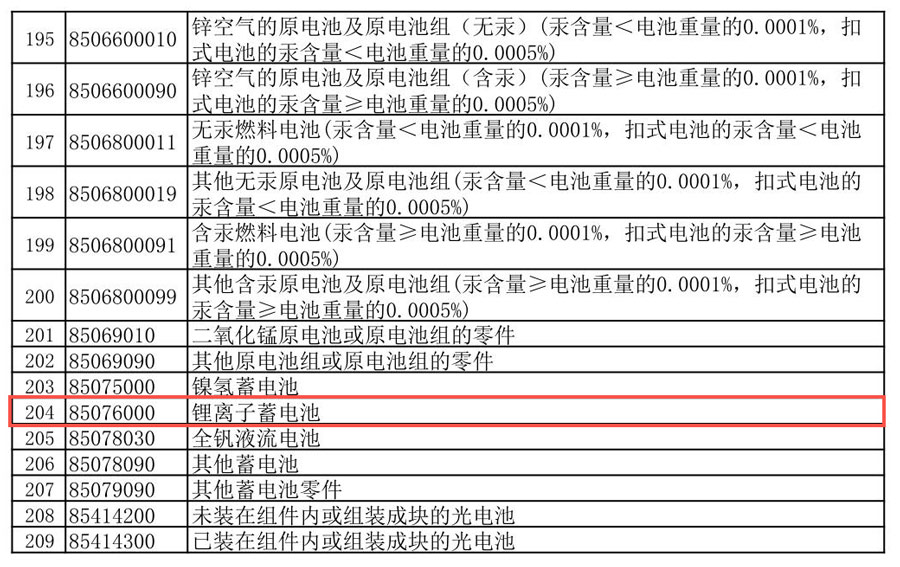

On November 15, the Ministry of Finance and the State Administration of Taxation jointly issued the Announcement on Adjusting the Export tax rebate Policy, which plans to implement a series of important adjustments from December 1, 2024. Among them, particularly notable is the reduction of the export tax rebate rate for photovoltaic and battery products, from the original 13% to 9%. It is undoubtedly a major negative for export enterprises in these industries. This announcement shall come into effect as of December 1, 2024. The export tax rebate rates applicable to the products listed in this announcement are defined by the date of export indicated in the export goods declaration."

This sudden policy adjustment does not give enterprises time to react, enterprises can only save themselves within 15 days, as far as possible to make up for the loss, after all, foreign trade enterprises from signing to shipping, short half a month, long months, tax rebates reduced by 4%, in this competitive market, it is very likely to make order losses.

As a professional international Logistics service solution provider, Sungreen Logistics should respond to this tax refund adjustment policy, and put forward the following remedial suggestions for enterprises:

1. The original shipment plan of early December will be advanced to the end of November, so that the factory will work overtime to catch up with production, and in the first working day (18th) after the notice of the new policy, the booking agent is entrusted to book the space in the morning, this wave of policy adjustment is bound to bring a new wave of burst stock market. Note: The shipping date can be advanced as far as possible in advance. Recently, the cold air is moving south, and the flight delay is more common.

2. If you can't book the big ship at the end of November, you can choose the nearest river-sea combined transport at the end of November, as long as you complete the customs declaration before boarding the inland branch ship, you can enjoy a 13% tax refund.

3, can give play to the advantages of the bonded area, before the end of the month to produce good pre-export goods all sent to the bonded area to complete the customs declaration, this batch of goods enjoy 13% tax rebate, and then export from the bonded area will not be limited by time, but also can appropriately avoid the peak period of shipment.

Just in 2023, the total export of China's "new three" (electric vehicles, lithium-ion batteries and solar batteries) exceeded the trillion yuan mark, reaching 1.06 trillion yuan, an increase of 29.9%. This significant growth not only reflects China's leading position in the global new energy sector, but also reflects the strong market demand for green and sustainable energy products.

However, the downward pressure on the global economy continues to increase, and multiple external factors have posed a severe challenge to China's exports. In this context, the adjustment of export tax rebate policy has become an effective means to deal with challenges and promote economic transformation and upgrading.

At this time, the adjustment of export tax rebate policy is proposed. Sungreen Logistics believes that the multiple considerations of policy adjustment are based on the following points:

1. Ease international trade tensions

Externally, the reduction of export tax rebate rate is also to offer an olive branch to Western countries, reduce the low price dumping of enterprises in the international market by reducing tax rebate subsidies, thereby reducing the initiation of anti-dumping and trade wars, and help ease trade tensions.

2, the industry to reduce capacity and accelerate the cycle reversal

Internally, this move aims to eliminate those enterprises that simply rely on the "price war", promote the industry to reduce capacity, and accelerate the cycle reversal of the photovoltaic and lithium battery industries.

3. Shift policy focus to domestic demand

With the increasing uncertainty of external demand, the national policy gradually turns to expanding domestic demand, guiding enterprises to increase investment in the domestic market by reducing the export tax rebate rate, and the country will also use the saved export tax rebate subsidies to expand domestic demand and investment, thus promoting the growth of domestic consumption and investment.

4. Upgrading of industrial structure and high-quality development

For photovoltaic, batteries and other industries that have strong international competitiveness, reducing export tax rebates will help eliminate backward production capacity, encourage technological innovation and industrial upgrading, and promote high-quality economic development.

So, what is the impact of export tax rebate and reduction on enterprises? Sungreen Logistics believes that:

In the short term, the reduction of export tax rebate rate may have a greater impact on low value-added enterprises that rely on price competition, and enterprises with leading technology and obvious brand advantages may therefore stimulate the power of technological innovation and product upgrading.

In terms of stock market reaction, stocks in photovoltaic, battery and other sectors generally fell after the release of the news of the export tax rebate rate reduction, which also reflects the market's concern about the decline in short-term profits of related enterprises.

However, in the long run, if enterprises can adapt to policy adjustments and actively transform and upgrade, their stock prices still have the potential to rise.

From a macroeconomic perspective, the reduction of export tax rebates is aimed at promoting domestic consumption and investment, and promoting economic structural transformation and upgrading to achieve high-quality development. Although the policy may have a certain impact on export growth in the short term, in the long run, it will help improve the overall competitiveness of our economy.

The Announcement on the adjustment of export tax rebate Policy is not only a response to the current economic situation, but also a far-reaching consideration for the long-term development of China's new energy industry.

For the lithium battery and photovoltaic markets, this policy adjustment brings both short-term challenges and long-term opportunities. The key lies in how enterprises adapt to the new policy environment, actively transform and upgrade, and enhance their competitiveness.