For $4.2 billion, Eukor strengthens its position in the automotive logistics sector in Asia

$4.2 billion, "historic" contract renewal

South Korea's Eukor Car Carriers (Eukor) has successfully renewed a "historic" contract worth $4.2 billion with Hyundai and Kia automakers.

Eukor is one of the world's largest professional car and ro-ro cargo shipping companies, with a fleet of 67 car carriers operating pure car carriers throughout Asia, the Middle East, Europe, Africa and the Americas.

The company is jointly owned by Wallenius Wilhelmsen and Hyundai Motor, with Wallenius Wilhelmsen holding 80% and Hyundai Motor holding 20%. Warren Wilson currently operates approximately 125 PCTCS on 15 trade routes connecting six continents and is a global leader in ro-ro shipping and vehicle logistics.

It is worth mentioning that during the execution of the contract, net freight revenue is expected to reach approximately $4.2 billion (about 30.6 billion yuan), and freight increases are in line with market prices for such contracts, according to the company statement.

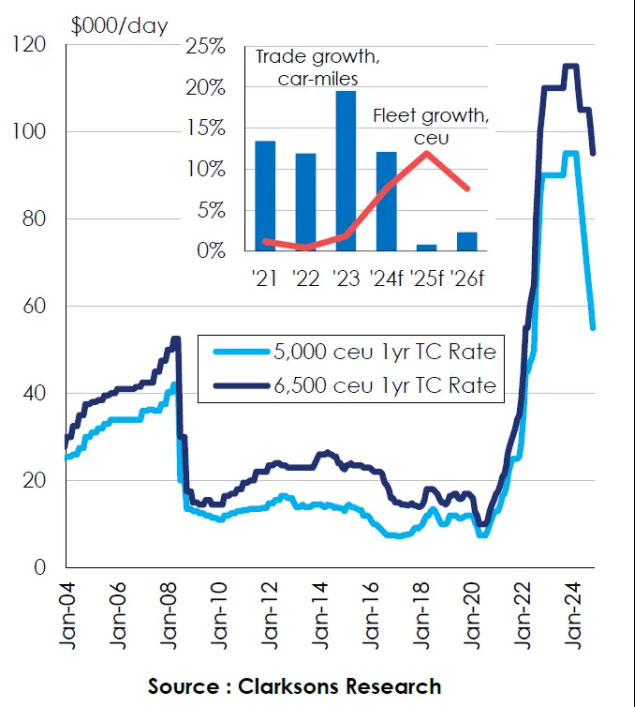

Recently, there has been a large-scale decline in the freight rate of car carriers. According to Clarkson's latest assessment, 5,000 car carriers are now renting at $55,000 per day, down more than 40% from their peak in early 2024. In contrast, the 6,500 car carrier declined by a relatively moderate 17%, and its rental rate was $95,000 / day in November, but the overall decline has not reversed.

Lasse Kristoffersen, President and Chief Executive Officer of Warren Wilson, said: "This contract strongly strengthens Warren Wilson's position in the Korean market and further strengthens our long-standing relationship with Hyundai Motor Group."

Xavier Leroi, CEO of Eukor and head of Warren Wilson's shipping division, added: "This contract is of great historic importance for Eukor and Warren Wilson and will play a key role in the company's development."

Preference for Chinese shipyards

Eukor has continued to expand its business and has shown great interest in Chinese shipyards.

Earlier this year, the company signed a construction contract to add six methanol dual-fuel pure car/truck carriers to its fleet. These 9300 standard parking PCTC vessels are being built at China Merchants Industrial Nanjing Jinling Shipyard (hereinafter referred to as "Nanjing Jinling") and are expected to be delivered between 2026 and 2027.

And Warren Wilson has made no secret of its preference for Chinese yards.

To date, Wallenius Wilhelmsen has confirmed orders for 14 vessels at Jinling Shipyard in Nanjing, comprising eight 11,700-car PCTCS (of which two are option purchases, two are option purchases, and four are upgrades from 9,300 car PCTCS) and six 9,300-car PCTCS, with two additional option orders.

The details are as follows:

October 2023: Signed 4+4+4 9,300 methanol dual-fuel PCTC shipbuilding contract.

March 2024: Orders for the first four alternative vessels take effect, with delivery expected between May and November 2027. At the same time, the company has added four additional vessels.

May 2024: The subsequent contract for four alternative vessels takes effect.

September 2024: Four 9,300 PCTC upgraded to 11,700.

