Hutchison port sale sparks more ripple effects

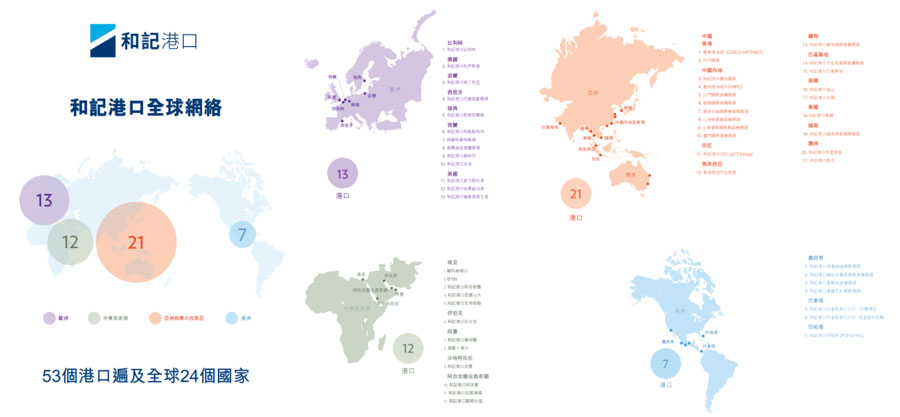

On March 4th, Li Ka-shing announced a partnership with BlackRock, Global Infrastructure Partners (GIP) and Terminal Investment Limited (TiL) (collectively, the "BlackRock-TiL Consortium") has reached an agreement in principle on the preliminary terms of the transaction, which will involve an 80% interest in Hutchison Ports Group, including Hutchison Ports' 43 ports, 199 berths and other related assets in 23 countries. Through the deal, Changhe expects to eventually bring back more than US $19 billion in cash, or about HK $148 billion, close to Changhe's total market value of about HK $180 billion.

At that time, the market's characterization of this equity sale only stayed at the level of "the largest transaction in the history of port and aviation". He also stressed that this is a purely commercial act and has nothing to do with the recent political news about Panama's ports. Its financial figures seem to back that up.

According to Changhe's latest annual report for 2024, the port and related services business recorded revenue of HK $45.282 billion, an increase of 11% over 2023; EBITDA (earnings before interest, tax, depreciation and amortisation) was HK $16.172 billion, up 19% year-on-year. However, both in terms of revenue and EBITDA, ports and related services business is the smallest of the major business segments, accounting for 9% of revenue. Retail (40%), infrastructure (12%), telecommunications (19%), and finance and investment (20%). That said, ports are not the most profitable segment of the business, but the sale could bring a significant premium.

Goldman Sachs, as the exclusive investment bank for the port sale to a consortium led by BlackRock, issued a research report that said the transaction's valuation is equivalent to about 14 times fiscal year 2024 EV/EBITDA (enterprise value/earnings before interest, tax, depreciation and amortization), compared with recent private port transactions or listed port company transactions with valuations of only 8-11 times. It is indeed a very good business.

Changhe not only faces the temptation of the above high premium "carrot", but also the threat of "stick".

US President Donald Trump claimed in his inaugural address to take back the Panama Canal from China, but the Panamanian government at first firmly denied that the canal was being manipulated by Chinese investors. But then, under pressure, Panama's audit Commission announced a review of Hutchison's accounts to ensure the efficient and transparent use of public resources.

As a Hong Kong-owned company with many years of overseas operating experience, Hutchison Ports has shown a more open and transparent attitude in handling public relations this time. In January 2025, the company voluntarily responded that it remained committed to its operations in Panama, fully cooperated with the audit, maintained the necessary transparency, and reiterated that its operations in Panama had contributed more than $5.9 billion to the Panamanian economy and created thousands of jobs.

But Hutchison's "business for business" approach is not working. Trump has successively issued 301 bills to crack down on China's port machinery, revitalize the shipbuilding industry, plan to charge high port fees for Chinese shipping companies and ships built and other policies, and continue to strengthen its "sense of presence" in the global port and shipping industry, which also makes Chinese port and shipping enterprises in the global region face huge scrutiny pressure, and Hutchison port is also within the range.

