CMA CGM Executive: Causing port congestion is caused by very large container ships

In recent years, port congestion has been a nightmare for shippers and shipping companies, and geopolitical risks, dock workers' strikes, and new tariff policies are often cited as important factors that prompt shippers to ship frantically, which leads to port congestion.

However, a senior executive of CMA CGM recently publicly said that the port congestion is caused by "super large container ships"!

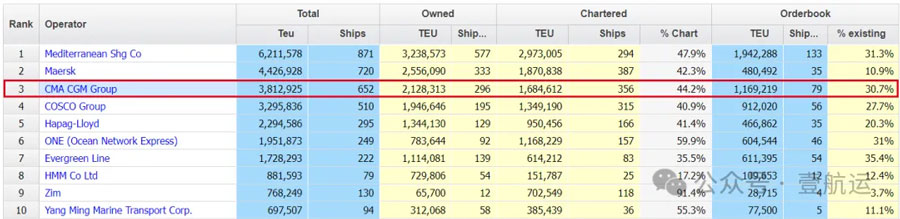

As the world's third largest shipping company, owns and is still ordering the construction of very large container ships, this is not even letting itself go?

Christine Cabau Woehrel, executive vice president of assets at CMA CGM, recently told a liner transport and logistics forum that very large container ships are the culprit behind the widespread congestion in container ports around the world.

"Port congestion is everywhere," Woehrel said. It started in Europe first, but now it's hurting our very efficient Asian ports as well."

"I think a big reason is that the container ships we operate are getting bigger and bigger."

Christine Cabau Woehrel, who has been with the CMA CGM Group since 1987, was appointed Executive Vice President of Assets at CMA CGM in January 2019, where her main responsibilities will include managing the Group's industrial assets such as fleet, new shipbuilding, container fleet, intermodal transport and the Group's terminals.

Woehrel said ports are facing increasing challenges as vessels with a capacity of up to 23,000 Teu are deployed on the Asia-Europe route.

She added that the bottleneck does not necessarily come from berthing efficiency, but could also come from container yard capacity taken up by very large vessels when they make successive weekly port calls.

"We need to get used to this new normal because it's not easy for ports around the world to immediately expand dock space."

"We need to create a new process between terminals and shipping companies and work together to create new working models with greater collaboration in predicting ship arrivals, productivity and yard readiness."

It is understood that as a liner giant operating a container fleet of more than 3.8 million TEU, CMA CGM has 296, 2.128 million TEU of its own container ships, in addition to 79, 1.169 million TEU of new container ships (an average capacity of 14,800 TEU each).

However, Hua Joo Tan, co-founder of shipping analyst Linerlytica, said the increased congestion could also be due to a number of other factors.

"It could be a bottleneck in berths, gates or yards, sometimes a Labour shortage, so you can't generalise."

However, a senior executive of CMA CGM recently publicly said that the port congestion is caused by "super large container ships"!

As the world's third largest shipping company, owns and is still ordering the construction of very large container ships, this is not even letting itself go?

Christine Cabau Woehrel, executive vice president of assets at CMA CGM, recently told a liner transport and logistics forum that very large container ships are the culprit behind the widespread congestion in container ports around the world.

"Port congestion is everywhere," Woehrel said. It started in Europe first, but now it's hurting our very efficient Asian ports as well."

"I think a big reason is that the container ships we operate are getting bigger and bigger."

Christine Cabau Woehrel, who has been with the CMA CGM Group since 1987, was appointed Executive Vice President of Assets at CMA CGM in January 2019, where her main responsibilities will include managing the Group's industrial assets such as fleet, new shipbuilding, container fleet, intermodal transport and the Group's terminals.

Woehrel said ports are facing increasing challenges as vessels with a capacity of up to 23,000 Teu are deployed on the Asia-Europe route.

She added that the bottleneck does not necessarily come from berthing efficiency, but could also come from container yard capacity taken up by very large vessels when they make successive weekly port calls.

"We need to get used to this new normal because it's not easy for ports around the world to immediately expand dock space."

"We need to create a new process between terminals and shipping companies and work together to create new working models with greater collaboration in predicting ship arrivals, productivity and yard readiness."

It is understood that as a liner giant operating a container fleet of more than 3.8 million TEU, CMA CGM has 296, 2.128 million TEU of its own container ships, in addition to 79, 1.169 million TEU of new container ships (an average capacity of 14,800 TEU each).

However, Hua Joo Tan, co-founder of shipping analyst Linerlytica, said the increased congestion could also be due to a number of other factors.

"It could be a bottleneck in berths, gates or yards, sometimes a Labour shortage, so you can't generalise."