8 November 2024: Exercise of the option to purchase two 11,700-car methanol dual-fuel PCTCS, with plans to upgrade two additional 9,300-car PCTCS already ordered to 11,700-car PCTCS, with two additional options available for confirmation by the second half of 2025.

Developed by the company in collaboration with Deltamarin, a Finnish design company owned by China Merchants Industry, the ships meet the EEDI 3 and Tier III, and in addition to operating on methanol fuel, they also use an ammonia fuel reserve design, which can be converted to use ammonia fuel in the future. In addition, the shipowner will also install bubble drag reduction, solar energy, batteries and other equipment, which is an energy-saving and environmentally friendly green ship.

At the same time, Weihai Jinling Automobile Carrier, another shipyard of China Merchants Industry, held orders for 7 ships. Overall, China Merchants Industry Group holds a total of 83 orders for automobile transport vessels, firmly occupying a dominant position in this ship type field.

South Korea's Eukor Car Carriers (Eukor) has successfully renewed a "historic" contract worth $4.2 billion with Hyundai and Kia automakers.

Eukor is one of the world's largest professional car and ro-ro cargo shipping companies, with a fleet of 67 car carriers operating pure car carriers throughout Asia, the Middle East, Europe, Africa and the Americas.

The company is jointly owned by Wallenius Wilhelmsen and Hyundai Motor, with Wallenius Wilhelmsen holding 80% and Hyundai Motor holding 20%. Warren Wilson currently operates approximately 125 PCTCS on 15 trade routes connecting six continents and is a global leader in ro-ro shipping and vehicle logistics.

It is worth mentioning that during the execution of the contract, net freight revenue is expected to reach approximately $4.2 billion (about 30.6 billion yuan), and freight increases are in line with market prices for such contracts, according to the company statement.

Recently, there has been a large-scale decline in the freight rate of car carriers. According to Clarkson's latest assessment, 5,000 car carriers are now renting at $55,000 per day, down more than 40% from their peak in early 2024. In contrast, the 6,500 car carrier declined by a relatively moderate 17%, and its rental rate was $95,000 / day in November, but the overall decline has not reversed.

Lasse Kristoffersen, President and Chief Executive Officer of Warren Wilson, said: "This contract strongly strengthens Warren Wilson's position in the Korean market and further strengthens our long-standing relationship with Hyundai Motor Group."

Xavier Leroi, CEO of Eukor and head of Warren Wilson's shipping division, added: "This contract is of great historic importance for Eukor and Warren Wilson and will play a key role in the company's development."

Preference for Chinese shipyards

Eukor has continued to expand its business and has shown great interest in Chinese shipyards.

Earlier this year, the company signed a construction contract to add six methanol dual-fuel pure car/truck carriers to its fleet. These 9300 standard parking PCTC vessels are being built at China Merchants Industrial Nanjing Jinling Shipyard (hereinafter referred to as "Nanjing Jinling") and are expected to be delivered between 2026 and 2027.

And Warren Wilson has made no secret of its preference for Chinese yards.

To date, Wallenius Wilhelmsen has confirmed orders for 14 vessels at Jinling Shipyard in Nanjing, comprising eight 11,700-car PCTCS (of which two are option purchases, two are option purchases, and four are upgrades from 9,300 car PCTCS) and six 9,300-car PCTCS, with two additional option orders.

The details are as follows:

October 2023: Signed 4+4+4 9,300 methanol dual-fuel PCTC shipbuilding contract.

March 2024: Orders for the first four alternative vessels take effect, with delivery expected between May and November 2027. At the same time, the company has added four additional vessels.

May 2024: The subsequent contract for four alternative vessels takes effect.

September 2024: Four 9,300 PCTC upgraded to 11,700.

8 November 2024: Exercise of the option to purchase two 11,700-car methanol dual-fuel PCTCS, with plans to upgrade two additional 9,300-car PCTCS already ordered to 11,700-car PCTCS, with two additional options available for confirmation by the second half of 2025.

Developed by the company in collaboration with Deltamarin, a Finnish design company owned by China Merchants Industry, the ships meet the EEDI 3 and Tier III, and in addition to operating on methanol fuel, they also use an ammonia fuel reserve design, which can be converted to use ammonia fuel in the future. In addition, the shipowner will also install bubble drag reduction, solar energy, batteries and other equipment, which is an energy-saving and environmentally friendly green ship.

At the same time, Weihai Jinling Automobile Carrier, another shipyard of China Merchants Industry, held orders for 7 ships. Overall, China Merchants Industry Group holds a total of 83 orders for automobile transport vessels, firmly occupying a dominant position in this ship type field.