China State Shipbuilding Corporation's absorption and merger of China Shipbuilding Industry Corporation has been approved by the China Securities Regulatory Commission

On July 18th, the China Securities Regulatory Commission issued an announcement, approving the share swap and absorption merger of China State Shipbuilding Corporation Limited (600150.SH, hereinafter referred to as "CSSC") with China Shipbuilding Industry Corporation Limited (601989.SH, hereinafter referred to as "CSIC"). This marks a significant progress in the integration of the two core listed platforms for ship assembly under China State Shipbuilding Corporation Limited.

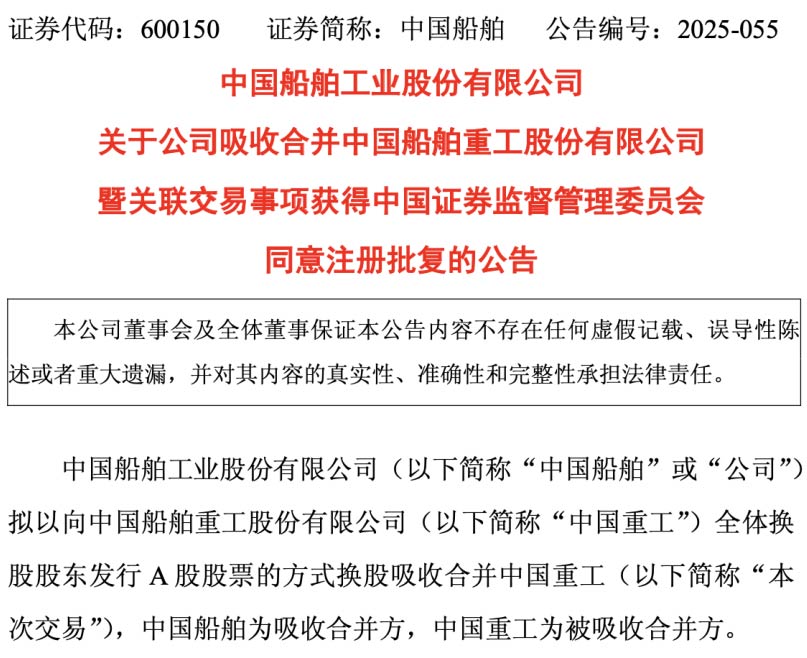

On the same evening, China State Shipbuilding Corporation announced that the company's absorption and merger of China Shipbuilding Industry Corporation had received the registration approval from the China Securities Regulatory Commission. The main contents of the approval include: Agreeing to the registration application of China State Shipbuilding Corporation Limited to absorb and merge China Shipbuilding Industry Corporation Limited with an additional 3.053 billion shares. This absorption merger shall be carried out strictly in accordance with the relevant application documents submitted to the Shanghai Stock Exchange. The validity period of the approval is 12 months.

This transaction will become the largest absorption merger deal in the history of A-share listed companies. According to the Securities Times, based on the financial data for 2024, it is estimated that after the merger, China State Shipbuilding Corporation's total assets will exceed 400 billion yuan and its operating income will exceed 130 billion yuan. It leads the world in terms of asset scale, operating income scale and the number of orders on hand. After the merger, the structure of new orders received by China State Shipbuilding Corporation will be further optimized, and the proportion of high value-added ship orders can be further increased. In the future, the company's operating performance and profit level can strongly support the company's market value.

Industry insiders believe that in the future, China State Shipbuilding Corporation will establish a valuation logic for a globally scarce leading enterprise, possessing the strength to reshape the international shipbuilding landscape from multiple dimensions such as asset scale, technological strength, delivery capacity to global market share, and thereby create a truly "world-class shipbuilding flagship listed company".

Last September, China State Shipbuilding Corporation (CSSC) announced that it and China Shipbuilding Industry Corporation (CSIC) were planning A share swap and absorption merger of CSIC through the issuance of A-share stocks by CSSC to all shareholders of CSIC. On January 7th of this year, China State Shipbuilding Corporation and China Shipbuilding Industry Corporation issued announcements stating that recently, the State-owned Assets Supervision and Administration Commission of the State Council and other competent authorities issued relevant approval opinions, in principle agreeing to the overall plan of this transaction. On July 4th of this year, the absorption and merger of China State Shipbuilding Corporation with China Shipbuilding Industry Corporation was approved by the Shanghai Stock Exchange.

