Cosco Shipping should join hands with the alliance to deal with the sanctions

With the Office of the United States Trade Representative (USTR) officially announcing the charges for Chinese vessels calling at US ports, large ocean carriers closely associated with the most severely affected shipping companies may face greater transportation pressure.

Alphaliner, a shipping research institution, pointed out in its weekly report that although COSCO Shipping Group and its subsidiary OOCL are expected to bear the main costs, the spillover effects brought about by the Trump administration's "tariffs on China" policy, It may also cause "significant troubles" for Ocean Alliance members CMA CGM and Evergreen.

Shipping data shows that the punctuality rate of the Ocean Alliance's shipping schedule reached 54.1% in February this year. The upgraded DAY 9 route network of the alliance was officially launched in April. At present, the alliance members have put 390 container ships into operation, with a total capacity of nearly 5 million TEUs. They operate 41 weekly routes and over 520 direct port combinations, among which 22 weekly routes are trans-Pacific routes that call at US ports. Each member company has never publicly disclosed the specific number of ships it provides for the alliance.

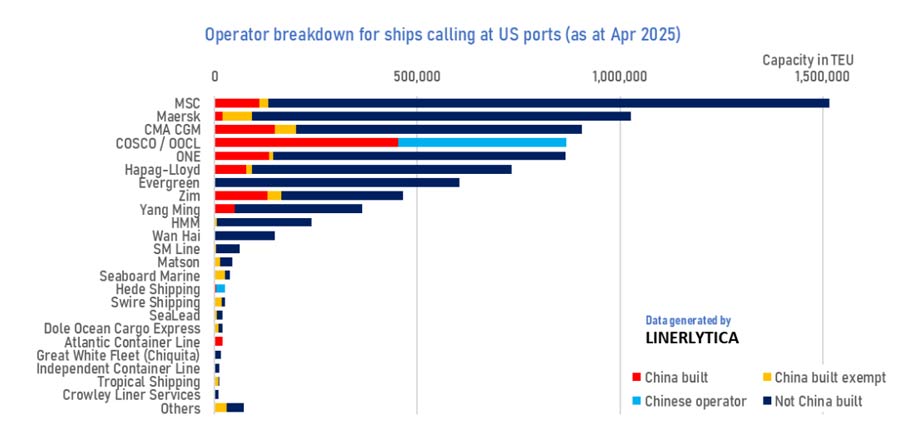

In a report released on the 21st, shipping analysis agency Linerlytica pointed out that although port charges for vessels operating and built in China will still be retained, shipping companies can avoid related charges by replacing all affected vessels within the next 180 days. The new regulation will no longer impose charges on the composition of shipping companies' fleets or future orders. Instead, it will charge ships calling at US ports separately by voyage (an adjustment from the initial method of charging based on the number of port calls). If Chinese shipping enterprises such as COSCO Shipping adopt the duty-free vessel cabins of their alliance partners for replacement, they are expected to avoid high port charges.

Small vessels with a capacity of 4,000 TEU or 55,000 DWT or less, as well as those sailing within 2,000 nautical miles of US ports, are eligible for exemptions. This will save costs for shipping companies operating short-haul routes to the Caribbean/South America and for vessel operators participating in the Maritime Safety Plan (MSP)/Voluntary Multimodal Transport Agreement (VISA) and flying the US flag. Shipping enterprises such as CMA CGM will benefit from this. As for the container fleet currently docked at US ports, only 20% of the vessels are affected by this. It is expected that within the next six months, these affected fleets will be replaced with vessels that meet the exemption conditions. Cosco Shipping may also choose to dispatch additional small vessels that meet this standard. According to the data on its official website, the enterprise currently operates 11 ships that meet the exemption criteria.

Linerlytica also pointed out that major shipping companies all have sufficient duty-free vessels available for allocation, and this conversion process will not cause serious operational disruptions.

However, Joe Kramek, the president and CEO of the World Shipping Council, still criticized the USTR's decision as "a step in the wrong direction", arguing that it would push up consumer prices and weaken US trade.

HMM Evergreen Marine Transport and Yang Ming Marine Transport are all likely to be the main beneficiaries of the new port charging structure, as the number of ships these companies build in China is very small. CNSS previously reported that the proportion of Chinese-made vessels in the fleets of shipping companies in Taiwan, China, is the lowest in the entire industry. Evergreen Marine and Wan Hai Lines' operating fleets on the US routes are 100% not built in China, while in Yang Ming Marine's fleet on the US routes, Chinese-made vessels account for 17%. HMM is only 3%.

The latest regulations of the USTR show that starting from October 14th, when ships built in China call at US ports, a fee of $18 per net ton or $120 per container loaded and unloaded (whichever is higher) will be charged. By April 2028, this fee will be gradually increased to $33 per net ton or $250 per container. For Chinese shipping enterprises such as COSCO Shipping, an additional surcharge of $50 per net ton is required regardless of where their ships are built. This surcharge will gradually increase to $140 by April 2028.

