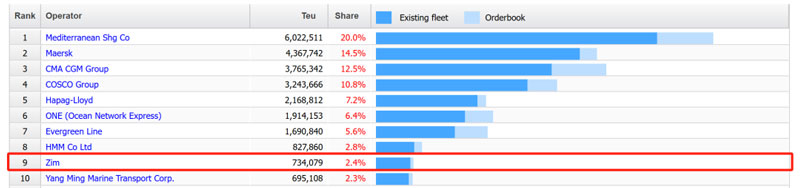

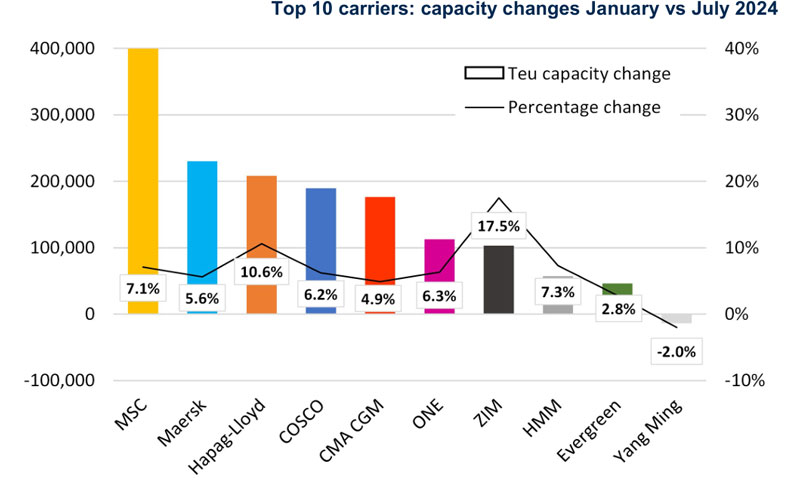

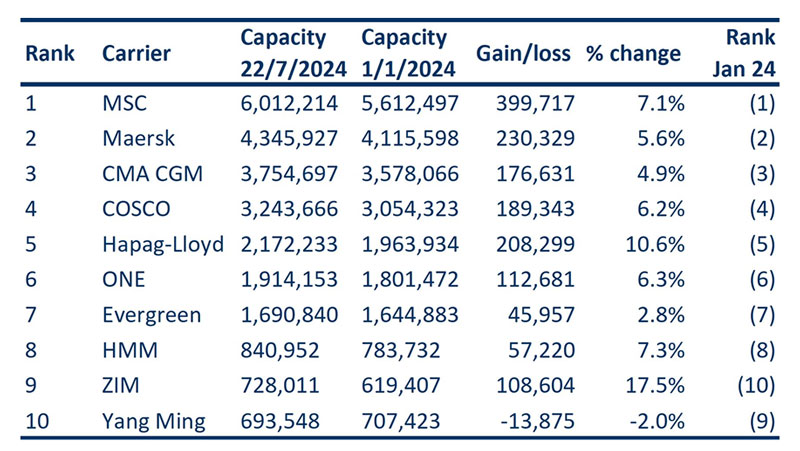

According to Alphaliner's latest report, Mediterranean Shipping (MSC) and ZIM were the fastest growing trunk line operators in the first half of the year, with ZIM having overtaken YangMing to become the ninth largest liner company in the world.

Thanks to the active ordering of new vessels and the purchase of second-hand vessels, MSC's fleet capacity has now exceeded 6 million TEU, and the latest vessel launched by MSC is the 16,616TEU MSC Juliette, This is the 17th large Super Panama class container ship (15,000-16,000TEU class container ship) added to MSC this year. Last week, MSC also purchased two older pre-owned vessels, the 1999 MSC Unity VI and the 2003 MSC Bay IV. Since the beginning of this year, MSC has added about 400,000 TEU of capacity, more than half of Yangming Shipping's capacity.

With Star (ZIM), which is dominated by long-term charters, fleet capacity increased by nearly 18% year-on-year to 734,079 TEU. To date, ZIM has taken delivery of three 15,250TEU vessels, seven 7,800-7,900TEU vessels and eight 5,300-5,500TEU vessels, many of which are assigned to the Trans-Pacific route. Meanwhile, YangMing was the only one of the top 10 liner companies to see a reduction in capacity.

After losing its number one position, Maersk will also be overtaken by CMA CGM, which currently has a capacity of 3.75 million TEU, and also has a large new ship order book, currently MSC and CMA CGM each have about 1.2 million TEU of new shipbuilding orders. Maersk's current fleet size is 4.34 million TEU, but it seems to be trying to regain lost ground, and Maersk, which has always been a firm ordering of methanol fuel vessels, reportedly recently asked shipyards to build a dozen 16,000TEU class LNGN-powered container ships.