Ship assembly, as the core business of China State Shipbuilding Corporation's military and civilian ship business, is mainly undertaken by the listed companies China State Shipbuilding Corporation and China Shipbuilding Industry Corporation, which belong to the former two major groups respectively. After years of development and in-depth cultivation, both China State Shipbuilding Corporation and China Shipbuilding Industry Corporation have formed a complete production and manufacturing system covering the entire industrial chain of ship assembly, including shipbuilding, ship maintenance, and mechanical and electrical equipment. The previously released plan pointed out that China State Shipbuilding Corporation focuses on the fields of ship and Marine engineering equipment and Marine technology application. Its main businesses include shipbuilding (military and civilian), ship repair, Marine engineering and mechanical and electrical equipment, etc. China Shipbuilding Industry Corporation mainly engages in the research and development, design and manufacturing of ships, covering Marine defense and Marine development equipment, Marine transportation equipment, deep-sea equipment and ship repair and modification, ship accessories and electromechanical equipment, strategic emerging industries, etc.

The previous plan pointed out that one of the purposes of this transaction is to integrate the main ship assembly business and standardize the competition among peers. After the joint reorganization of China State Shipbuilding Corporation and China Shipbuilding Industry Corporation in 2019, both China State Shipbuilding Corporation and China Shipbuilding Industry Corporation have become listed companies under the control of China State Shipbuilding Corporation. They have a high degree of business overlap in the fields of shipbuilding and maintenance, constituting competition within the same industry. After the implementation of this transaction, China State Shipbuilding Corporation, as the surviving company, will significantly reduce competition in the same industry, effectively safeguard the rights and interests of small and medium-sized shareholders, and further consolidate and highlight its main business of shipbuilding and shipping. The surviving company will integrate the resources of both sides, optimize the industrial layout of the shipbuilding sector, leverage the synergy effect, effectively enhance the core functions and core competitiveness of the surviving company, comprehensively promote the development of the shipbuilding industry towards high-end, green, intelligent, digital and standardized directions, and build a world-class shipbuilding enterprise with international competitiveness.

Previously, it was learned from China State Shipbuilding Corporation that this reorganization will integrate the advantageous scientific research and production resources as well as supply chain resources of China State Shipbuilding Corporation and China Shipbuilding Industry Corporation, promote the in-depth integration and upgrading of advanced shipbuilding and repair technologies, and through market-oriented means, drive the deepening of reforms of China State Shipbuilding Corporation, China Shipbuilding Industry Corporation and their affiliated enterprises, and improve their governance structure and governance capacity. Realize the integrated development and mutual promotion of industrial operation and capital operation, give full play to the synergy effect, and achieve complementary advantages.

After the completion of this reorganization, the surviving listed company will become the world's largest flagship shipbuilding listed company, leading the world in terms of asset scale, operating income scale and the number of ship orders in hand. Lay a solid foundation for China State Shipbuilding Corporation to become a world-class shipbuilding group and a leader in the global shipbuilding industry.

Recently, China State Shipbuilding Corporation and China Shipbuilding Industry Corporation released their pre-announcements of increased performance for the first half of the year. China State Shipbuilding Corporation expects to achieve a net profit attributable to shareholders of between 2.8 billion yuan and 3.1 billion yuan for the first half of this year, representing a year-on-year increase of 98.25% to 119.49%. China Shipbuilding Industry Corporation is expected to achieve a net profit attributable to shareholders of between 1.5 billion yuan and 1.8 billion yuan in the first half of this year. Compared with the same period last year (statutory disclosed data), it represents a year-on-year growth of 181.73% to 238.08%. Compared with the same period of the previous year (restated financial data), it increased by 181.09% to 237.30% year-on-year.

As of the close of trading on July 18th, China State Shipbuilding Corporation (600150.SH) was quoted at 34.08 yuan per share, up 0.62%, with a market value of 152.4 billion yuan. China Shipbuilding Industry Corporation (601989.SH) was quoted at 4.69 yuan per share, up 0.86%, with a market value of 106.9 billion yuan.

On the same evening, China State Shipbuilding Corporation announced that the company's absorption and merger of China Shipbuilding Industry Corporation had received the registration approval from the China Securities Regulatory Commission. The main contents of the approval include: Agreeing to the registration application of China State Shipbuilding Corporation Limited to absorb and merge China Shipbuilding Industry Corporation Limited with an additional 3.053 billion shares. This absorption merger shall be carried out strictly in accordance with the relevant application documents submitted to the Shanghai Stock Exchange. The validity period of the approval is 12 months.

This transaction will become the largest absorption merger deal in the history of A-share listed companies. According to the Securities Times, based on the financial data for 2024, it is estimated that after the merger, China State Shipbuilding Corporation's total assets will exceed 400 billion yuan and its operating income will exceed 130 billion yuan. It leads the world in terms of asset scale, operating income scale and the number of orders on hand. After the merger, the structure of new orders received by China State Shipbuilding Corporation will be further optimized, and the proportion of high value-added ship orders can be further increased. In the future, the company's operating performance and profit level can strongly support the company's market value.

Industry insiders believe that in the future, China State Shipbuilding Corporation will establish a valuation logic for a globally scarce leading enterprise, possessing the strength to reshape the international shipbuilding landscape from multiple dimensions such as asset scale, technological strength, delivery capacity to global market share, and thereby create a truly "world-class shipbuilding flagship listed company".

