Adjusting capacity in response to tariffs, MSC cancelled several trans-Pacific routes

The latest round of "reciprocal tariffs" imposed by the United States has deeply affected the shipping market, and shipping companies are seeking solutions through means such as capacity adjustment.

According to MSC's announcement, the following voyages will be cancelled:

• Week 14: CHINOOK Route UK514A;

• Week 17: PEARL Route GQ517N, ORIENT Route GO517N, AMERICA Route GU517W, LONE STAR Route GN517E

• Week 18: EMPIRE Route GE518E.

In addition, according to the latest statistics from industry consultancy Delury, the world's major east-west routes - including trans-Pacific, trans-Atlantic and Asia-Nordic and Mediterranean routes - have announced the cancellation of 57 flights between April 7 and May 11, accounting for 8% of the 718 planned flights. About 53 percent of the canceled flights were on trans-Pacific eastbound routes, 23 percent on Asia-Nordic and Mediterranean routes, and 24 percent on trans-Atlantic westbound routes.

Behind the fluctuation of freight rates is the different strategies of the major shipping alliances in the allocation of capacity.

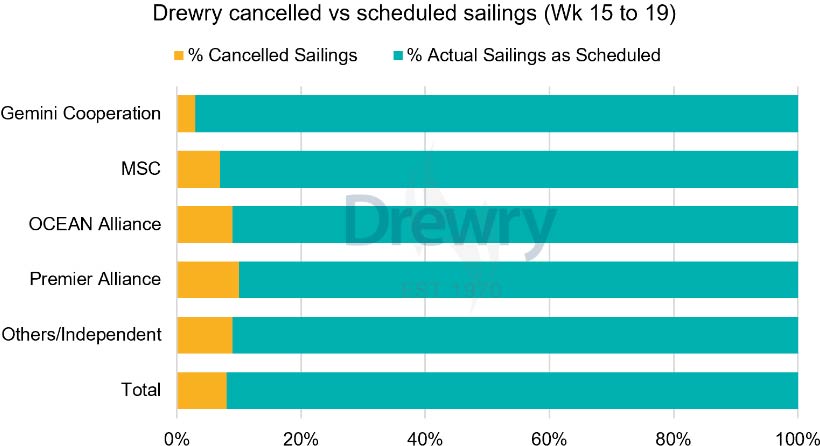

Delury analysis said that the freight rate recovery is mainly driven by the comprehensive rate increase surcharge (GRI) and MSC voluntary suspension. However, the divergence in capacity management strategies among the major shipping alliances is still evident: of the 57 scheduled cancellations worldwide in the next five weeks, 30 are from MSC and Ocean Alliance, while the newly formed "Gemini Alliance" has not announced any cancellations.

Despite some signs of stabilisation in the market, Mr Delury warned shippers of potential demand weakness and policy uncertainty. Delury stressed that the new round of tariff adjustments in the United States is becoming a key variable affecting the structure of the global shipping market.

Philip Damas, head of Delury supply chain Consulting, believes that this tariff adjustment is expected to profoundly change the ecology of the global container shipping industry, forcing market participants to re-evaluate the supply chain layout, market strategy and service path. In addition, high and uneven tariff barriers are expected to shrink the global trade volume, change the distribution pattern of goods, and form a new market order.

At the same time, the tariffs have also hit global financial markets.

According to foreign media reports, the US stock market lost a total of $5 trillion in market value on April 3 and April 4, marking the worst plunge since the COVID-19 outbreak in March 2020. A number of shipping companies share prices fell sharply, with Maersk down more than 21%, Star Line down more than 17%, Hapag-Lloyd down 16%, Maison Shipping down 11%.

Behind the volatility of the capital market, freight rates and orders are also facing practical challenges.

Due to the extremely high level of tariffs, some importers of consumer goods with low profit margins are difficult to pass on costs through price increases, and the notice period for the effect of tariffs is extremely short, many US importers choose to suspend or even cancel orders, and repeat the "order cliff" type volatility in the early stage of the epidemic. This could cause shipping companies to face a double decline in freight rates and booking capacity.

There are also voices in the industry that due to high tariffs, US importers will reduce their demand for containerized goods, and the economies of their trading partners will also be affected, and demand in the tanker and dry bulk markets may also be weak.

