Foreign media: The United States to impose port fees on Chinese ships will disrupt the global trade order

In an effort to give the U.S. shipping industry an edge over China, the U.S. is considering adding millions of dollars in port fees to each Chinese-made ship that arrives at U.S. ports, but the move could hit U.S. retailers and shipping companies that are closely linked to global supply chains first. Bloomberg reported on the 23rd that the business community, trade organizations and experts in the United States are concerned that the plan may disrupt the global trade order more dramatically than President Trump's tariff war, and may even trigger a "trade apocalypse" crisis.

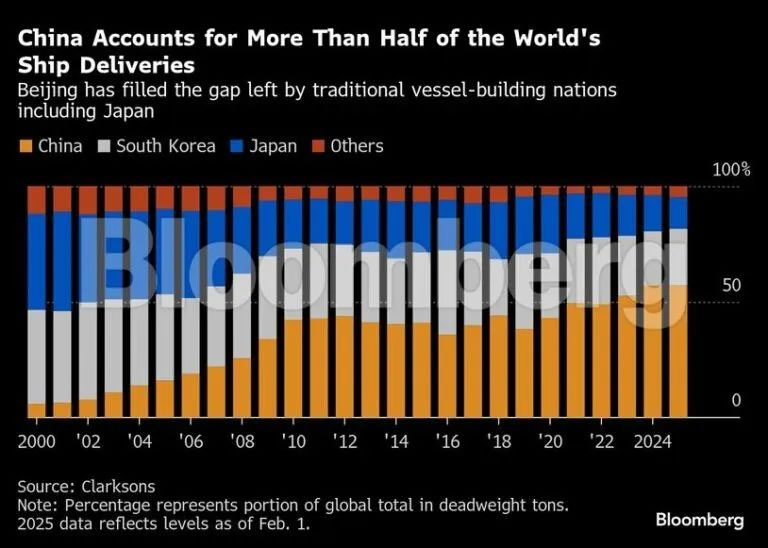

The incident is just one of many deal-making muddles triggered by a proposal by the Office of the United States Trade Representative aimed at curbing China's dominance in the shipbuilding, logistics and maritime industries. China now produces more than half of the world's cargo ships, up from just 5 percent in 1999. By comparison, U.S. shipyards built just 0.01 percent of the world's cargo ships last year. The Office of the United States Trade Representative is seeking to revive the long-dormant U.S. merchant Marine manufacturing industry.

In unveiling the proposal, the USTR said China's dominance gives it "the market power to control global supply, pricing, and access." However, China Shipbuilding Group objected, saying the measures violated World Trade Organization rules.

Jonathan Gold, vice president of supply chain and customs policy at the National Retail Federation, said: "They see it as more threatening than tariffs because of the impact it will have on the supply chain. "Carriers say they will not only pass on costs, but also pull out of certain routes, which will affect smaller ports like Oakland, Charleston, Delaware, Philadelphia and others."

Business owners and industry officials argued in letters to the USTR and in interviews that the proposals make no sense and could be devastating to the U.S. economy if the goal is to revive the domestic shipbuilding industry. They fear it would make U.S. goods uncompetitive in international markets, divert trade to Canada and Mexico, overwhelm major U.S. ports, and push up global shipping rates and domestic inflation.

In theory, the levies could generate $40 billion to $52 billion for the U.S. Treasury, according to Clarkson Research Services, the world's largest shipbroking firm. However, some U.S. companies and others in the industry are anxious because of escalating tariffs on Chinese goods, steel and aluminum, and a new round of reciprocal measures expected to be introduced on April 2.

Joe Kramaker, CEO of the World Shipping Council, said: "The plan proposed by USTR - a retrospective, retroactive, multimillion dollar fee per port of call - will not work. It will only punish American consumers, businesses, and especially farmers by raising prices and threatening jobs."

Maritime expert and shipping industry veteran John McCowan put it more bluntly: "If you want to do business with a sledgehammer, this is what you do." You put everything together - it's like the end of trade."

The case of the Atlantic container line ACL is a telling example. The company ships more than half of all construction and agricultural equipment exported from the United States to Europe. When it came time to procure "container ro-ro ships," the company eventually found vessels in China because shipyards in Japan and South Korea were reluctant to build them and U.S. shipyards said they couldn't deliver them in time. Andrew Abbott, chief executive of Atlantic Container Line, wrote in a report to the Office of the US Trade Representative: "The proposed action would put us out of business for a business decision we made 13 years ago, when US shipyards were too busy processing US Navy orders to build our ships and the Chinese shipbuilding industry was a small player in the world."

While commentators expressed support for curbing China's maritime power, they also urged the USTR to reconsider its approach. However, there were a few comments in support of the proposed measures out of more than 250 comments. "If fully implemented, these 'remedies' will help restore America's economic security and revitalize the U.S. shipbuilding industry," said Scott Paul, president of the Alliance for American Manufacturing.

Given how damaging the proposal would be to world trade, several industry executives believe it could be watered down. Fees and export requirements will certainly be adjusted and may even be abolished. However, industry lobby groups insist there are good reasons to think at least some of them will remain.

The idea of reviving the U.S. shipbuilding industry to bolster U.S. maritime influence has caught Trump's attention and fits with his grand plan to push back what he calls the golden age of American manufacturing. Today, in Washington, the Marine industry is seen as an important pillar of national security, and the shift is accelerating.

