Singapore Shipping company Vasi Shipping declared bankruptcy

Singapore Shipping company Vasi Shipping has begun bankruptcy proceedings, becoming another victim of the collapse in container freight rates.

According to a notice published by the directors of Vasi Shipping in the Government Gazette on April 10, the company plans to hold a creditors' meeting on the 28th of this month, at which the liquidators will be formally appointed and the list of creditors and their declared amounts will be collated.

Venkat Padmanabhan, director of Vasi Shipping, said in an interview that he could not give more details before the creditors' meeting on April 28, but confirmed that the company was in serious difficulties due to high charter costs and low freight rates during the same period.

Padmanabhan is a long-time resident of Singapore and an Indian shipping veteran with over four decades of experience. He said helplessly: "Rents are high, but freight rates are all the way down, completely deviating." It is what it is and I have nothing more to say."

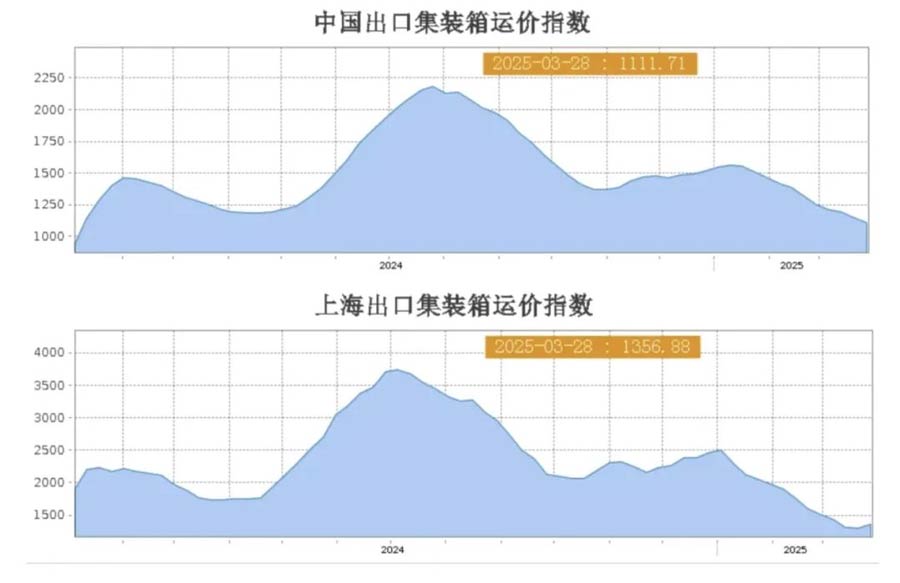

Data show that this year, the container freight rate of many routes has been halved, but the charter market has risen due to the shortage of available ships, forming a sharp scissors gap.

According to the latest report from MB Shipbrokers, there were a lot of negotiations going on in the container market during the week ending April 11, and ship daily rentals were solid. So far in 2025, daily container ship rentals are higher than last year's average for almost all ship types.

By the end of 2022, the company was operating regional and regional routes between Singapore, Vietnam and Bangladesh, some of which were in partnership with CMA CGM's sub-regional market focused CNC. However, since the beginning of March 2025, Vasi Shipping has ceased all vessel operations.

According to VesselsValue data, Vasi Shippingi previously owned two container ships, which have all been scrapped: one was built in 1996, 1730 TEU "Vasi Star" ship, which was sold for dismantling in March 2023; Another vessel, the 1743 TEU Vasi Sun, built in 1990, was dismantled and decommissioned as early as December 2018.

According to a notice published by the directors of Vasi Shipping in the Government Gazette on April 10, the company plans to hold a creditors' meeting on the 28th of this month, at which the liquidators will be formally appointed and the list of creditors and their declared amounts will be collated.

Venkat Padmanabhan, director of Vasi Shipping, said in an interview that he could not give more details before the creditors' meeting on April 28, but confirmed that the company was in serious difficulties due to high charter costs and low freight rates during the same period.

Padmanabhan is a long-time resident of Singapore and an Indian shipping veteran with over four decades of experience. He said helplessly: "Rents are high, but freight rates are all the way down, completely deviating." It is what it is and I have nothing more to say."

Data show that this year, the container freight rate of many routes has been halved, but the charter market has risen due to the shortage of available ships, forming a sharp scissors gap.

According to the latest report from MB Shipbrokers, there were a lot of negotiations going on in the container market during the week ending April 11, and ship daily rentals were solid. So far in 2025, daily container ship rentals are higher than last year's average for almost all ship types.

By the end of 2022, the company was operating regional and regional routes between Singapore, Vietnam and Bangladesh, some of which were in partnership with CMA CGM's sub-regional market focused CNC. However, since the beginning of March 2025, Vasi Shipping has ceased all vessel operations.

According to VesselsValue data, Vasi Shippingi previously owned two container ships, which have all been scrapped: one was built in 1996, 1730 TEU "Vasi Star" ship, which was sold for dismantling in March 2023; Another vessel, the 1743 TEU Vasi Sun, built in 1990, was dismantled and decommissioned as early as December 2018.