"There's no question that China is the central target of this trade policy change," said Ryan Petersen, chief executive of Flexport, a leading freight forwarder.

According to the US Census Bureau, goods from China will account for 30% of total US container imports by weight in 2023. According to Descartes, a US research firm, the figure is 39 per cent in TEU terms.

Jason Miller, a freight economist at Michigan State University, said: "This will have an impact on the demand for container shipping in the United States, especially in the context of spot freight rates have fallen, which is definitely worse for shipping companies."

Jason Miller further said that this shock may really push the restructuring of global trade patterns. "The rest of the world will trade more with each other in the future rather than being highly dependent on the trade relationship with the United States."

According to MSC's announcement, the following voyages will be cancelled:

• Week 14: CHINOOK Route UK514A;

• Week 17: PEARL Route GQ517N, ORIENT Route GO517N, AMERICA Route GU517W, LONE STAR Route GN517E

• Week 18: EMPIRE Route GE518E.

In addition, according to the latest statistics from industry consultancy Delury, the world's major east-west routes - including trans-Pacific, trans-Atlantic and Asia-Nordic and Mediterranean routes - have announced the cancellation of 57 flights between April 7 and May 11, accounting for 8% of the 718 planned flights. About 53 percent of the canceled flights were on trans-Pacific eastbound routes, 23 percent on Asia-Nordic and Mediterranean routes, and 24 percent on trans-Atlantic westbound routes.

Behind the fluctuation of freight rates is the different strategies of the major shipping alliances in the allocation of capacity.

Delury analysis said that the freight rate recovery is mainly driven by the comprehensive rate increase surcharge (GRI) and MSC voluntary suspension. However, the divergence in capacity management strategies among the major shipping alliances is still evident: of the 57 scheduled cancellations worldwide in the next five weeks, 30 are from MSC and Ocean Alliance, while the newly formed "Gemini Alliance" has not announced any cancellations.

Despite some signs of stabilisation in the market, Mr Delury warned shippers of potential demand weakness and policy uncertainty. Delury stressed that the new round of tariff adjustments in the United States is becoming a key variable affecting the structure of the global shipping market.

Philip Damas, head of Delury supply chain Consulting, believes that this tariff adjustment is expected to profoundly change the ecology of the global container shipping industry, forcing market participants to re-evaluate the supply chain layout, market strategy and service path. In addition, high and uneven tariff barriers are expected to shrink the global trade volume, change the distribution pattern of goods, and form a new market order.

At the same time, the tariffs have also hit global financial markets.

According to foreign media reports, the US stock market lost a total of $5 trillion in market value on April 3 and April 4, marking the worst plunge since the COVID-19 outbreak in March 2020. A number of shipping companies share prices fell sharply, with Maersk down more than 21%, Star Line down more than 17%, Hapag-Lloyd down 16%, Maison Shipping down 11%.

Behind the volatility of the capital market, freight rates and orders are also facing practical challenges.

Due to the extremely high level of tariffs, some importers of consumer goods with low profit margins are difficult to pass on costs through price increases, and the notice period for the effect of tariffs is extremely short, many US importers choose to suspend or even cancel orders, and repeat the "order cliff" type volatility in the early stage of the epidemic. This could cause shipping companies to face a double decline in freight rates and booking capacity.

There are also voices in the industry that due to high tariffs, US importers will reduce their demand for containerized goods, and the economies of their trading partners will also be affected, and demand in the tanker and dry bulk markets may also be weak.

"There's no question that China is the central target of this trade policy change," said Ryan Petersen, chief executive of Flexport, a leading freight forwarder.

According to the US Census Bureau, goods from China will account for 30% of total US container imports by weight in 2023. According to Descartes, a US research firm, the figure is 39 per cent in TEU terms.

Jason Miller, a freight economist at Michigan State University, said: "This will have an impact on the demand for container shipping in the United States, especially in the context of spot freight rates have fallen, which is definitely worse for shipping companies."

Jason Miller further said that this shock may really push the restructuring of global trade patterns. "The rest of the world will trade more with each other in the future rather than being highly dependent on the trade relationship with the United States."