SCFI fell for six consecutive weeks, and freight rates on major routes fell sharply

SCFI fell for six consecutive weeks, approaching the loss point of shipping companies, affected by the threat of strikes in the East of the United States and the off-season, the freight rate of major routes fell sharply, shipping companies added surcharges to cope with risks, and the market was weak and full of uncertainty.

On the eve of the 11th holiday, the market widely expected shipment boom did not come as expected, the latest Shanghai export container Freight index (SCFI) was announced on the 27th, this week's index continued to fall sharply 231.16 points to 2135.08 points, which has been declining for six consecutive weeks, and the decline from 5.76% last week significantly expanded to 9.77%. Approaching the ship company's break-even point of 2100 points.

Freight forwarding industry insiders pointed out that the threat of an upcoming strike in the East of the United States on October 1 has exacerbated market volatility. In order to avoid the potential impact, cargo customers in the East of the United States have shipped in advance or turned to the West of the United States, resulting in further decline in freight rates in the East of the United States. However, the volume of cargo in the western ports of the United States has not been able to effectively support rates, and the European, Mediterranean and Persian Gulf routes have entered the traditional low season and new vessels have continued to be commissioned, and the rate decline of these routes has remained high.

It is worth noting that although the International Longshoremen's Association of the United States (ILA) took a tough stance on the strike, the news did not effectively boost freight rates this week, but the decline further widened. Industry experts believe that the upcoming October holiday will lead to a reduction in load, although the potential strike in the US East port may stimulate the short-term market, but in the long run, port congestion and supply chain disruption on global trade more negative impact, and may even exacerbate inflationary pressure. Therefore, with the United States East Terminal labor negotiations entering a critical moment, the market should be wary of the increase in profit-taking selling pressure.

In the face of the imminent strike in the East of the United States, many shipping companies and cargo owners have taken measures in advance to deal with it, including transferring the goods in the East of the United States to the port of the West or postponing the shipment. Due to the shortage of resources, the industry generally reflects that it is difficult to receive urgent orders. At the same time, in order to cope with possible risks and rising costs, a number of large shipping companies in the world have announced the addition of local port surcharges on the Eastern United States and the Gulf of Mexico routes, including CMA CGM, Maersk and Asia's HMM shipping companies are among them.

Maritime consultancy Sea-Intelligence further estimated that the US East strike for one day, clearing the backlog of goods will take an additional four to six days, if the strike continues for a week, it may take four to six weeks to fully recover, meaning that the backlog of goods may not be fully processed until mid-November. This chain reaction has undoubtedly added more uncertainties and challenges to the global shipping market.

SCFI index

Shanghai to Europe line freight 2250 US dollars /TEU, down 342 US dollars, or 13.19%;

Shanghai to the Mediterranean freight rate of $2,541 /TEU, down $414, or 14.01%;

Shanghai to West freight 4852 US dollars /FEU, week down 489 US dollars, down 9.16%;

Shanghai to the United States East freight 5626 US dollars /FEU, week down 860 US dollars, down 13.26%;

Persian Gulf route freight 962 dollars, down 185 dollars, or 16.13%;

South American route (Santos) freight of $6439, week down $551, down 7.88%;

Southeast Asia Line (Singapore) freight 396 US dollars, down 16 US dollars, down 3.88%;

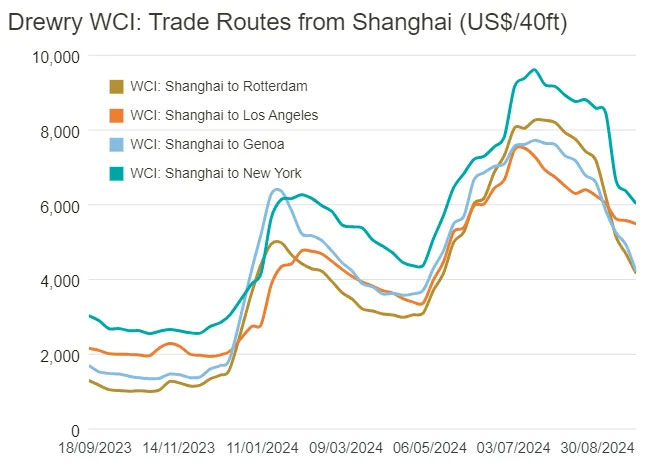

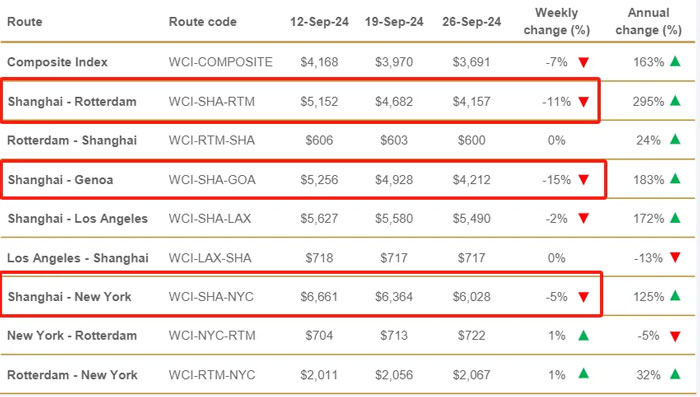

WCI index

WCI fell 7% this week to $3,691 per large box, 64% below the epidemic peak of $10,377 in September 2021, but 160% above the pre-pandemic 2019 average rate of $1,420.

