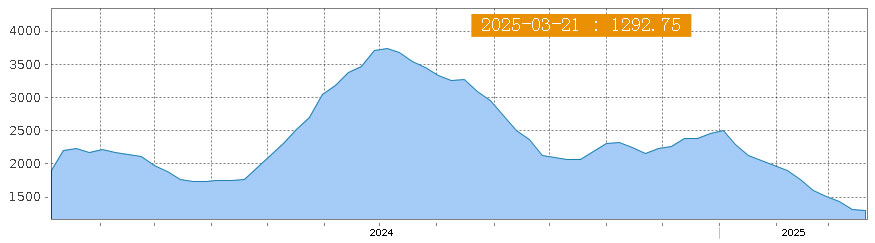

The decline reached 48.4%, and freight rates fell for 11 consecutive weeks

According to the latest Shanghai export container comprehensive Freight Index (SCFI) released by the Shanghai HNA Exchange, on March 21, the index was 1292.75 points, down 2.0% from a week ago, which is also the 11th consecutive decline since SCFI 2025, the decline reached 48.4%.

In addition, on March 21, the freight rate of Shanghai's exports to the European basic port market (sea and sea surcharges) was US $1306 /TEU, down 2.7% from a week ago; Shanghai port exports to the Mediterranean basic port market freight (sea and sea surcharge) was 2,195 US dollars /TEU, down 4.4% from a week ago. At the beginning of 2025, freight rates were $2,850 /TEU and $3,747 /TEU, respectively, with declines of 54.2% and 41.4%.

In 2025, the container shipping market environment is complex and volatile, and factors such as greater geopolitical influence, continued uncertainty in the Red Sea situation, and stronger trade tariff policies will continue to impact the market.

On the one hand, the United States consumption is weak, the transportation demand is sluggish, the North American route transportation market is facing greater pressure, and the market freight rate is falling rapidly. On the other hand, the Russia-Ukraine conflict ceasefire negotiations are not smooth, some European countries have significantly increased defense spending, resulting in high geopolitical risks in Europe, lack of growth momentum in transport demand, and market freight rates continue to fall. In addition, Europe is also facing the escalation of the trade conflict with the United States, and the global economic outlook is not optimistic under the influence of multiple risks.

The poor market conditions are expected to continue.

Mr Delury also said that while 92 per cent of sailings would continue to operate as planned over the next five weeks, punctuality could fall further. The agency advised shippers to pay close attention to market dynamics and adjust their strategies in a timely manner to cope with market volatility and supply chain tightness.

In addition, on March 21, the freight rate of Shanghai's exports to the European basic port market (sea and sea surcharges) was US $1306 /TEU, down 2.7% from a week ago; Shanghai port exports to the Mediterranean basic port market freight (sea and sea surcharge) was 2,195 US dollars /TEU, down 4.4% from a week ago. At the beginning of 2025, freight rates were $2,850 /TEU and $3,747 /TEU, respectively, with declines of 54.2% and 41.4%.

In 2025, the container shipping market environment is complex and volatile, and factors such as greater geopolitical influence, continued uncertainty in the Red Sea situation, and stronger trade tariff policies will continue to impact the market.

On the one hand, the United States consumption is weak, the transportation demand is sluggish, the North American route transportation market is facing greater pressure, and the market freight rate is falling rapidly. On the other hand, the Russia-Ukraine conflict ceasefire negotiations are not smooth, some European countries have significantly increased defense spending, resulting in high geopolitical risks in Europe, lack of growth momentum in transport demand, and market freight rates continue to fall. In addition, Europe is also facing the escalation of the trade conflict with the United States, and the global economic outlook is not optimistic under the influence of multiple risks.

The poor market conditions are expected to continue.

Mr Delury also said that while 92 per cent of sailings would continue to operate as planned over the next five weeks, punctuality could fall further. The agency advised shippers to pay close attention to market dynamics and adjust their strategies in a timely manner to cope with market volatility and supply chain tightness.