The new tax introduced by France will cost CMA CGM nearly $900 million

Ramon Fernandez, CMA CGM's chief financial officer, said the "special tax on shipping" proposed by the French government in its austerity budget will cost CMA CGM about 800 million euros (about $875 million) over two years.

Faced with a huge hole in its coffers, the French government is targeting cash-rich shipping companies in its latest budget plan - shipping companies that choose to use the national tonnage tax system and have an annual turnover of 500 million euros ($546 million) or more will be subject to a 9 percent tax next year and a 5.5 percent tax in 2026.

CMA CGM CEO Rodolph Saade said at the end of last month that the company would actively participate in the tax plan.

Saade said that if there is a company that contributes to the unity of the country by making profits, then CMA CGM is on the list.

Fernandez argued that the tax would put CMA CGM at a "competitive disadvantage."

Fernandez's comments suggested that paying 800 million euros in taxes was more than the third-largest liner company had expected.

Fernandez also revealed that the company's ship investments would be hurt if the French government imposed a "one-time tax."

Under the budget plan, a temporary tax will be imposed on some 440 profitable companies with annual revenues of more than 1 billion euros, generating 8 billion euros next year and 4 billion euros in 2026; In addition, a special tax on shipping companies will contribute 500 million euros and 300 million euros in the next two years, respectively.

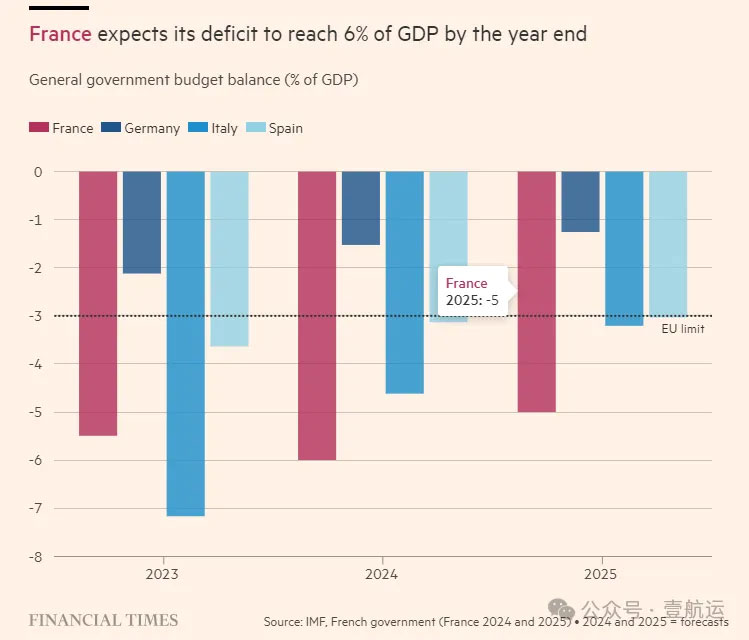

French Prime Minister Michel Barnier made clear in his new government's agenda earlier this month that France must cut its budget deficit, aiming to reduce it to 5% of gross domestic product (GDP) by 2025 and 3% by 2029

Faced with a huge hole in its coffers, the French government is targeting cash-rich shipping companies in its latest budget plan - shipping companies that choose to use the national tonnage tax system and have an annual turnover of 500 million euros ($546 million) or more will be subject to a 9 percent tax next year and a 5.5 percent tax in 2026.

CMA CGM CEO Rodolph Saade said at the end of last month that the company would actively participate in the tax plan.

Saade said that if there is a company that contributes to the unity of the country by making profits, then CMA CGM is on the list.

Fernandez argued that the tax would put CMA CGM at a "competitive disadvantage."

Fernandez's comments suggested that paying 800 million euros in taxes was more than the third-largest liner company had expected.

Fernandez also revealed that the company's ship investments would be hurt if the French government imposed a "one-time tax."

Under the budget plan, a temporary tax will be imposed on some 440 profitable companies with annual revenues of more than 1 billion euros, generating 8 billion euros next year and 4 billion euros in 2026; In addition, a special tax on shipping companies will contribute 500 million euros and 300 million euros in the next two years, respectively.

French Prime Minister Michel Barnier made clear in his new government's agenda earlier this month that France must cut its budget deficit, aiming to reduce it to 5% of gross domestic product (GDP) by 2025 and 3% by 2029