American line rates fell again, shipping companies announced new FAK rates

As shipping lines failed to raise prices ahead of a series of GRIs on December 1, there was another mild decline in container spot rates on major routes.

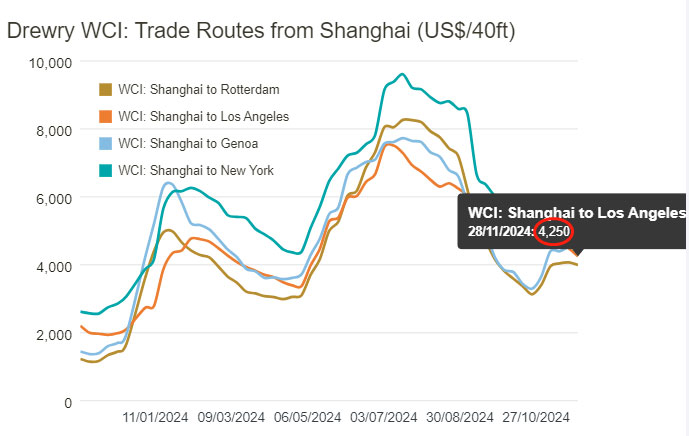

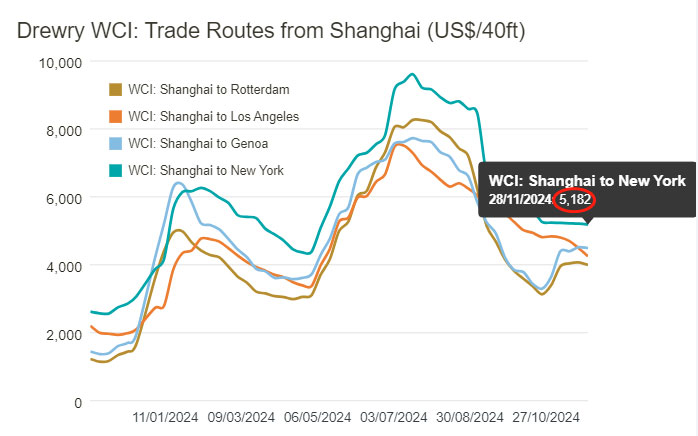

On November 28, the World Container Index (WCI) composite Index released by Drury fell 2% month-on-month to $3,331 per 40-foot container. Asia-nordic/Mediterranean rates fell 1 per cent, trans-Pacific rates fell 3 per cent and transatlantic rates remained unchanged.

As far as the United States line is concerned, the market transportation demand growth is weak, the balance of supply and demand is not ideal, and the freight rate continues to fall, of which the US-West route has a larger decline. WCI's Shanghai to Los Angeles freight rates fell 5% month-on-month in the past week, to $4,250 per 40-foot container; The Shanghai-New York route also dropped 1% to $5,182.

The threat of tariffs did not make much of a ripple in the markets

Speaking of tariffs, we have to mention US President Donald Trump. He previously announced tariffs of 25 per cent on imports from Canada, 10 per cent on imports from Mexico and 10 per cent on imports from China. However, the news did not cause much reaction in the market.

The announcement of the tariffs had been expected to prompt US importers to bring forward shipments, pushing up spot freight rates. But this is not the case. Peter Sander, principal analyst at Xeneta, said that's not the only risk U.S. shippers face in the near term. Many U.S. shippers have been front-loading throughout the year in response to supply chain disruptions and other issues. Therefore, even if the tariffs do go through, it is unlikely to see a significant increase in demand, as some inventories may already be saturated.

However, Sander also raised the possibility that if Trump does force the tariffs into effect on his first day in office in January, some importers could be scrambling to move goods in short order. But so far, the implementation date of the new tariffs remains unknown.

In addition to tariffs, rates are changing.

Spot and contract rates on trans-Pacific routes are falling, and although the WCI index has not been affected by this trend in the past week, the Shanghai to Rotterdam and Shanghai to Genoa routes have fallen.

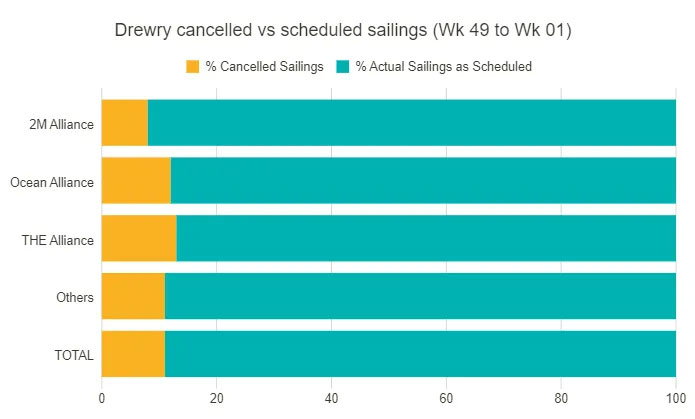

At the same time, about 10% of planned voyages have been cancelled this month, but this has not stopped the downward trend in prices. From Week 49 (2 December to 8 December) and Week 01 (29 December to 5 January), a total of 719 scheduled voyages were cancelled, a cancellation rate of 10%. This shows how uncertain the shipping market remains.

In general, although the tariff and freight adjustment and other news continue to come, but the shipping market does not seem to have too much waves, the future market trend needs to be further observed and analyzed.

On November 28, the World Container Index (WCI) composite Index released by Drury fell 2% month-on-month to $3,331 per 40-foot container. Asia-nordic/Mediterranean rates fell 1 per cent, trans-Pacific rates fell 3 per cent and transatlantic rates remained unchanged.

As far as the United States line is concerned, the market transportation demand growth is weak, the balance of supply and demand is not ideal, and the freight rate continues to fall, of which the US-West route has a larger decline. WCI's Shanghai to Los Angeles freight rates fell 5% month-on-month in the past week, to $4,250 per 40-foot container; The Shanghai-New York route also dropped 1% to $5,182.

The threat of tariffs did not make much of a ripple in the markets

Speaking of tariffs, we have to mention US President Donald Trump. He previously announced tariffs of 25 per cent on imports from Canada, 10 per cent on imports from Mexico and 10 per cent on imports from China. However, the news did not cause much reaction in the market.

The announcement of the tariffs had been expected to prompt US importers to bring forward shipments, pushing up spot freight rates. But this is not the case. Peter Sander, principal analyst at Xeneta, said that's not the only risk U.S. shippers face in the near term. Many U.S. shippers have been front-loading throughout the year in response to supply chain disruptions and other issues. Therefore, even if the tariffs do go through, it is unlikely to see a significant increase in demand, as some inventories may already be saturated.

However, Sander also raised the possibility that if Trump does force the tariffs into effect on his first day in office in January, some importers could be scrambling to move goods in short order. But so far, the implementation date of the new tariffs remains unknown.

In addition to tariffs, rates are changing.

Spot and contract rates on trans-Pacific routes are falling, and although the WCI index has not been affected by this trend in the past week, the Shanghai to Rotterdam and Shanghai to Genoa routes have fallen.

At the same time, about 10% of planned voyages have been cancelled this month, but this has not stopped the downward trend in prices. From Week 49 (2 December to 8 December) and Week 01 (29 December to 5 January), a total of 719 scheduled voyages were cancelled, a cancellation rate of 10%. This shows how uncertain the shipping market remains.

In general, although the tariff and freight adjustment and other news continue to come, but the shipping market does not seem to have too much waves, the future market trend needs to be further observed and analyzed.