If the USTR implements its proposal as written, shipping executives and brokers say the market is likely to gradually fragment, with ships made in China being treated differently than those built elsewhere. In the tanker market, that seems to have happened. Charterers are starting to balk at long-term chartering of China-related tankers because they expect the vessels to be at risk of future tariffs.

For shipowners who want to increase the size of their fleets while avoiding penalties, they are also in a bind. Shipyards in South Korea and Japan are already close to full capacity, and the next orders for new ships won't be completed until around 2028. However, at a time when the age of the global fleet is rising, not buying new vessels means they will only be able to use aging vessels.

Severin said he would continue to closely monitor the outcome of the USTR's decision, which is expected to be announced in the coming weeks. He noted that the Louisiana project still needs the 16,000 tons of steel pipe due to a lack of domestic supply. This incident once again highlights the complexity and uncertainty of the current global trade environment, and the important impact of national policies on international trade.

The incident is just one of many deal-making muddles triggered by a proposal by the Office of the United States Trade Representative aimed at curbing China's dominance in the shipbuilding, logistics and maritime industries. China now produces more than half of the world's cargo ships, up from just 5 percent in 1999. By comparison, U.S. shipyards built just 0.01 percent of the world's cargo ships last year. The Office of the United States Trade Representative is seeking to revive the long-dormant U.S. merchant Marine manufacturing industry.

In unveiling the proposal, the USTR said China's dominance gives it "the market power to control global supply, pricing, and access." However, China Shipbuilding Group objected, saying the measures violated World Trade Organization rules.

Jonathan Gold, vice president of supply chain and customs policy at the National Retail Federation, said: "They see it as more threatening than tariffs because of the impact it will have on the supply chain. "Carriers say they will not only pass on costs, but also pull out of certain routes, which will affect smaller ports like Oakland, Charleston, Delaware, Philadelphia and others."

Business owners and industry officials argued in letters to the USTR and in interviews that the proposals make no sense and could be devastating to the U.S. economy if the goal is to revive the domestic shipbuilding industry. They fear it would make U.S. goods uncompetitive in international markets, divert trade to Canada and Mexico, overwhelm major U.S. ports, and push up global shipping rates and domestic inflation.

In theory, the levies could generate $40 billion to $52 billion for the U.S. Treasury, according to Clarkson Research Services, the world's largest shipbroking firm. However, some U.S. companies and others in the industry are anxious because of escalating tariffs on Chinese goods, steel and aluminum, and a new round of reciprocal measures expected to be introduced on April 2.

Joe Kramaker, CEO of the World Shipping Council, said: "The plan proposed by USTR - a retrospective, retroactive, multimillion dollar fee per port of call - will not work. It will only punish American consumers, businesses, and especially farmers by raising prices and threatening jobs."

Maritime expert and shipping industry veteran John McCowan put it more bluntly: "If you want to do business with a sledgehammer, this is what you do." You put everything together - it's like the end of trade."

The case of the Atlantic container line ACL is a telling example. The company ships more than half of all construction and agricultural equipment exported from the United States to Europe. When it came time to procure "container ro-ro ships," the company eventually found vessels in China because shipyards in Japan and South Korea were reluctant to build them and U.S. shipyards said they couldn't deliver them in time. Andrew Abbott, chief executive of Atlantic Container Line, wrote in a report to the Office of the US Trade Representative: "The proposed action would put us out of business for a business decision we made 13 years ago, when US shipyards were too busy processing US Navy orders to build our ships and the Chinese shipbuilding industry was a small player in the world."

While commentators expressed support for curbing China's maritime power, they also urged the USTR to reconsider its approach. However, there were a few comments in support of the proposed measures out of more than 250 comments. "If fully implemented, these 'remedies' will help restore America's economic security and revitalize the U.S. shipbuilding industry," said Scott Paul, president of the Alliance for American Manufacturing.

Given how damaging the proposal would be to world trade, several industry executives believe it could be watered down. Fees and export requirements will certainly be adjusted and may even be abolished. However, industry lobby groups insist there are good reasons to think at least some of them will remain.

The idea of reviving the U.S. shipbuilding industry to bolster U.S. maritime influence has caught Trump's attention and fits with his grand plan to push back what he calls the golden age of American manufacturing. Today, in Washington, the Marine industry is seen as an important pillar of national security, and the shift is accelerating.

If the USTR implements its proposal as written, shipping executives and brokers say the market is likely to gradually fragment, with ships made in China being treated differently than those built elsewhere. In the tanker market, that seems to have happened. Charterers are starting to balk at long-term chartering of China-related tankers because they expect the vessels to be at risk of future tariffs.

For shipowners who want to increase the size of their fleets while avoiding penalties, they are also in a bind. Shipyards in South Korea and Japan are already close to full capacity, and the next orders for new ships won't be completed until around 2028. However, at a time when the age of the global fleet is rising, not buying new vessels means they will only be able to use aging vessels.

Severin said he would continue to closely monitor the outcome of the USTR's decision, which is expected to be announced in the coming weeks. He noted that the Louisiana project still needs the 16,000 tons of steel pipe due to a lack of domestic supply. This incident once again highlights the complexity and uncertainty of the current global trade environment, and the important impact of national policies on international trade.