coast ports.

Valid: for shipments on or after January 20, 2025, in the event of a strike, until further notice.

ZIM imposes a strike surcharge

ZIM recently announced that it will impose a Strike Surcharge on all shipments to and from terminals on the US East Coast and Gulf of Mexico, effective January 10, 2025 (port of entry date).

On Dec. 19, Maersk issued a related alert "regarding an update on the status of the ILA-USMX negotiations and their potential impact," and claimed that the team continues to develop contingency plans to reduce the potential impact in the event of a workforce disruption.

From January 18, 2025, the NWC Northern Europe (including from the United Kingdom and "ScanBaltic") to the United States, the Bahamas and Puerto Rico Emergency Operations Surcharge (EOS) will be increased until further notice.

In addition, Trump will take office as president of the United States in January next year, and its trade policy against China, especially the tariff issue, has attracted much attention, which also makes the shipping market in 2025 doomed to be difficult to calm, and the global shipping market will still face a complex and volatile situation for some time to come.