15 ships, dry bulk shipping industry again exposed important acquisitions

Following the acquisition of Eagle Bulk by Star Bulk, the dry bulk shipping industry has again exposed important acquisitions. M.T. Maritime Management is selling its fleet of 15 handysize vessels in a package.

Heavy news came from the dry bulk shipping market, September 23, Pangaea Logistics Solutions Ltd. (" Pangaea ") and M.T. Maritime Management (USA) LLC (" MTM ") have issued a double notice announcing the agreement on 15 June The handysize dry bulk carrier was incorporated into Pangaea's fleet in a definitive agreement.

Ship and financial details

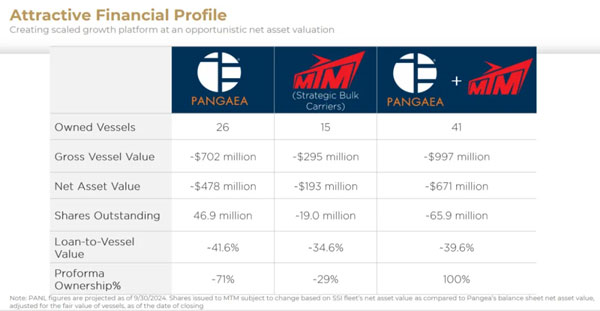

The 15 Handyships are currently owned by Strategic Shipping Inc. (" SSI "), a privately held company based in Southport, Connecticut, managed by MTM. The vessels are valued at approximately $295 million, including approximately $102 million in ship-related financing agreements, and have a net asset value of $193 million.

DNB Markets, Inc. will act as Pangaea's financial adviser on the transaction, and Seward & Kissel LLP will act as legal counsel.

As consideration for the transaction, NasdaQ-listed Pangaea will issue approximately 19 million common shares to SSI, representing approximately 29% of the Company's outstanding common shares upon completion of the proposed transaction. The transaction is expected to close in the fourth quarter of 2024, subject to customary closing conditions and shareholder approval. (This also means that after the transaction is completed, Pangaea shareholders and MTM shareholders will hold 71% and 29% respectively.)

Pangaea's chairman, Richard du Moulin, said the transaction was a transformational strategic milestone for the company's business, expanding its owned-fleet size by nearly 60% to 41 vessels.

Pangaea currently has a fleet of 26 vessels, including supramax, ultramax,panamax and post-panamax.

MTM's current fleet consists of dry bulk and oil tanker, after the sale of the dry bulk vessels, the company's fleet will be mainly focused on the oil tanker segment (including 25 chemical tankers and 2 oil product tankers).

Upon completion of the acquisition, MTM's dry bulk charter and operations teams and certain members of the executive team will join Pangaea.

In addition, after the deal, the Gross of Pangaea LTV will be improved from 41.6% to 39.6% (based on September 30, 2024, to balance, Gross Loan - to - Value namely Gross Loan - to - Value, total Loan to Value ratio, It is a measure of the relationship between debt and asset value and is commonly used in the financial and real estate sectors. In the shipping industry, Gross LTV can be used to assess a shipping company's debt level relative to the value of its ship assets. Specifically, it refers to the ratio of the shipping company's total loans to the total value of the ship.) The company's dividend policy will remain unchanged. MTM will have the right to appoint two members to the Company's Board of Directors.

From a strategic point of view, the merger is important.

On the one hand, a commercially attractive, mobile fleet will increase scale and broaden the growth base of the entire enterprise. Entry into the mobility segment offers scale and diversification, and with Pangaea already using mobility vessels to charter certain customers, the additional vessels will enable it to further leverage a differentiated business model to improve fleet utilisation and TCE returns. On the other hand, the expanded fleet will allow it to grow its business with new and existing customers and generate commercial synergies in its port and logistics operations.

"We have always operated in the area of convenience, but the addition of these vessels will allow us to offer a broader range of services and help us better leverage our integrated shipping and port logistics model, improve overall fleet utilization and maximize our profitability," Pangaea CEO Mark Filanowski said.

Doug MacShane, Executive Chairman of MTM, believes that Pangaea's unique business model and track record of excellence in dry bulk shipping and logistics make it the ideal partner, and that this combination will provide the scale and capabilities to better meet the needs of both parties' existing customers and create a strong platform to pursue commercial and operational synergies.

Pangaea also highlighted the financial advantages of the deal. Opportunism at relative net asset valuations creates a platform for scaled growth, and all-stock trading protects a consistent dividend plan, preserves liquidity and minimizes financial leverage.

Filanowski also said that the addition of MTM's experienced dry bulk charter and operations team will support future growth. Chief Financial Officer Gianni DelSignore expects the deal to add to the company's earnings as the dry bulk market copes with a tight supply environment.