In addition to the combination of "carrot" and "stick", another important reason for the deal is that TiL in the acquisition consortium is currently a terminal operator under the world's largest container liner company Mediterranean Shipping (hereinafter referred to as MSC). According to Hong Kong's "Sing Tao Daily" quoted news reported that MSC was established by the Italian Aponte family, and the deal was facilitated by MSC's second-generation speaker Diego Aponte, and the Lee family and the Aponte family are family friends.

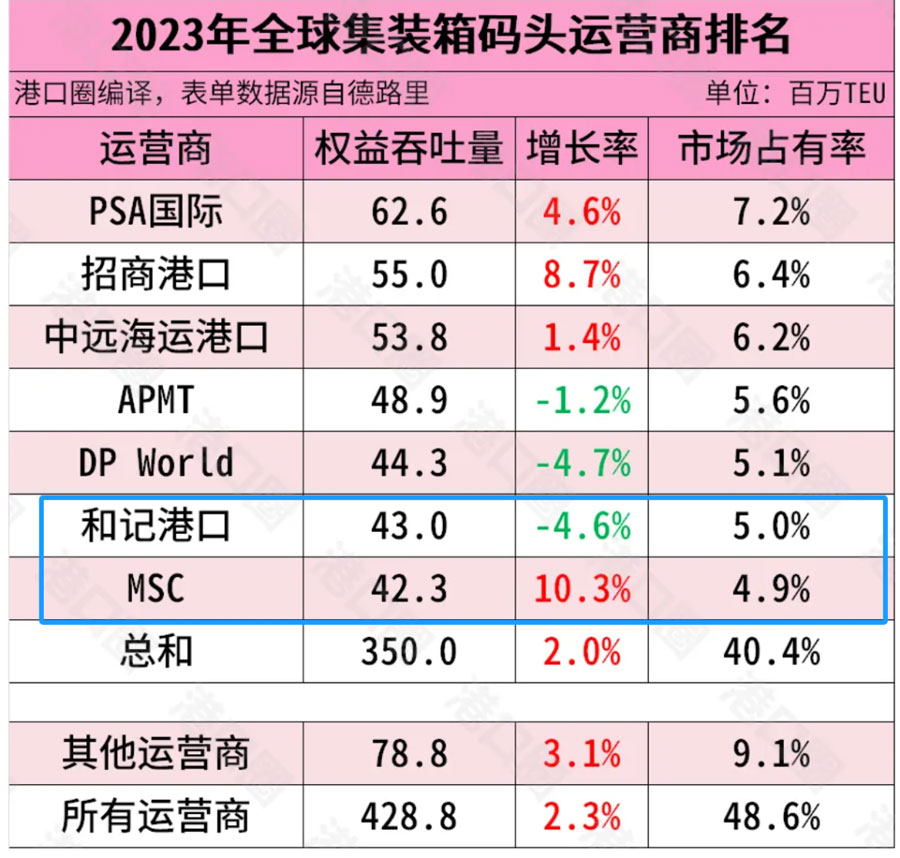

Because BlackRock CEO Fink has a personal relationship with Trump, it is reported that he went to the White House to report to Trump during the acquisition negotiations, which makes the deal with the political color of the great power game. However, it is worth noting that if the deal is finally completed, it is more likely that TiL, which is already the sixth largest terminal operator in the world, can actually control the global terminal network of Hutchison Port, with an equity throughput of 42.3 million TEU in 2023, plus an equity throughput of 43 million TEU in Hutchison Port. This makes MSC the number one port operator in the world. Not only that, a richer global network, hub ports of several important nodes, will be integrated with MSC's global shipping network. As a result, BlackRock is more of a financial investor in the consortium, while MSC is more of a strategic investor who wants to exercise these terminal interests and functions.

