Freight rates fell for the first time after 13 consecutive weeks of increases, with a weekly decline of 5.5% in the U.S. West

Freight market in the continuous rise after a correction, of which, the European route rose slightly, the Mediterranean route fell slightly, the United States West, the United States East route is a comprehensive decline.

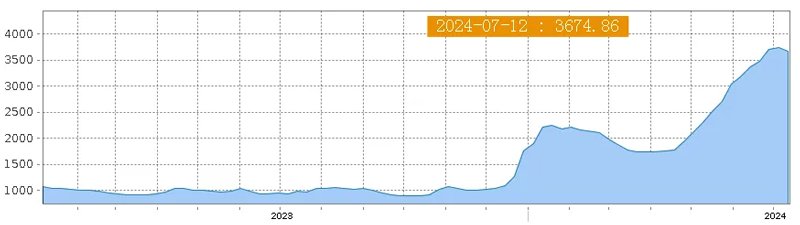

The Shanghai Export Container Composite Freight Index (SCFI) released by the Shanghai Shipping Exchange shows that the SCFI was 3674.86 points on July 12, down 1.6% from a week ago, which is the first time that the SCFI has fallen after 13 consecutive weeks of growth since April.

On July 12, the freight rate (sea freight and sea surcharge) for exports from Shanghai port to the European basic port market was US $5,051 /TEU, up 4.0% from a week ago. The freight rate (sea freight and sea surcharge) for exports from Shanghai port to the Mediterranean basic port market was US $5,424 /TEU, down 0.1% from a week ago.

Although freight rates on European routes still rose slightly, the increase was lower than the increase announced by some liner companies in the previous period. A week ago, European routes also fell 0.5 percent, in sharp contrast to previous double-digit weekly increases.

However, after several liner companies pushed up freight rates, compared with the beginning of April, the current European route freight has risen as high as 153%, and the Mediterranean route freight has risen by 80%.

At the same time, due to the lack of transportation demand support, the North American route freight rate has been adjusted.

On July 12, the freight rate (sea and sea surcharge) for exports from Shanghai port to the West and East basic port markets of the United States was US $7654 /FEU and US $9881 /FEU, respectively, down 5.5% and 0.6% from a week ago. This is also the first time that freight rates in the West and East markets fell after 11 consecutive weeks of growth.

Recently, supported by the growth of imports from the United States, the market demand for shipping capacity is strong, and a number of liner companies have resumed and increased the United States routes, forming a dynamic of supply and demand. However, at the same time, due to the advance shipment of most e-commerce platforms, the current stock has been completed, and some importers and exporters can not afford the high freight rate, choose to suspend or delay the shipment, making the current transportation demand decline, the market into oversupply.

In this context, liner companies have postponed or canceled the push up of freight rates on North American routes, and some liner companies have lowered freight rates. However, it is still too early to conclude that the US line market has reached a turning point in freight rates.

From the end of March to the middle of April, the US line market also saw a decline in freight rates for many weeks, but then ushered in a hot market with a 20% rise in freight rates for a single week, and freight rates rose all the way. Compared with the freight rate at that time, the current U.S.-West route freight rate increased by 125%, and the U.S.-East route freight rate increased by 122%.

According to data released by the General Administration of Customs, in the first half of this year, China's exports to the US reached 1.71 trillion yuan, an increase of 4.7% year-on-year, and the trade surplus with the US reached 1.14 trillion yuan, an increase of 8.4%. China-us trade has maintained a steady and positive trend on the whole.

In the long run, the probability of Sino-US trade volume will remain at a high level, if the liner company no longer continues to increase the supply of shipping capacity, it is expected that supply and demand will maintain a dynamic balance, and the freight rate may fluctuate slightly on the basis of a high base.

In terms of other routes, the Persian Gulf route transportation demand lacks further growth momentum, the supply and demand relationship is not good, and freight rates continue to fall. On July 12, the freight rate (sea freight and sea surcharge) for exports from Shanghai port to the basic port market of the Persian Gulf was 2,273 US dollars /TEU, down 6.7% from a week ago.