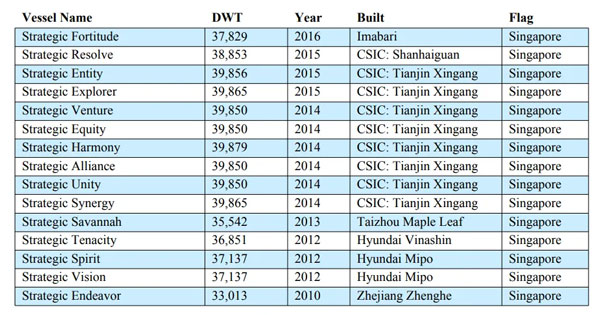

As for the details of the transaction, Pangaea will acquire 15 portable vessels with an average age of about 10 and a half years. Specific ship information includes Strategic Fortitude and Strategic Resolve. Details of the fleet are as follows:

In addition, MTM's seven dry bulk charter and operations team employees will join the company, and MTM's Senior Vice President Dan Schildt will join Pangaea's executive management team as Chief Strategy Officer. Mark Filanowski will continue to serve as CEO.

Heavy news came from the dry bulk shipping market, September 23, Pangaea Logistics Solutions Ltd. (" Pangaea ") and M.T. Maritime Management (USA) LLC (" MTM ") have issued a double notice announcing the agreement on 15 June The handysize dry bulk carrier was incorporated into Pangaea's fleet in a definitive agreement.

Ship and financial details

The 15 Handyships are currently owned by Strategic Shipping Inc. (" SSI "), a privately held company based in Southport, Connecticut, managed by MTM. The vessels are valued at approximately $295 million, including approximately $102 million in ship-related financing agreements, and have a net asset value of $193 million.

DNB Markets, Inc. will act as Pangaea's financial adviser on the transaction, and Seward & Kissel LLP will act as legal counsel.

As consideration for the transaction, NasdaQ-listed Pangaea will issue approximately 19 million common shares to SSI, representing approximately 29% of the Company's outstanding common shares upon completion of the proposed transaction. The transaction is expected to close in the fourth quarter of 2024, subject to customary closing conditions and shareholder approval. (This also means that after the transaction is completed, Pangaea shareholders and MTM shareholders will hold 71% and 29% respectively.)

Pangaea's chairman, Richard du Moulin, said the transaction was a transformational strategic milestone for the company's business, expanding its owned-fleet size by nearly 60% to 41 vessels.

Pangaea currently has a fleet of 26 vessels, including supramax, ultramax,panamax and post-panamax.

MTM's current fleet consists of dry bulk and oil tanker, after the sale of the dry bulk vessels, the company's fleet will be mainly focused on the oil tanker segment (including 25 chemical tankers and 2 oil product tankers).

Upon completion of the acquisition, MTM's dry bulk charter and operations teams and certain members of the executive team will join Pangaea.

In addition, after the deal, the Gross of Pangaea LTV will be improved from 41.6% to 39.6% (based on September 30, 2024, to balance, Gross Loan - to - Value namely Gross Loan - to - Value, total Loan to Value ratio, It is a measure of the relationship between debt and asset value and is commonly used in the financial and real estate sectors. In the shipping industry, Gross LTV can be used to assess a shipping company's debt level relative to the value of its ship assets. Specifically, it refers to the ratio of the shipping company's total loans to the total value of the ship.) The company's dividend policy will remain unchanged. MTM will have the right to appoint two members to the Company's Board of Directors.

From a strategic point of view, the merger is important.

On the one hand, a commercially attractive, mobile fleet will increase scale and broaden the growth base of the entire enterprise. Entry into the mobility segment offers scale and diversification, and with Pangaea already using mobility vessels to charter certain customers, the additional vessels will enable it to further leverage a differentiated business model to improve fleet utilisation and TCE returns. On the other hand, the expanded fleet will allow it to grow its business with new and existing customers and generate commercial synergies in its port and logistics operations.

"We have always operated in the area of convenience, but the addition of these vessels will allow us to offer a broader range of services and help us better leverage our integrated shipping and port logistics model, improve overall fleet utilization and maximize our profitability," Pangaea CEO Mark Filanowski said.

Doug MacShane, Executive Chairman of MTM, believes that Pangaea's unique business model and track record of excellence in dry bulk shipping and logistics make it the ideal partner, and that this combination will provide the scale and capabilities to better meet the needs of both parties' existing customers and create a strong platform to pursue commercial and operational synergies.

Pangaea also highlighted the financial advantages of the deal. Opportunism at relative net asset valuations creates a platform for scaled growth, and all-stock trading protects a consistent dividend plan, preserves liquidity and minimizes financial leverage.

Filanowski also said that the addition of MTM's experienced dry bulk charter and operations team will support future growth. Chief Financial Officer Gianni DelSignore expects the deal to add to the company's earnings as the dry bulk market copes with a tight supply environment.

As for the details of the transaction, Pangaea will acquire 15 portable vessels with an average age of about 10 and a half years. Specific ship information includes Strategic Fortitude and Strategic Resolve. Details of the fleet are as follows:

In addition, MTM's seven dry bulk charter and operations team employees will join the company, and MTM's Senior Vice President Dan Schildt will join Pangaea's executive management team as Chief Strategy Officer. Mark Filanowski will continue to serve as CEO.