Last September, China State Shipbuilding Corporation (CSSC) announced that it and China Shipbuilding Industry Corporation (CSIC) were planning A share swap and absorption merger of CSIC through the issuance of A-share stocks by CSSC to all shareholders of CSIC. On January 7th of this year, China State Shipbuilding Corporation and China Shipbuilding Industry Corporation issued announcements stating that recently, the State-owned Assets Supervision and Administration Commission of the State Council and other competent authorities issued relevant approval opinions, in principle agreeing to the overall plan of this transaction. On July 4th of this year, the absorption and merger of China State Shipbuilding Corporation with China Shipbuilding Industry Corporation was approved by the Shanghai Stock Exchange.

Ship assembly, as the core business of China State Shipbuilding Corporation's military and civilian ship business, is mainly undertaken by the listed companies China State Shipbuilding Corporation and China Shipbuilding Industry Corporation, which belong to the former two major groups respectively. After years of development and in-depth cultivation, both China State Shipbuilding Corporation and China Shipbuilding Industry Corporation have formed a complete production and manufacturing system covering the entire industrial chain of ship assembly, including shipbuilding, ship maintenance, and mechanical and electrical equipment. The previously released plan pointed out that China State Shipbuilding Corporation focuses on the fields of ship and Marine engineering equipment and Marine technology application. Its main businesses include shipbuilding (military and civilian), ship repair, Marine engineering and mechanical and electrical equipment, etc. China Shipbuilding Industry Corporation mainly engages in the research and development, design and manufacturing of ships, covering Marine defense and Marine development equipment, Marine transportation equipment, deep-sea equipment and ship repair and modification, ship accessories and electromechanical equipment, strategic emerging industries, etc.

The previous plan pointed out that one of the purposes of this transaction is to integrate the main ship assembly business and standardize the competition among peers. After the joint reorganization of China State Shipbuilding Corporation and China Shipbuilding Industry Corporation in 2019, both China State Shipbuilding Corporation and China Shipbuilding Industry Corporation have become listed companies under the control of China State Shipbuilding Corporation. They have a high degree of business overlap in the fields of shipbuilding and maintenance, constituting competition within the same industry. After the implementation of this transaction, China State Shipbuilding Corporation, as the surviving company, will significantly reduce competition in the same industry, effectively safeguard the rights and interests of small and medium-sized shareholders, and further consolidate and highlight its main business of shipbuilding and shipping. The surviving company will integrate the resources of both sides, optimize the industrial layout of the shipbuilding sector, leverage the synergy effect, effectively enhance the core functions and core competitiveness of the surviving company, comprehensively promote the development of the shipbuilding industry towards high-end, green, intelligent, digital and standardized directions, and build a world-class shipbuilding enterprise with international competitiveness.

Previously, it was learned from China State Shipbuilding Corporation that this reorganization will integrate the advantageous scientific research and production resources as well as supply chain resources of China State Shipbuilding Corporation and China Shipbuilding Industry Corporation, promote the in-depth integration and upgrading of advanced shipbuilding and repair technologies, and through market-oriented means, drive the deepening of reforms of China State Shipbuilding Corporation, China Shipbuilding Industry Corporation and their affiliated enterprises, and improve their governance structure and governance capacity. Realize the integrated development and mutual promotion of industrial operation and capital operation, give full play to the synergy effect, and achieve complementary advantages.

After the completion of this reorganization, the surviving listed company will become the world's largest flagship shipbuilding listed company, leading the world in terms of asset scale, operating income scale and the number of ship orders in hand. Lay a solid foundation for China State Shipbuilding Corporation to become a world-class shipbuilding group and a leader in the global shipbuilding industry.

Recently, China State Shipbuilding Corporation and China Shipbuilding Industry Corporation released their pre-announcements of increased performance for the first half of the year. China State Shipbuilding Corporation expects to achieve a net profit attributable to shareholders of between 2.8 billion yuan and 3.1 billion yuan for the first half of this year, representing a year-on-year increase of 98.25% to 119.49%. China Shipbuilding Industry Corporation is expected to achieve a net profit attributable to shareholders of between 1.5 billion yuan and 1.8 billion yuan in the first half of this year. Compared with the same period last year (statutory disclosed data), it represents a year-on-year growth of 181.73% to 238.08%. Compared with the same period of the previous year (restated financial data), it increased by 181.09% to 237.30% year-on-year.

As of the close of trading on July 18th, China State Shipbuilding Corporation (600150.SH) was quoted at 34.08 yuan per share, up 0.62%, with a market value of 152.4 billion yuan. China Shipbuilding Industry Corporation (601989.SH) was quoted at 4.69 yuan per share, up 0.86%, with a market value of 106.9 billion yuan.