Tariffs have been repeatedly staged, and freight prices in the bulk transport market have gradually risen

Trump recently can be described as a "show", "levy", "delay", "negotiation" and "exemption" play repeatedly staged, his old man "thick skin", but the world is really tired by him...... Fortunately, for the container market, so far it is not really "scare", but usher in a "surprise", that is, the freight rate really rose.

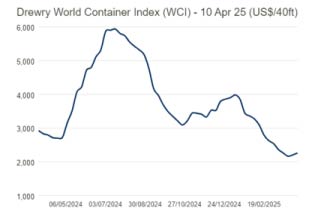

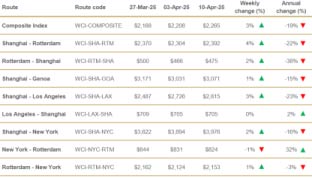

Drewry analyst Simon Heaney said the uncertainty caused by Trump 2.0's "recurring" tariff policy "led analysts to expect the downward trend in freight rates to continue, particularly on trans-Pacific routes." However, it was the Pacific route that drove the Drewry World Container Rate Index (WCI) up 3% month-on-month (as of April 10).

Drewry expects rates to rise in the coming weeks due to increased U.S. tariffs and cancellations.

Simon Heaney noted that "shipping companies are doing everything they can to push rates up," including implementing a comprehensive rate increase surcharge (GRI) and cancelling voyages. He added that while the increase was small compared with recent declines, "at least rates have stopped falling, which is a positive momentum."

He then analyzed the possible resistance to the rate increase and concluded that the 3 percent increase on the Pacific route was "transitory."

"We are hearing that shippers are cancelling orders, but the details are uncertain," he explained.

Meanwhile, the results of the U.S. Trade Representative's (USTR) "301 investigation" are expected to be released on April 17, and Simon Heaney said there are signs that the program will at least be softened, but its impact will be felt.

"Tariffs, port fees and a falling dollar will weigh on demand in the container market," he stressed.

Meanwhile, Darron Wadey, analyst at Dynamar Netherlands, was surprised by the increase in freight rates. "It's really counterintuitive, especially given the economic indicators so far. I think more voyages would need to be cancelled to have such an unexpected impact on rates."

Darron Wadey said congestion in northern European ports may also have played a role, although he would like to see freight rates continue to rise.

"Next week's data will be interesting to see if it's a surprise or a sign of real improvement," he said.

In short, Trump 2.0 has finally kicked off its long-simmering "reciprocal tariffs" show. However, the "main goal" of Trump's "big chess game" is to respond calmly, so that the Trump administration is in chaos, and become the object of global criticism. Apparently, I'm afraid even the most die-hard "Trump fans" have to admit that Trump's tariff "show" has botched...... However, there is no winner in the trade war, and the uncertainty of Trump will eventually affect the demand for container transportation in the US market. In the short term, the "tariff war" has begun to have a certain impact on the Sino-US route transportation market, some goods have canceled the shipment plan, and the spot market booking has decreased significantly.

Drewry analyst Simon Heaney said the uncertainty caused by Trump 2.0's "recurring" tariff policy "led analysts to expect the downward trend in freight rates to continue, particularly on trans-Pacific routes." However, it was the Pacific route that drove the Drewry World Container Rate Index (WCI) up 3% month-on-month (as of April 10).

Drewry expects rates to rise in the coming weeks due to increased U.S. tariffs and cancellations.

Simon Heaney noted that "shipping companies are doing everything they can to push rates up," including implementing a comprehensive rate increase surcharge (GRI) and cancelling voyages. He added that while the increase was small compared with recent declines, "at least rates have stopped falling, which is a positive momentum."

He then analyzed the possible resistance to the rate increase and concluded that the 3 percent increase on the Pacific route was "transitory."

"We are hearing that shippers are cancelling orders, but the details are uncertain," he explained.

Meanwhile, the results of the U.S. Trade Representative's (USTR) "301 investigation" are expected to be released on April 17, and Simon Heaney said there are signs that the program will at least be softened, but its impact will be felt.

"Tariffs, port fees and a falling dollar will weigh on demand in the container market," he stressed.

Meanwhile, Darron Wadey, analyst at Dynamar Netherlands, was surprised by the increase in freight rates. "It's really counterintuitive, especially given the economic indicators so far. I think more voyages would need to be cancelled to have such an unexpected impact on rates."

Darron Wadey said congestion in northern European ports may also have played a role, although he would like to see freight rates continue to rise.

"Next week's data will be interesting to see if it's a surprise or a sign of real improvement," he said.

In short, Trump 2.0 has finally kicked off its long-simmering "reciprocal tariffs" show. However, the "main goal" of Trump's "big chess game" is to respond calmly, so that the Trump administration is in chaos, and become the object of global criticism. Apparently, I'm afraid even the most die-hard "Trump fans" have to admit that Trump's tariff "show" has botched...... However, there is no winner in the trade war, and the uncertainty of Trump will eventually affect the demand for container transportation in the US market. In the short term, the "tariff war" has begun to have a certain impact on the Sino-US route transportation market, some goods have canceled the shipment plan, and the spot market booking has decreased significantly.