The seventh consecutive week of decline, the four major routes have continued to fall

After the strike in the East of the United States, freight rates continued to adjust, the latest SCFI index came out, declining for seven consecutive weeks, but still facing downward pressure in the off-season. Shipping companies have begun to reduce flights in response to market changes, while considering changes in pricing strategy, which is expected to stop falling freight rates next week.

The dockworkers' strike in the eastern United States lasted only three days, but its impact continued to ferment. After the strike ended, freight rates were still being adjusted. According to the latest container Freight rate Index (SCFI) released by the Shanghai Shipping Exchange, the index was at 2,062.57 points, down 72.51 points, or 3.40%, from the previous period, which is the seventh consecutive week of decline in the freight rate index.

During this period, the four major routes have continued to fall, but the decline has narrowed. The decline of the US-East route has been particularly significant, which has narrowed significantly from the high level before the holiday to just over 1%. Industry analysts said that this was mainly because cargo was still being cleared after the strike on the East Coast of the United States, while shipping companies significantly reduced flights, which eased the sharp drop of 9.77% in the previous two weeks. However, overall, the market has entered the off-season, freight rates are facing downward pressure, easy to fall difficult to rise.

Specifically, on September 26, freight rates on European and Mediterranean routes fell between 13 and 14%, while this week the two major routes fell 9.33% and 7.77% respectively; There are more overtime ships on European routes, which is one of the main reasons for the decline in freight rates. At the same time, the decline of the US-West and US-East routes was also significantly reduced from the higher level before the holiday, 2.51% and 1.28% respectively. But it is worth noting that the peak season surcharge of $1,200 per large box has stopped this month.

Shipping companies and freight forwarders in the industry said that although the amount of cargo is still small after the resumption of work after the holiday, the number of ships on the market has also decreased accordingly. This is mainly due to the seasonal sharp reduction in shipping schedules, and the US East strike slightly affected the return time of ships. In addition, the recent frequent typhoons in Asia have caused port congestion at multiple terminals, which has also led to the subsequent need to skip port or empty classes to restore the shipping schedule, increasing the pressure.

After entering the traditional off-season in the fourth quarter, freight rates are facing greater downward pressure. According to freight forwarders, carriers such as COSCO are considering cancelling the special price of the US line because the gap with the spot price is too large. At the same time, the shipping company has notified that the freight rate of the European line will be extended to the end of the month, and will be adjusted immediately according to the cargo status.

In response to market changes, Alliance shipping companies adjusted their capacity after the Golden Week. From September 30 to November 3, a total of 100 flights were cancelled on east-west routes from Asia to Europe and the United States, with a cancellation rate of up to 14%. 63% of the cancellations were on trans-Pacific eastbound routes, 23% on Asia-Nordic and Mediterranean routes, and 14% on trans-Atlantic westbound routes.

Industry insiders expect that freight rates are expected to stop falling next week. At present, the shipping company is studying the pricing strategy for October 15. Some carriers are considering measures such as the elimination of preferential rates, but because this is too far from the flat rate, there is a need to discuss how to increase the price to be accepted by the market.

SCFI index

Shanghai to Europe line freight of 2,040 US dollars /TEU, down 210 US dollars, down 9.33%;

Shanghai to Mediterranean freight 2369 US dollars /TEU, down 172 US dollars, down 6.77%;

Shanghai to the United States West freight 4730 US dollars /FEU, down 122 US dollars, down 2.51%;

Shanghai to the United States East freight 5554 US dollars /FEU, week down 72 US dollars, down 1.28%.

Persian Gulf route freight 986 US dollars, up 24 US dollars, an increase of 2.49%;

South American route (Santos) freight 6341 US dollars, down 98 US dollars, down 1.52%.

The freight rate on the Australia and New Zealand route was $1,966, down $42, or 2.1%, for the week.

Southeast Asia Line (Singapore) freight of $389, down $7, or 1.77%.

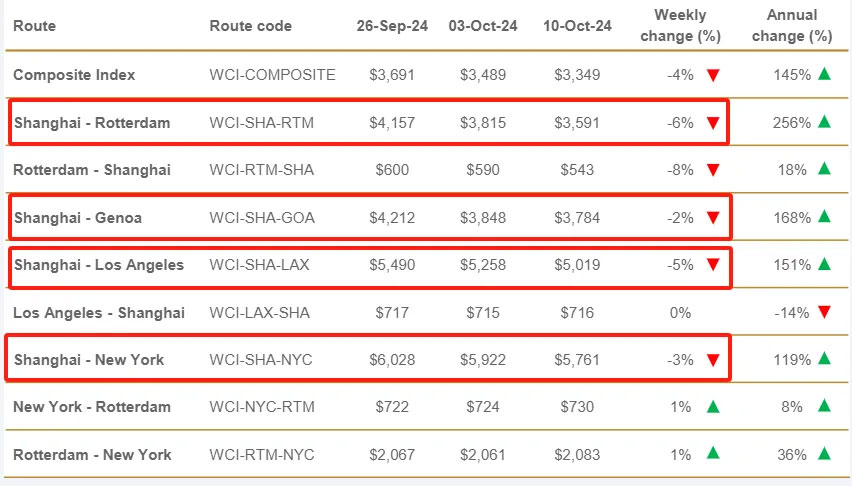

WCI index

WCI fell 4 percent this week to $3,349 per large box, 68 percent below the epidemic peak of $10,377 in September 2021, but 136 percent above the pre-pandemic 2019 average rate of $1,420.

The year-to-date average composite index is $4,079 per large box, $1,248 higher than the 10-year average rate of $2,831. Freight from Shanghai to Genoa fell 2% this week, down $64 to $3,784 per carton. Freight from Shanghai to Rotterdam fell 6%, to $224 to $3,591; Freight from Shanghai to New York fell 3%, down $161 to $5,761; Fares from Shanghai to Los Angeles fell 5 percent, $239 to $5,019.

Mr Delury expects rates to continue to fall slightly in the coming weeks.