Rates also fell on South American routes. On July 12, the freight rate (sea freight and sea surcharge) for exports from Shanghai port to South America's basic port market was 8,760 US dollars /TEU, down 2.9% from a week ago.

The market demand for Australia and New Zealand routes is stable, supply and demand fundamentals are improving, and freight rates are rising. On July 12, the freight rate (sea freight and sea surcharge) for exports from Shanghai port to the basic port market of Australia and New Zealand was US $1,404 /TEU, up 2.1% from the previous period.

The Shanghai Export Container Composite Freight Index (SCFI) released by the Shanghai Shipping Exchange shows that the SCFI was 3674.86 points on July 12, down 1.6% from a week ago, which is the first time that the SCFI has fallen after 13 consecutive weeks of growth since April.

SCFI diagram

On July 12, the freight rate (sea freight and sea surcharge) for exports from Shanghai port to the European basic port market was US $5,051 /TEU, up 4.0% from a week ago. The freight rate (sea freight and sea surcharge) for exports from Shanghai port to the Mediterranean basic port market was US $5,424 /TEU, down 0.1% from a week ago.

Although freight rates on European routes still rose slightly, the increase was lower than the increase announced by some liner companies in the previous period. A week ago, European routes also fell 0.5 percent, in sharp contrast to previous double-digit weekly increases.

However, after several liner companies pushed up freight rates, compared with the beginning of April, the current European route freight has risen as high as 153%, and the Mediterranean route freight has risen by 80%.

At the same time, due to the lack of transportation demand support, the North American route freight rate has been adjusted.

On July 12, the freight rate (sea and sea surcharge) for exports from Shanghai port to the West and East basic port markets of the United States was US $7654 /FEU and US $9881 /FEU, respectively, down 5.5% and 0.6% from a week ago. This is also the first time that freight rates in the West and East markets fell after 11 consecutive weeks of growth.

Recently, supported by the growth of imports from the United States, the market demand for shipping capacity is strong, and a number of liner companies have resumed and increased the United States routes, forming a dynamic of supply and demand. However, at the same time, due to the advance shipment of most e-commerce platforms, the current stock has been completed, and some importers and exporters can not afford the high freight rate, choose to suspend or delay the shipment, making the current transportation demand decline, the market into oversupply.

In this context, liner companies have postponed or canceled the push up of freight rates on North American routes, and some liner companies have lowered freight rates. However, it is still too early to conclude that the US line market has reached a turning point in freight rates.

From the end of March to the middle of April, the US line market also saw a decline in freight rates for many weeks, but then ushered in a hot market with a 20% rise in freight rates for a single week, and freight rates rose all the way. Compared with the freight rate at that time, the current U.S.-West route freight rate increased by 125%, and the U.S.-East route freight rate increased by 122%.

According to data released by the General Administration of Customs, in the first half of this year, China's exports to the US reached 1.71 trillion yuan, an increase of 4.7% year-on-year, and the trade surplus with the US reached 1.14 trillion yuan, an increase of 8.4%. China-us trade has maintained a steady and positive trend on the whole.

In the long run, the probability of Sino-US trade volume will remain at a high level, if the liner company no longer continues to increase the supply of shipping capacity, it is expected that supply and demand will maintain a dynamic balance, and the freight rate may fluctuate slightly on the basis of a high base.

In terms of other routes, the Persian Gulf route transportation demand lacks further growth momentum, the supply and demand relationship is not good, and freight rates continue to fall. On July 12, the freight rate (sea freight and sea surcharge) for exports from Shanghai port to the basic port market of the Persian Gulf was 2,273 US dollars /TEU, down 6.7% from a week ago.

Rates also fell on South American routes. On July 12, the freight rate (sea freight and sea surcharge) for exports from Shanghai port to South America's basic port market was 8,760 US dollars /TEU, down 2.9% from a week ago.

The market demand for Australia and New Zealand routes is stable, supply and demand fundamentals are improving, and freight rates are rising. On July 12, the freight rate (sea freight and sea surcharge) for exports from Shanghai port to the basic port market of Australia and New Zealand was US $1,404 /TEU, up 2.1% from the previous period.