Compared with the initial proposal, the current charging standard has been improved. The original plan stipulated that each time a Chinese vessel docked at a port, it might face a fine of up to 1.5 million US dollars, and the cost for each port would be calculated cumulatively instead of the current improved plan of charging based on the entire voyage to the United States.

Data calculated by Clarksons Research shows that among the number of ships calling at the United States in 2024, only 9% will be affected by the new regulations later, a significant decrease from the previously estimated 43%. The research institution pointed out that based on the current ship deployment model, the final plan could theoretically generate an annual fee of 12 billion US dollars in 2026 and rise to 18 billion US dollars by 2028. This figure is significantly lower than the previously estimated charge scale of 40 billion to 52 billion US dollars in the proposal.

Alphaliner, a shipping research institution, pointed out in its weekly report that although COSCO Shipping Group and its subsidiary OOCL are expected to bear the main costs, the spillover effects brought about by the Trump administration's "tariffs on China" policy, It may also cause "significant troubles" for Ocean Alliance members CMA CGM and Evergreen.

Shipping data shows that the punctuality rate of the Ocean Alliance's shipping schedule reached 54.1% in February this year. The upgraded DAY 9 route network of the alliance was officially launched in April. At present, the alliance members have put 390 container ships into operation, with a total capacity of nearly 5 million TEUs. They operate 41 weekly routes and over 520 direct port combinations, among which 22 weekly routes are trans-Pacific routes that call at US ports. Each member company has never publicly disclosed the specific number of ships it provides for the alliance.

In a report released on the 21st, shipping analysis agency Linerlytica pointed out that although port charges for vessels operating and built in China will still be retained, shipping companies can avoid related charges by replacing all affected vessels within the next 180 days. The new regulation will no longer impose charges on the composition of shipping companies' fleets or future orders. Instead, it will charge ships calling at US ports separately by voyage (an adjustment from the initial method of charging based on the number of port calls). If Chinese shipping enterprises such as COSCO Shipping adopt the duty-free vessel cabins of their alliance partners for replacement, they are expected to avoid high port charges.

Small vessels with a capacity of 4,000 TEU or 55,000 DWT or less, as well as those sailing within 2,000 nautical miles of US ports, are eligible for exemptions. This will save costs for shipping companies operating short-haul routes to the Caribbean/South America and for vessel operators participating in the Maritime Safety Plan (MSP)/Voluntary Multimodal Transport Agreement (VISA) and flying the US flag. Shipping enterprises such as CMA CGM will benefit from this. As for the container fleet currently docked at US ports, only 20% of the vessels are affected by this. It is expected that within the next six months, these affected fleets will be replaced with vessels that meet the exemption conditions. Cosco Shipping may also choose to dispatch additional small vessels that meet this standard. According to the data on its official website, the enterprise currently operates 11 ships that meet the exemption criteria.

Linerlytica also pointed out that major shipping companies all have sufficient duty-free vessels available for allocation, and this conversion process will not cause serious operational disruptions.

However, Joe Kramek, the president and CEO of the World Shipping Council, still criticized the USTR's decision as "a step in the wrong direction", arguing that it would push up consumer prices and weaken US trade.

HMM Evergreen Marine Transport and Yang Ming Marine Transport are all likely to be the main beneficiaries of the new port charging structure, as the number of ships these companies build in China is very small. CNSS previously reported that the proportion of Chinese-made vessels in the fleets of shipping companies in Taiwan, China, is the lowest in the entire industry. Evergreen Marine and Wan Hai Lines' operating fleets on the US routes are 100% not built in China, while in Yang Ming Marine's fleet on the US routes, Chinese-made vessels account for 17%. HMM is only 3%.

The latest regulations of the USTR show that starting from October 14th, when ships built in China call at US ports, a fee of $18 per net ton or $120 per container loaded and unloaded (whichever is higher) will be charged. By April 2028, this fee will be gradually increased to $33 per net ton or $250 per container. For Chinese shipping enterprises such as COSCO Shipping, an additional surcharge of $50 per net ton is required regardless of where their ships are built. This surcharge will gradually increase to $140 by April 2028.

Compared with the initial proposal, the current charging standard has been improved. The original plan stipulated that each time a Chinese vessel docked at a port, it might face a fine of up to 1.5 million US dollars, and the cost for each port would be calculated cumulatively instead of the current improved plan of charging based on the entire voyage to the United States.

Data calculated by Clarksons Research shows that among the number of ships calling at the United States in 2024, only 9% will be affected by the new regulations later, a significant decrease from the previously estimated 43%. The research institution pointed out that based on the current ship deployment model, the final plan could theoretically generate an annual fee of 12 billion US dollars in 2026 and rise to 18 billion US dollars by 2028. This figure is significantly lower than the previously estimated charge scale of 40 billion to 52 billion US dollars in the proposal.