First LNG ship to return to Red Sea

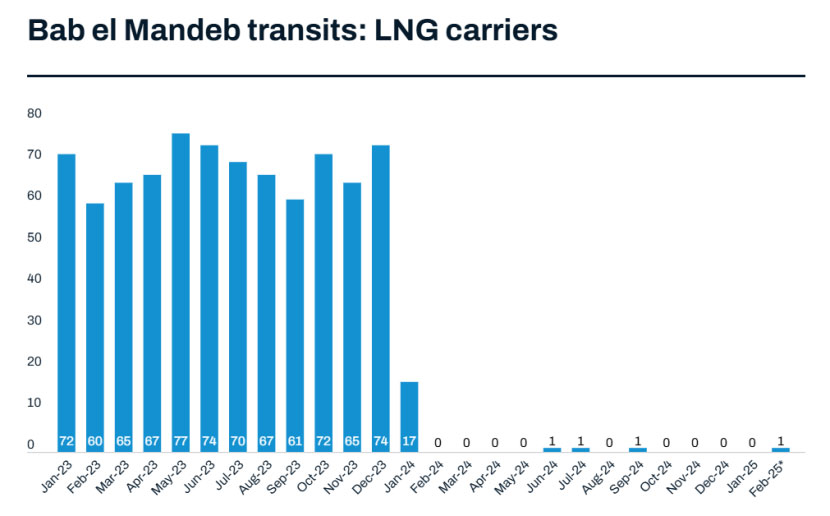

Due to the continuous attacks by the Houthi armed group, shipping companies are avoiding the Red Sea throughout 2024. A ceasefire in Gaza was agreed in January. The first non-Russian liquefied natural gas (LNG) carrier has successfully crossed the Bab el-Mandeb Strait at the southern end of the Red Sea, signaling that improvements to the route may be on the way. However, Trump's recent actions have complicated the situation.

First LNG ship to pass through Red Sea after ceasefire

On the evening of February 8, the ship "Salalah LNG" with a capacity of 148,173 cubic meters successfully crossed the Red Sea, all the way north. It is the first LNG vessel to pass through the Red Sea since the Gaza ceasefire came into effect, and the first non-Russian LNG vessel to do so in 12 months.

Salalah LNG was built in 2005 under the flag of Panama and is owned by Oman Shipping Co SAOC.

Prior to the passage of Salalah LNG, the last LNG carrier to cross the Red Sea was the Russian "Shadow Fleet" Pioneer, which arrived in the Red Sea at the end of September 2024. Before that, another Russian-affiliated transport ship, the Asya Energy (now East Energy), crossed the same waters in June 2024.

The two ships are part of a "shadow fleet" sanctioned by the United States and the European Union.

On January 16, Hamas and Israel reached a breakthrough ceasefire agreement, which came into effect on January 19. On Monday, the Houthis said it would halt attacks on non-Israeli ships, including those operated by Israeli companies, those heading to Israeli ports or those associated with the United States or Britain, in line with the Gaza ceasefire.

When the ceasefire came into effect, the container shipping sector was the first to react.

On January 19, CMA CGM Columba, owned by CMA CGM, set sail for the Suez Canal from Algeciras, the Spanish hub, becoming the first ship to cross the Red Sea since the ceasefire took effect.

A number of container ship owners, including MSC, Maersk and Hapag-Lloyd, have made it clear that they will only return to the Red Sea if they are confident that their ships will not be attacked. Even if the cargo ships return to the Red Sea, shipping companies will need some time to fully adjust their operations.

In the oil tanker sector, the Chrysalis became the first tanker to pass through the Red Sea and Suez Canal since the Houthi blockade was announced earlier this week. The ship's passage is seen by the Suez Canal Authority as a sign that tanker traffic is resuming and that the situation is stabilizing. It is understood that the ship was attacked by Houthi forces in July 2024.

In terms of LNG shipments, the transit of Salalah LNG shows the urgent need for LNG in Europe, where gas prices jumped to a two-year high on Monday and stocks are already at their lowest level since the 2022 energy crisis. Due to the unusually weak market, market watchers speculate that even with the first LNG carrier, a large number of vessels in the sector may continue to avoid the waterway.

In terms of dry bulk cargo transport, shipowners generally remain cautious. In its Dry bulk market report since January 2024, BIMCO said that if ships return to the Red Sea, demand and freight rates in other sectors other than Capesize vessels could fall significantly.

Although the Gaza ceasefire agreement has been announced, the car carrier companies are still in a wait-and-see mode, and no company has explicitly announced a return to the Red Sea route. It is worth mentioning that as a positive response to the ceasefire agreement, the Houthi armed group released the crew of the car carrier "Galaxy Leader" after the agreement took effect 14 months ago.

The Suez Canal is eager to reopen in March

Recently, the head of the Suez Canal Authority, Osama Rabi, said that if the Gaza ceasefire holds, it is expected that traffic in Egypt's important waterway will gradually return to normal by the end of March and achieve full recovery by the middle of the year.

Revenue from the Suez Canal, one of the world's main trade routes, has fallen by about 60 percent as a result of the war. Losses are estimated to be about $7 billion in the current fiscal year, which ends in June.

