U.S. freight rates continued to rise, with a 9.12% increase in the U.S. West

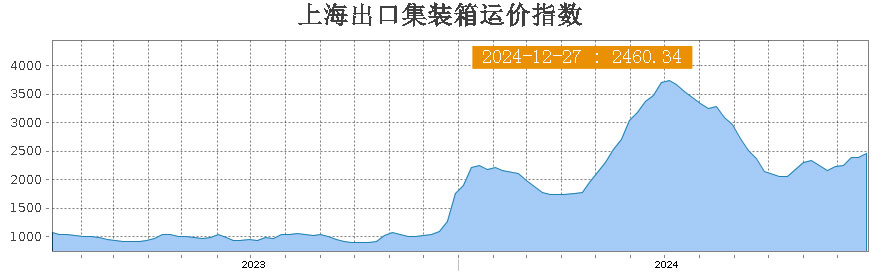

Shanghai Shipping Exchange released the latest Shanghai export container freight index (SCFI) on the 27th, the latest data show that the freight index rose from 2390.17 points in the previous period to 2460.34 points, a weekly increase of about 3%, to achieve five consecutive weeks of growth, of which the United States East and West routes showed strong growth momentum. The increase was 7.66% and 9.12% respectively, and the freight rate of the European route was slightly warmer, up about 1%.

At the same time, shipping companies have increased the number of empty flights on European routes, resulting in relatively tight shipping space, which has supported the rise in freight rates. In particular, the United States West line, the freight rate increased by more than 9%, the United States East line increased by more than 7%, and even broke the $6,000 mark. Industry pointed out that the United States line freight rate continues to be bullish, the United States East per large box freight is expected to further rise to $7,100.

In particular, freight rates per TEU from the Far East to Europe increased slightly by 0.5%, and freight rates per TEU from the Far East to the Mediterranean increased by about 1%. The rate per FEU from the Far East to the West of the United States increased by more than 9%, and the rate per FEU from the Far East to the East of the United States also increased by more than 7%. In terms of near-ocean routes, Japanese routes increased slightly, while Southeast Asian routes fell by about 5%.

Compared with the same period in 2023, freight rates in the West and East of the United States have increased significantly, with annual increases of nearly 80% and more than 70%, respectively. By contrast, both European and Mediterranean freight rates are rising by less than 10 per cent a year. This is mainly related to the fact that after the outbreak of the Red Sea crisis at the end of last year, the European line took the lead in rising, resulting in a higher base period.

Freight forwarding industry insiders also revealed that the current European line of small boat space is easy to fill, thus supporting the stability of freight rates. However, many large ships still have space, so there has been a revision of freight rates. In addition, many shipping companies took advantage of the high freight rates and began to stock up for the off-season Spring Festival flights in late January. As a result, the original plan to raise prices on New Year's Day may be changed.

For the United States route freight rate rise expectations, large freight forwarders had expected January 1 next year, the United States West route freight rate will continue to rise. However, with shipping companies such as Maersk not scheduled to raise rates until January 11, some shipping companies have already predicted that most shipping companies may not be able to meet the increase. In spite of this, there are still some shipping companies insist on price increases, but the specific increase remains to be further observed. In contrast, European routes did not experience price increases as expected, mainly because European routes were not affected by the strike in the US East.

With the countdown to the restructuring of the shipping alliance next year, shipping companies are increasing their efforts to grab goods and grab customers, and the price war and competition are becoming increasingly fierce, and the market is also paying close attention to this dynamic.

SCFI Rates:

Freight from Shanghai to Europe is 2,962 US dollars /TEU, up slightly by 16 US dollars, or 0.54%;

Shanghai to the Mediterranean freight 3780 US dollars /TEU, up 47 US dollars, or 1.26%;

Freight from Shanghai to West America is 4581 USD /FEU, up 383 USD, a weekly increase of 9.12%;

Shanghai to the United States East freight 6074 US dollars /FEU, up 432 US dollars, a weekly increase of 7.66%;

Persian Gulf route freight of 1,444 US dollars per box, up 15 US dollars, a weekly increase of 1.05%;

South American route (Santos) freight of $5,468 per box, up $117, a weekly increase of 2.19%;

Southeast Asia route (Singapore) per box freight of $672, down $39, or 5.49%.

The portion of the ocean line, the Far East to Kansai, Japan, and the Far East to Kanto, Japan, increased by $12 and $9, respectively, from the previous period.

At the same time, shipping companies have increased the number of empty flights on European routes, resulting in relatively tight shipping space, which has supported the rise in freight rates. In particular, the United States West line, the freight rate increased by more than 9%, the United States East line increased by more than 7%, and even broke the $6,000 mark. Industry pointed out that the United States line freight rate continues to be bullish, the United States East per large box freight is expected to further rise to $7,100.

In particular, freight rates per TEU from the Far East to Europe increased slightly by 0.5%, and freight rates per TEU from the Far East to the Mediterranean increased by about 1%. The rate per FEU from the Far East to the West of the United States increased by more than 9%, and the rate per FEU from the Far East to the East of the United States also increased by more than 7%. In terms of near-ocean routes, Japanese routes increased slightly, while Southeast Asian routes fell by about 5%.

Compared with the same period in 2023, freight rates in the West and East of the United States have increased significantly, with annual increases of nearly 80% and more than 70%, respectively. By contrast, both European and Mediterranean freight rates are rising by less than 10 per cent a year. This is mainly related to the fact that after the outbreak of the Red Sea crisis at the end of last year, the European line took the lead in rising, resulting in a higher base period.

Freight forwarding industry insiders also revealed that the current European line of small boat space is easy to fill, thus supporting the stability of freight rates. However, many large ships still have space, so there has been a revision of freight rates. In addition, many shipping companies took advantage of the high freight rates and began to stock up for the off-season Spring Festival flights in late January. As a result, the original plan to raise prices on New Year's Day may be changed.

For the United States route freight rate rise expectations, large freight forwarders had expected January 1 next year, the United States West route freight rate will continue to rise. However, with shipping companies such as Maersk not scheduled to raise rates until January 11, some shipping companies have already predicted that most shipping companies may not be able to meet the increase. In spite of this, there are still some shipping companies insist on price increases, but the specific increase remains to be further observed. In contrast, European routes did not experience price increases as expected, mainly because European routes were not affected by the strike in the US East.

With the countdown to the restructuring of the shipping alliance next year, shipping companies are increasing their efforts to grab goods and grab customers, and the price war and competition are becoming increasingly fierce, and the market is also paying close attention to this dynamic.

SCFI Rates:

Freight from Shanghai to Europe is 2,962 US dollars /TEU, up slightly by 16 US dollars, or 0.54%;

Shanghai to the Mediterranean freight 3780 US dollars /TEU, up 47 US dollars, or 1.26%;

Freight from Shanghai to West America is 4581 USD /FEU, up 383 USD, a weekly increase of 9.12%;

Shanghai to the United States East freight 6074 US dollars /FEU, up 432 US dollars, a weekly increase of 7.66%;

Persian Gulf route freight of 1,444 US dollars per box, up 15 US dollars, a weekly increase of 1.05%;

South American route (Santos) freight of $5,468 per box, up $117, a weekly increase of 2.19%;

Southeast Asia route (Singapore) per box freight of $672, down $39, or 5.49%.

The portion of the ocean line, the Far East to Kansai, Japan, and the Far East to Kanto, Japan, increased by $12 and $9, respectively, from the previous period.