In summary, under the temptation of the "carrot" and the threat of the "stick", coupled with the close relationship between the Lee family and the Aponte family, MSC may seize a "world first" strategic future, which makes the largest transaction in the history of port and shipping quickly concluded in a few weeks. However, Ta Kung Pao published two comments one after another on March 13 and 15, "Don't be naive" and "great entrepreneurs are Zheng patriots", angrily denouncing Chang and "in the face of such a big event, the relevant enterprises should think twice", The Hong Kong and Macao Affairs Office of the State Council then reprinted the article on the website on the 13th, and the deal suddenly appeared a lot of uncertainty.

The public's first concern is whether the deal will trigger Chinese antitrust and national security reviews.

It can only be implemented after an antitrust review. However, since the seller, CK Hutchison intends to sell all the shares of the target company, after the transaction, CK Hutchison loses all control of the target company and cannot affect the market concentration after the transaction. Therefore, CK Hutchison is not regarded as an operator participating in the concentration.

Specifically, it includes new enterprises, mergers and acquisitions of equity or assets of domestic enterprises, etc., and these transactions must submit national security declarations and be reviewed before they can be carried out. Therefore, from a formal point of view, the transaction does not meet the definition of "foreign investment" in Article 2 of the Measures for Security review, and there are certain obstacles to direct application of foreign investment security review procedures.

Therefore, based on the current legal framework and past practice, it is yet to be confirmed whether this transaction will trigger Chinese scrutiny.

Second, will Chinese port operators be able to cut off the beard? Yes, but there are several difficulties.

In recent years, Europe and the US have stepped up scrutiny of foreign investment, especially in the critical infrastructure sector. For example, Germany's 2020 amendment law includes ports as "key areas" and requires foreign acquisitions of more than 10% of the equity to be reviewed. The United States has the Hart-Scott-Rodino Act, if the transaction amount exceeds $126.4 million, it needs to be reported to the Federal Trade Commission and the antitrust department of the United States Department of Justice, and the port is a sensitive infrastructure, and may also be involved on the grounds of "national security". If an acquirer already has assets in the US, such as COsco Shipping's Long Beach terminal, it may need to divest some of those businesses.

In general, if a Chinese state-owned port operator acquires 80% of Hutchison Ports, it is likely to trigger antitrust reviews in the EU, the UK and other places, especially in key ports such as Rotterdam in the Netherlands and Felixstowe in the UK. The success of the deal depends on: Whether competition concerns can be alleviated through asset divestments or behavioral remedies, that is, the sale of some business, assets or equity to eliminate conflicts with competitors over control of overlapping markets or key resources, with structural adjustments to directly reduce market concentration; National security clearance, especially in Europe and the United States.

Of course, the above-mentioned anti-monopoly review behavior is not only targeted at Chinese port operators. TiL and Hutchison Ports jointly hold terminals in Antwerp Port of Belgium and Rotterdam Port of the Netherlands, which means that there is business overlap between the two sides in the same port or neighboring ports. There is also the possibility of monopoly position after TiL's acquisition, even if the subsequent transaction goes smoothly. It may also be necessary to divest some assets in response to the review.

In addition, the size of the deal exceeding $19 billion is rare, and earlier sources said that although BlackRock did not hire financial advisers, banks have competed to provide advisory and financing roles for it. If Chinese port operators are involved, they also need to carry out multi-channel financing: including but not limited to bank loans, bond issuance, equity financing, government support funds, etc., and may also need the support of national policy banks, such as loans provided by the Export-Import Bank of China, China Development Bank, etc., and may also involve some international syndicated loans.

The huge social uproar caused by the Hutchison Port stake sale was unexpected, but it is also reasonable. From a commercial point of view, as a diversified group, the port is no longer the most profitable sector, and the cash flow close to market value can be obtained only by selling part of the port assets, which is very attractive for any enterprise. But to throw the deal into the murky arena of great power political wrangling, to identify the global network of ports as an indispensable strategic resource, and to talk about port value only from a commercial point of view, would be seen as "short-sighted." It will take time for the deal to be finalized, but in any case, it has become a microcosm of a more fragmented, anti-globalization, geopolitical confluence.