For Egypt, which is struggling to emerge from its worst economic crisis in decades, a return to normal traffic on the Suez Canal is particularly urgent. Last March, as part of a $57 billion global bailout package, the Egyptian government allowed the currency to devalue by about 40 percent, thus receiving fresh financial assistance from the International Monetary Fund and other international institutions.

Shipowners remain conservative

Although the Houthis have announced a "cessation of attacks", the vast majority of shipowners remain cautious.

On January 22, the White House issued a statement redesignating the Houthi armed group as a "foreign terrorist organization." In response, the Houthi armed group said that it is considering banning US ships from passing through the Bab el-Mandeb Strait and resuming full-scale military operations in Yemen.

Recently, US President Donald Trump proposed "I'm committed to buying and owning Gaza", which once again dealt a blow to the global shipping industry's hopes of restoring normal trade through the Red Sea.

First LNG ship to pass through Red Sea after ceasefire

On the evening of February 8, the ship "Salalah LNG" with a capacity of 148,173 cubic meters successfully crossed the Red Sea, all the way north. It is the first LNG vessel to pass through the Red Sea since the Gaza ceasefire came into effect, and the first non-Russian LNG vessel to do so in 12 months.

Salalah LNG was built in 2005 under the flag of Panama and is owned by Oman Shipping Co SAOC.

Prior to the passage of Salalah LNG, the last LNG carrier to cross the Red Sea was the Russian "Shadow Fleet" Pioneer, which arrived in the Red Sea at the end of September 2024. Before that, another Russian-affiliated transport ship, the Asya Energy (now East Energy), crossed the same waters in June 2024.

The two ships are part of a "shadow fleet" sanctioned by the United States and the European Union.

On January 16, Hamas and Israel reached a breakthrough ceasefire agreement, which came into effect on January 19. On Monday, the Houthis said it would halt attacks on non-Israeli ships, including those operated by Israeli companies, those heading to Israeli ports or those associated with the United States or Britain, in line with the Gaza ceasefire.

When the ceasefire came into effect, the container shipping sector was the first to react.

On January 19, CMA CGM Columba, owned by CMA CGM, set sail for the Suez Canal from Algeciras, the Spanish hub, becoming the first ship to cross the Red Sea since the ceasefire took effect.

A number of container ship owners, including MSC, Maersk and Hapag-Lloyd, have made it clear that they will only return to the Red Sea if they are confident that their ships will not be attacked. Even if the cargo ships return to the Red Sea, shipping companies will need some time to fully adjust their operations.

In the oil tanker sector, the Chrysalis became the first tanker to pass through the Red Sea and Suez Canal since the Houthi blockade was announced earlier this week. The ship's passage is seen by the Suez Canal Authority as a sign that tanker traffic is resuming and that the situation is stabilizing. It is understood that the ship was attacked by Houthi forces in July 2024.

In terms of LNG shipments, the transit of Salalah LNG shows the urgent need for LNG in Europe, where gas prices jumped to a two-year high on Monday and stocks are already at their lowest level since the 2022 energy crisis. Due to the unusually weak market, market watchers speculate that even with the first LNG carrier, a large number of vessels in the sector may continue to avoid the waterway.

In terms of dry bulk cargo transport, shipowners generally remain cautious. In its Dry bulk market report since January 2024, BIMCO said that if ships return to the Red Sea, demand and freight rates in other sectors other than Capesize vessels could fall significantly.

Although the Gaza ceasefire agreement has been announced, the car carrier companies are still in a wait-and-see mode, and no company has explicitly announced a return to the Red Sea route. It is worth mentioning that as a positive response to the ceasefire agreement, the Houthi armed group released the crew of the car carrier "Galaxy Leader" after the agreement took effect 14 months ago.

The Suez Canal is eager to reopen in March

Recently, the head of the Suez Canal Authority, Osama Rabi, said that if the Gaza ceasefire holds, it is expected that traffic in Egypt's important waterway will gradually return to normal by the end of March and achieve full recovery by the middle of the year.

Revenue from the Suez Canal, one of the world's main trade routes, has fallen by about 60 percent as a result of the war. Losses are estimated to be about $7 billion in the current fiscal year, which ends in June.

For Egypt, which is struggling to emerge from its worst economic crisis in decades, a return to normal traffic on the Suez Canal is particularly urgent. Last March, as part of a $57 billion global bailout package, the Egyptian government allowed the currency to devalue by about 40 percent, thus receiving fresh financial assistance from the International Monetary Fund and other international institutions.

Shipowners remain conservative

Although the Houthis have announced a "cessation of attacks", the vast majority of shipowners remain cautious.

On January 22, the White House issued a statement redesignating the Houthi armed group as a "foreign terrorist organization." In response, the Houthi armed group said that it is considering banning US ships from passing through the Bab el-Mandeb Strait and resuming full-scale military operations in Yemen.

Recently, US President Donald Trump proposed "I'm committed to buying and owning Gaza", which once again dealt a blow to the global shipping industry's hopes of restoring normal trade through the Red Sea.

Lars Jensen, CEO of Vespucci Maritime, believes: "A week ago, there was light at the end of the tunnel. But now, Trump's move makes a return to the Red Sea less likely."