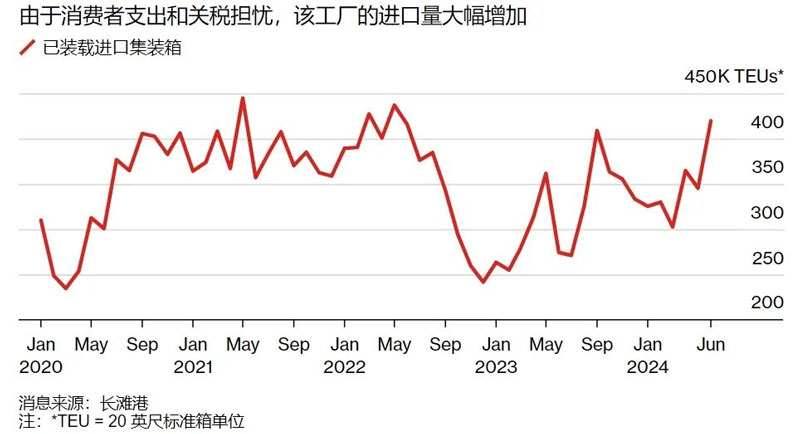

Before the new tariffs took effect, container volumes at U.S. ports rose

American businesses are increasing imports to avoid tariffs

"Our tariffs are higher than they've been in more than two years," said Matt Priest, president of the Footwear Distributors and Retailers Association of America. While some of the new tariffs by the Biden administration did not directly affect the footwear industry, "we believe there was already a strain on capacity in the footwear industry before the tariffs went into effect on August 1."

On Wednesday, Priest appeared at a briefing with Gene Seroka, executive director of the Port of Los Angeles, to answer questions about global route turmoil and tariff uncertainty.

If Trump wins and imposes a 10 percent universal tariff on imports and a 60 percent tariff on Chinese goods, then "that could change the landscape and the future of the Port of Los Angeles," Seroka said. But since then-President Donald Trump first imposed tariffs in 2018, "we've shown pretty agile action, and we've really been working hard to get the goods."

Finally, Priest said he would encourage Trump or Joe Biden to separate the footwear industry from other industries that are "critical" to China and emphasize that tariffs are paid by consumers.

Trade activity is strong and container volumes at US ports are up

U.S. business fears of more U.S. tariffs on Chinese goods and the threat of labor unrest at eastern and Gulf Coast ports have led to an earlier than usual peak season.

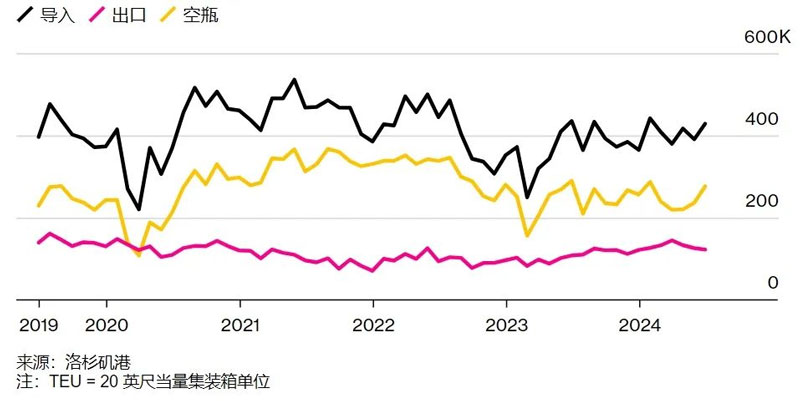

According to figures released Wednesday, the Port of Los Angeles handled 4.7 million 20-foot container equivalents in the first half of 2024, up 14.4 percent from the same period last year. Imports in June were down 1.5 percent from a year earlier, while exports were up more than 13 percent and empty container volumes were down 4.6 percent.

Gene Seroka, executive director of the Port of Los Angeles, said at a news conference that lower inflation, rising wages and a strong job market have spurred consumer spending, which has led to steady cargo volumes.

Shipping containers flowing through the Port of Los Angeles

Mario Cordero, CEO of the Port of Long Beach, said: "We are regaining market share and consumer spending is driving cargo into our terminals as the peak shipping season approaches. I expect moderate growth in the second half of 2024."

Separately, the Port of Oakland reported imports of 84,040 TEUs in June, up 26.8 percent from the same month last year and the highest monthly total since August 2022. Full-load exports from the San Francisco Bay trading hub, after declining during the pandemic, continue to stabilize at around 65,000 to 70,000 TEUs per month.

"Our tariffs are higher than they've been in more than two years," said Matt Priest, president of the Footwear Distributors and Retailers Association of America. While some of the new tariffs by the Biden administration did not directly affect the footwear industry, "we believe there was already a strain on capacity in the footwear industry before the tariffs went into effect on August 1."

On Wednesday, Priest appeared at a briefing with Gene Seroka, executive director of the Port of Los Angeles, to answer questions about global route turmoil and tariff uncertainty.

If Trump wins and imposes a 10 percent universal tariff on imports and a 60 percent tariff on Chinese goods, then "that could change the landscape and the future of the Port of Los Angeles," Seroka said. But since then-President Donald Trump first imposed tariffs in 2018, "we've shown pretty agile action, and we've really been working hard to get the goods."

Finally, Priest said he would encourage Trump or Joe Biden to separate the footwear industry from other industries that are "critical" to China and emphasize that tariffs are paid by consumers.

Trade activity is strong and container volumes at US ports are up

U.S. business fears of more U.S. tariffs on Chinese goods and the threat of labor unrest at eastern and Gulf Coast ports have led to an earlier than usual peak season.

According to figures released Wednesday, the Port of Los Angeles handled 4.7 million 20-foot container equivalents in the first half of 2024, up 14.4 percent from the same period last year. Imports in June were down 1.5 percent from a year earlier, while exports were up more than 13 percent and empty container volumes were down 4.6 percent.

Gene Seroka, executive director of the Port of Los Angeles, said at a news conference that lower inflation, rising wages and a strong job market have spurred consumer spending, which has led to steady cargo volumes.

Shipping containers flowing through the Port of Los Angeles

Mario Cordero, CEO of the Port of Long Beach, said: "We are regaining market share and consumer spending is driving cargo into our terminals as the peak shipping season approaches. I expect moderate growth in the second half of 2024."

Separately, the Port of Oakland reported imports of 84,040 TEUs in June, up 26.8 percent from the same month last year and the highest monthly total since August 2022. Full-load exports from the San Francisco Bay trading hub, after declining during the pandemic, continue to stabilize at around 65,000 to 70,000 TEUs per month.