Mr Trump set up the Foreign Revenue Service to collect tariffs

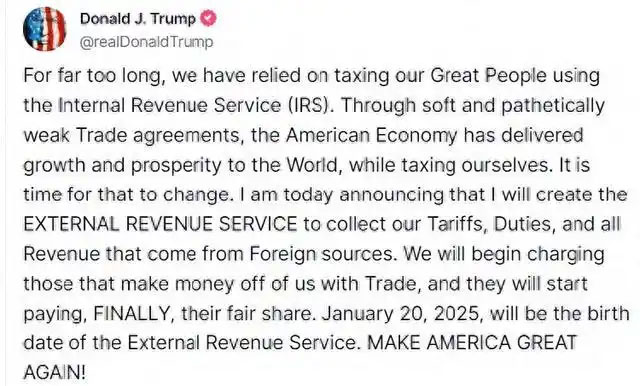

U.S. President-elect Donald Trump has said he will create a new agency called the External Revenue Service, whose main function will be to collect duties, taxes and other revenue from foreign countries.

In a post on social media, Trump said he would formally announce the establishment of the Foreign Revenue Service on January 20, the same day he will be sworn in as president for a second term.

He said he would pursue a more aggressive trade policy that would require countries and businesses that benefit from U.S. trade to bear more of the cost, ensuring they pay their fair "share" of the economic benefits brought to the United States.

Trump has threatened to impose tariffs of 10 to 20 percent on all imports once he returns to the White House. That's despite warnings from many economists that such a program could cause U.S. inflation to rise again. Many Republicans in Congress are also likely to oppose such an aggressive tariff plan.

Representative Richard Neal, Democrat of Massachusetts, dismissed Mr. Trump's latest idea as an empty promise devoid of substance and details. In particular, Neal mentioned that the proposal reminded him of Trump's vague promises on health care reform in the past, suggesting that Trump tends to make political propositions that are grand but short on concrete proposals.

Currently, U.S. tariffs are collected by Customs and Border Protection, whose staff reviews documents, performs audits and collects taxes and fines, which are then deposited into accounts at the Treasury Department. Although the collection of tariffs plays a role in the U.S. economy, they account for less than 2 percent of the federal government's total revenue.

But the approach highlights Mr. Trump's desire to frame the imposition of tariffs on foreign imports as a means of offsetting the costs of his policy agenda. Trump believes that by imposing tariffs, especially on foreign imports, it can reduce the pressure on the US government to spend and promote domestic economic growth.

Analysts were skeptical of the news, stressing that Customs and Border Protection already collects this revenue, a function that dates back to Alexander Hamilton's time. They also point out that tariff revenue is not an external source because it is ultimately paid for by U.S. consumers.

Ernie Tedeschi, director of economics at Yale University's Budget Lab, said creating a new tax agency would require a vote of Congress and would probably not substantially change the existing process for collecting tariff revenue.

Mainstream economists have warned that Trump's threatened tariffs could raise prices for American consumers, exacerbate public anxiety about inflation and could alter or reduce trade flows without generating the revenue the president-elect expects.

While Trump has won the support of many Wall Street executives and corporate leaders, uncertainty over his plans to implement tariffs has unnerved markets and the business community.

In a post on social media, Trump said he would formally announce the establishment of the Foreign Revenue Service on January 20, the same day he will be sworn in as president for a second term.

He said he would pursue a more aggressive trade policy that would require countries and businesses that benefit from U.S. trade to bear more of the cost, ensuring they pay their fair "share" of the economic benefits brought to the United States.

Trump has threatened to impose tariffs of 10 to 20 percent on all imports once he returns to the White House. That's despite warnings from many economists that such a program could cause U.S. inflation to rise again. Many Republicans in Congress are also likely to oppose such an aggressive tariff plan.

Representative Richard Neal, Democrat of Massachusetts, dismissed Mr. Trump's latest idea as an empty promise devoid of substance and details. In particular, Neal mentioned that the proposal reminded him of Trump's vague promises on health care reform in the past, suggesting that Trump tends to make political propositions that are grand but short on concrete proposals.

Currently, U.S. tariffs are collected by Customs and Border Protection, whose staff reviews documents, performs audits and collects taxes and fines, which are then deposited into accounts at the Treasury Department. Although the collection of tariffs plays a role in the U.S. economy, they account for less than 2 percent of the federal government's total revenue.

But the approach highlights Mr. Trump's desire to frame the imposition of tariffs on foreign imports as a means of offsetting the costs of his policy agenda. Trump believes that by imposing tariffs, especially on foreign imports, it can reduce the pressure on the US government to spend and promote domestic economic growth.

Analysts were skeptical of the news, stressing that Customs and Border Protection already collects this revenue, a function that dates back to Alexander Hamilton's time. They also point out that tariff revenue is not an external source because it is ultimately paid for by U.S. consumers.

Ernie Tedeschi, director of economics at Yale University's Budget Lab, said creating a new tax agency would require a vote of Congress and would probably not substantially change the existing process for collecting tariff revenue.

Mainstream economists have warned that Trump's threatened tariffs could raise prices for American consumers, exacerbate public anxiety about inflation and could alter or reduce trade flows without generating the revenue the president-elect expects.

While Trump has won the support of many Wall Street executives and corporate leaders, uncertainty over his plans to implement tariffs has unnerved markets and the business community.