Continued downward trend, the European line has fallen to $1600 /FEU

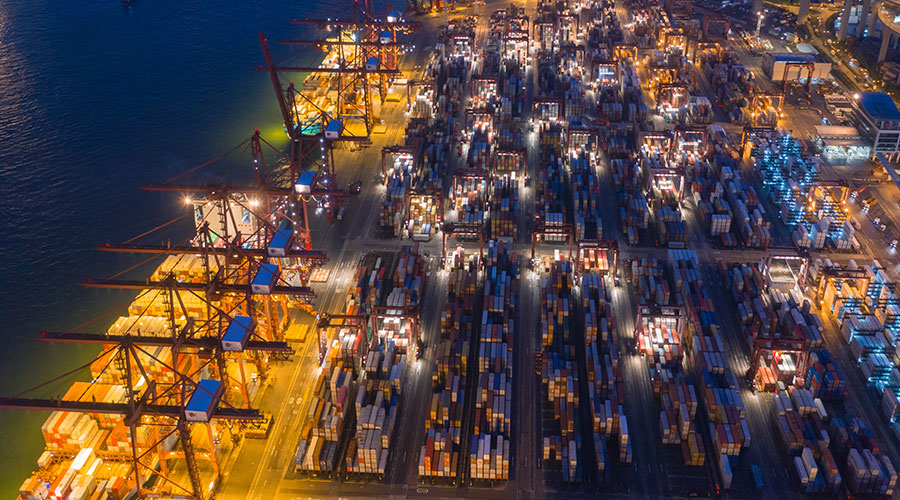

Recently, the container shipping market has seen a series of changes in the European line. Although shipping giant Mediterranean Shipping (MSC) has shifted its 19,000-24,000 TEU very large container ships from the Far East-Northern Europe route to deploy new Panamax vessels with an average capacity of 14,700 TEU, the move has not been effective in preventing the continued decline in freight rates. The freight rate of each large box in the original market is about $2,000, but the two members of the shipping alliance have notified that they will continue to reduce the price, and the current market has a freight rate of $1,600.

According to the online quotation of the shipping company, the quotation of the 20-foot container of Maersk departing from Shanghai to Rotterdam on April 3 is 1170 US dollars, which is 1430 US dollars lower than the previous value in the same period. The price of a 40-foot container is $1800, down $2200 from the previous value.

Looking back at the beginning of this year, the freight rate of each large box on the European line was still close to $5,000. In addition to the impact of the traditional off-season in the first quarter, the new shipbuilding has been put into the market is also one of the main reasons. In addition, the EU tariff issue has also had an impact on the market. For example, since October 30 last year, the EU has imposed additional tariffs on electric vehicles imported from China, with a rate of up to 35.3%, which is scheduled to be implemented for five years. This policy led to a rush last year, because the port docking capacity of special ships for cars is limited, and many cars choose to be transported in containers, further aggravating the contradiction between supply and demand in the market.

However, the current freight rate is close to the cost line, and the industry estimates that the room for further decline is limited. The shipping company has notified the freight rate until April 15, and whether the freight rate can recover after that will depend on whether there is a large increase in the market volume.

From the intuitive offer point of view, although the end of March some routes appeared full load situation, but MSC's relatively pragmatic pricing style still has an impact on the overall pricing tone, other ships mainly adopted a follow-up strategy. Currently, MSC and MSK offers continue through Week 14, while ONE continues through week 15, which is mid-April. It can be said that the movement of spot prices has led the downward trend of futures prices.

In addition, the geopolitical risk factors that have had a greater impact on futures prices in the past few days - the Palestinian-Israeli ceasefire agreement has basically failed, and the Gaza war has broken out again. However, the actual impact on freight rates on European routes was relatively small as shipping lines did not begin to resume operations with the Gaza ceasefire.

For the future market, from the fundamental point of view, the supply and demand structure in early April has improved. In the case of continuing to use the main probability in the first week, observe the subsequent pricing strategy, whether to continue to prioritize the loading rate, or moderately consider the profit margin. At the same time, the marginal change in the high capacity scale in week 16-17 and the pressure on the supply and demand structure will also affect the pricing rhythm in late April. In the short term, the trend of European routes (EC) may show a volatile downward trend, and you can continue to pay attention to the situation in the Middle East and the follow-up initiatives of mainstream shipping companies.

According to the online quotation of the shipping company, the quotation of the 20-foot container of Maersk departing from Shanghai to Rotterdam on April 3 is 1170 US dollars, which is 1430 US dollars lower than the previous value in the same period. The price of a 40-foot container is $1800, down $2200 from the previous value.

Looking back at the beginning of this year, the freight rate of each large box on the European line was still close to $5,000. In addition to the impact of the traditional off-season in the first quarter, the new shipbuilding has been put into the market is also one of the main reasons. In addition, the EU tariff issue has also had an impact on the market. For example, since October 30 last year, the EU has imposed additional tariffs on electric vehicles imported from China, with a rate of up to 35.3%, which is scheduled to be implemented for five years. This policy led to a rush last year, because the port docking capacity of special ships for cars is limited, and many cars choose to be transported in containers, further aggravating the contradiction between supply and demand in the market.

However, the current freight rate is close to the cost line, and the industry estimates that the room for further decline is limited. The shipping company has notified the freight rate until April 15, and whether the freight rate can recover after that will depend on whether there is a large increase in the market volume.

From the intuitive offer point of view, although the end of March some routes appeared full load situation, but MSC's relatively pragmatic pricing style still has an impact on the overall pricing tone, other ships mainly adopted a follow-up strategy. Currently, MSC and MSK offers continue through Week 14, while ONE continues through week 15, which is mid-April. It can be said that the movement of spot prices has led the downward trend of futures prices.

In addition, the geopolitical risk factors that have had a greater impact on futures prices in the past few days - the Palestinian-Israeli ceasefire agreement has basically failed, and the Gaza war has broken out again. However, the actual impact on freight rates on European routes was relatively small as shipping lines did not begin to resume operations with the Gaza ceasefire.

For the future market, from the fundamental point of view, the supply and demand structure in early April has improved. In the case of continuing to use the main probability in the first week, observe the subsequent pricing strategy, whether to continue to prioritize the loading rate, or moderately consider the profit margin. At the same time, the marginal change in the high capacity scale in week 16-17 and the pressure on the supply and demand structure will also affect the pricing rhythm in late April. In the short term, the trend of European routes (EC) may show a volatile downward trend, and you can continue to pay attention to the situation in the Middle East and the follow-up initiatives of mainstream shipping companies.