The year-to-date average composite index is $4,113 per large box, $1,288 higher than the 10-year average rate of $2,825. Freight from Shanghai to Genoa plunged 15% this week, dropping $716 to $4,212 per carton. Freight from Shanghai to Rotterdam fell 11%, to $525 to $4,157; Prices from Shanghai to New York fell 5%, $336 to $6,028; Fares from Shanghai to Los Angeles fell 2 percent, by $90 to $5,490.

On the eve of the 11th holiday, the market widely expected shipment boom did not come as expected, the latest Shanghai export container Freight index (SCFI) was announced on the 27th, this week's index continued to fall sharply 231.16 points to 2135.08 points, which has been declining for six consecutive weeks, and the decline from 5.76% last week significantly expanded to 9.77%. Approaching the ship company's break-even point of 2100 points.

Freight forwarding industry insiders pointed out that the threat of an upcoming strike in the East of the United States on October 1 has exacerbated market volatility. In order to avoid the potential impact, cargo customers in the East of the United States have shipped in advance or turned to the West of the United States, resulting in further decline in freight rates in the East of the United States. However, the volume of cargo in the western ports of the United States has not been able to effectively support rates, and the European, Mediterranean and Persian Gulf routes have entered the traditional low season and new vessels have continued to be commissioned, and the rate decline of these routes has remained high.

It is worth noting that although the International Longshoremen's Association of the United States (ILA) took a tough stance on the strike, the news did not effectively boost freight rates this week, but the decline further widened. Industry experts believe that the upcoming October holiday will lead to a reduction in load, although the potential strike in the US East port may stimulate the short-term market, but in the long run, port congestion and supply chain disruption on global trade more negative impact, and may even exacerbate inflationary pressure. Therefore, with the United States East Terminal labor negotiations entering a critical moment, the market should be wary of the increase in profit-taking selling pressure.

In the face of the imminent strike in the East of the United States, many shipping companies and cargo owners have taken measures in advance to deal with it, including transferring the goods in the East of the United States to the port of the West or postponing the shipment. Due to the shortage of resources, the industry generally reflects that it is difficult to receive urgent orders. At the same time, in order to cope with possible risks and rising costs, a number of large shipping companies in the world have announced the addition of local port surcharges on the Eastern United States and the Gulf of Mexico routes, including CMA CGM, Maersk and Asia's HMM shipping companies are among them.

Maritime consultancy Sea-Intelligence further estimated that the US East strike for one day, clearing the backlog of goods will take an additional four to six days, if the strike continues for a week, it may take four to six weeks to fully recover, meaning that the backlog of goods may not be fully processed until mid-November. This chain reaction has undoubtedly added more uncertainties and challenges to the global shipping market.

SCFI index

Shanghai to Europe line freight 2250 US dollars /TEU, down 342 US dollars, or 13.19%;

Shanghai to the Mediterranean freight rate of $2,541 /TEU, down $414, or 14.01%;

Shanghai to West freight 4852 US dollars /FEU, week down 489 US dollars, down 9.16%;

Shanghai to the United States East freight 5626 US dollars /FEU, week down 860 US dollars, down 13.26%;

Persian Gulf route freight 962 dollars, down 185 dollars, or 16.13%;

South American route (Santos) freight of $6439, week down $551, down 7.88%;

Southeast Asia Line (Singapore) freight 396 US dollars, down 16 US dollars, down 3.88%;

WCI index

WCI fell 7% this week to $3,691 per large box, 64% below the epidemic peak of $10,377 in September 2021, but 160% above the pre-pandemic 2019 average rate of $1,420.

The year-to-date average composite index is $4,113 per large box, $1,288 higher than the 10-year average rate of $2,825. Freight from Shanghai to Genoa plunged 15% this week, dropping $716 to $4,212 per carton. Freight from Shanghai to Rotterdam fell 11%, to $525 to $4,157; Prices from Shanghai to New York fell 5%, $336 to $6,028; Fares from Shanghai to Los Angeles fell 2 percent, by $90 to $5,490.

Mr Delury expects rates on Asia-Europe routes to continue to fall because of weak demand. At the same time, due to the impact of potential strikes and Golden Week holidays, freight rates are expected to rise on transatlantic and trans-Pacific routes.