Nine voyages on the East Coast of the United States route will be cancelled next month

As liner companies adjust their capacity deployments to adapt to the sharp fluctuations in demand since Trump's 2.0 tariff "chaos", the number of cancellations on the eastbound Trans-Pacific route has soared in the coming months.

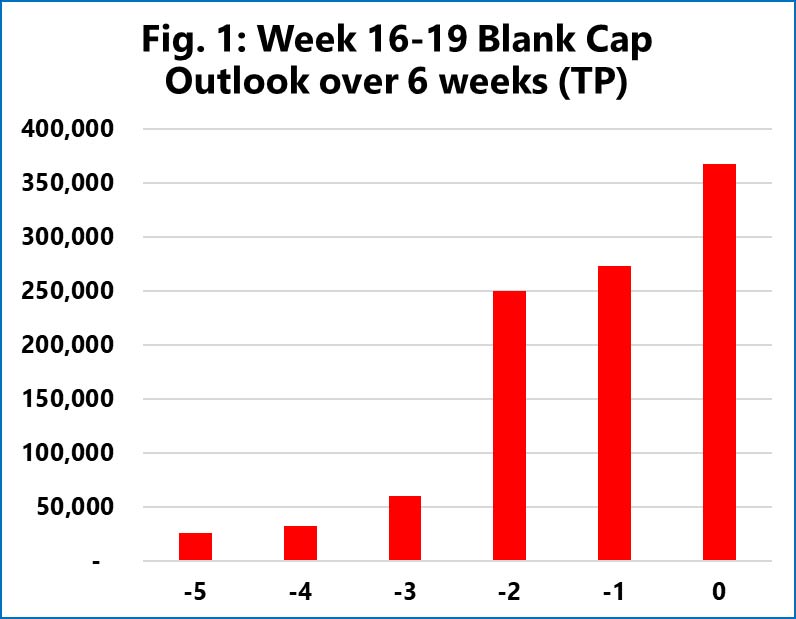

According to the analysis of Sea-Intelligence, from the 16th to the 19th week, the total blank navigation capacity has soared to 367,800 TEU, with a significant increase compared to 60,000 TEU three weeks ago. The planned capacity of the Asia-North America West Coast route has decreased by 12% compared to six weeks ago, while the Asia-North America East Coast route has witnessed a more significant decline, with a drop of 14%.

In the 20th week, from May 12th to 18th, 10 voyations will also be cancelled. Although currently it is equivalent to 25% of the weekly capacity of this route, given that liner companies are likely to cancel more voyations, the data may change further.

Sea-Intelligence pointed out, "Obviously, the impact of the trade war has led many shippers to suspend or completely cancel transportation." Conversely, this reduces the demand for capacity, and liner companies respond by canceling voyages.

Sea-Intelligence believes that the cancellation of a large number of voyages clearly indicates the booking situation of liner companies. In other words, as of now, the proportion of cancellations is estimated to be between 30% and 60%.

Sea-Intelligence said, "From this perspective, the impact is very astonishing." On the Asia-North America West route, liner companies predict that the demand in the 18th week will be 28% lower than expected. On the Asia-North America East route, the cargo transported is expected to be 42% less than expected.

Meanwhile, Drewry predicts that from April 21 to May 25, 2025, 72 voyages on the east-west main route are expected to be cancelled, accounting for 10% of the planned 713 voyages. Among them, approximately 56% will be on the eastbound Trans-Pacific route, 31% on the Asia-Nordic and Mediterranean routes, and 13% on the westbound Trans-Atlantic route.

Drewry said that the number of cancellations on the East and West Coast routes of the United States has been on the rise recently. In the coming weeks, the number of cancelled voyages is expected to increase, mainly concentrated on the eastbound Trans-Pacific routes. The number of booking cancellations continues to rise, and some ships departing from China may have a high proportion of empty cabins before May. Affected by the uncertainty of tariff policies, shippers are striving to absorb the cost pressure, resulting in many goods having their orders cancelled or being stranded at the place of origin.

In short, the impact of Trump's 2.0 tariff "chaotic punches" on the container shipping market is obviously very huge. Before Trump launched the trade war, American companies were cautious about increasing inventories, and retailers were clearly inclined to reduce some of the excess inventories. However, the trade war has developed so rapidly and unpredictably that it is very difficult to predict what strategies retailers will adopt at present.

According to the analysis of Sea-Intelligence, from the 16th to the 19th week, the total blank navigation capacity has soared to 367,800 TEU, with a significant increase compared to 60,000 TEU three weeks ago. The planned capacity of the Asia-North America West Coast route has decreased by 12% compared to six weeks ago, while the Asia-North America East Coast route has witnessed a more significant decline, with a drop of 14%.

In the 20th week, from May 12th to 18th, 10 voyations will also be cancelled. Although currently it is equivalent to 25% of the weekly capacity of this route, given that liner companies are likely to cancel more voyations, the data may change further.

Sea-Intelligence pointed out, "Obviously, the impact of the trade war has led many shippers to suspend or completely cancel transportation." Conversely, this reduces the demand for capacity, and liner companies respond by canceling voyages.

Sea-Intelligence believes that the cancellation of a large number of voyages clearly indicates the booking situation of liner companies. In other words, as of now, the proportion of cancellations is estimated to be between 30% and 60%.

Sea-Intelligence said, "From this perspective, the impact is very astonishing." On the Asia-North America West route, liner companies predict that the demand in the 18th week will be 28% lower than expected. On the Asia-North America East route, the cargo transported is expected to be 42% less than expected.

Meanwhile, Drewry predicts that from April 21 to May 25, 2025, 72 voyages on the east-west main route are expected to be cancelled, accounting for 10% of the planned 713 voyages. Among them, approximately 56% will be on the eastbound Trans-Pacific route, 31% on the Asia-Nordic and Mediterranean routes, and 13% on the westbound Trans-Atlantic route.

Drewry said that the number of cancellations on the East and West Coast routes of the United States has been on the rise recently. In the coming weeks, the number of cancelled voyages is expected to increase, mainly concentrated on the eastbound Trans-Pacific routes. The number of booking cancellations continues to rise, and some ships departing from China may have a high proportion of empty cabins before May. Affected by the uncertainty of tariff policies, shippers are striving to absorb the cost pressure, resulting in many goods having their orders cancelled or being stranded at the place of origin.

In short, the impact of Trump's 2.0 tariff "chaotic punches" on the container shipping market is obviously very huge. Before Trump launched the trade war, American companies were cautious about increasing inventories, and retailers were clearly inclined to reduce some of the excess inventories. However, the trade war has developed so rapidly and unpredictably that it is very difficult to predict what strategies retailers will adopt at present.