The air cargo industry continues to see strong demand growth in 2024

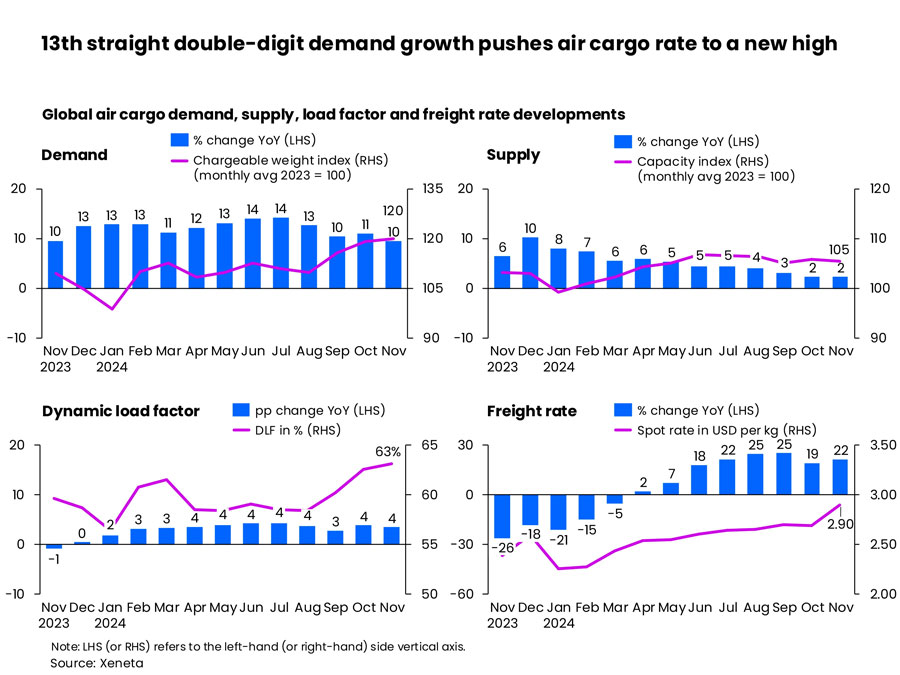

According to Xeneta's latest market analysis, global air cargo demand showed no signs of slowing down in November, with cargo volumes Posting 13 consecutive months of double-digit growth and load factors at their highest level since April 2022.

Demand rose 10 per cent year on year in November, driven by the continued boom in e-commerce. Combined with only a modest 2 per cent increase in air cargo volumes, global spot air cargo prices (valid for one month) also reached their highest level in almost two years at $2.90 per kg, marking the sixth consecutive month of double-digit year-on-year growth.

The air cargo market had a strong monthly performance in 2024, with some market segments hoping for a "peak" in the fourth quarter. However, Niall van de Wouw, chief air cargo officer at Xeneta, said the industry has avoided this very well.

"Peaks should not be the goal. This should be avoided as it creates an imbalance between winners and losers. 2024 has all the ingredients for crazy peak season price increases, but we have yet to see this develop, which is another sign of the maturity of the global air cargo market we mentioned earlier. The chaos we are witnessing in 2023 is also a valuable lesson. In 2024, we will see these lessons put into practice, "he said.

"People shouldn't be disappointed. We see a more mature air cargo market based on better allocation of resources and better terms and conditions among all parties involved. In contrast, the peak year of 2023 saw a shortage of capacity and a crazy increase in freight rates, all at the expense of shippers, "added Niall van de Wouw. "Why should we go back there? Supply chain stress at all peaks can hurt consumers and place unnecessary restrictions on relationships. It would be opportunistic for short-term gains."

While some observers say the end of the year will be a sluggish air cargo market, Niall van de Wouw called for objectivity.

"The air cargo industry is working flat out but not out of control," he said. Data for November showed that market freight volumes were 10% higher than at the peak of the same month last year, and freight rates had also risen.

"The final months of 2024 could again be very chaotic for shippers, but we're not hearing that." It's not because there's not enough cargo, and it's not because flights aren't full enough. It's because, in general, everything is better managed. The industry deserves a lot of credit for that."

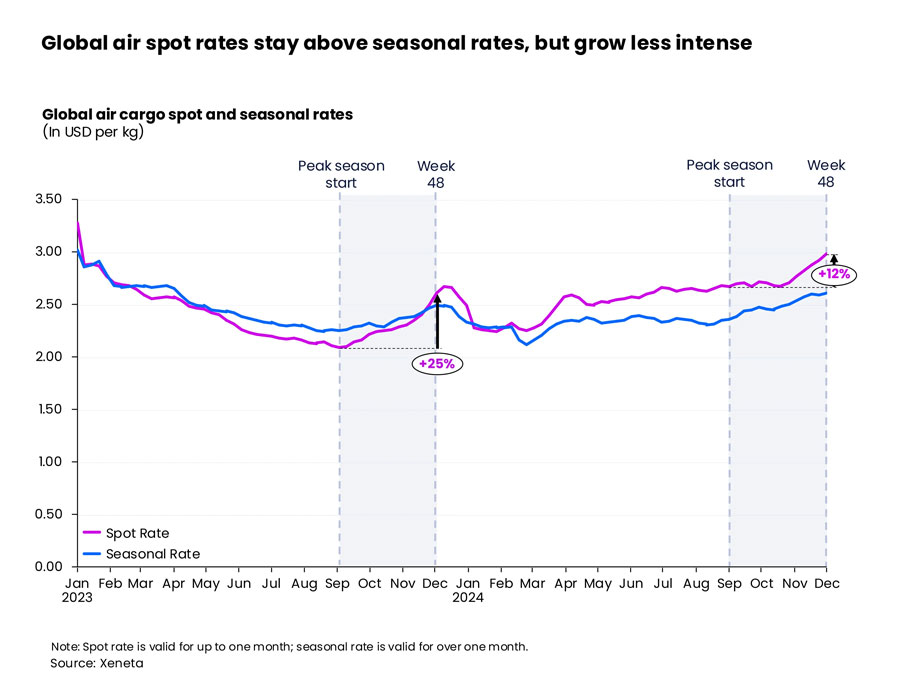

Global spot rates for air cargo remain higher than seasonal rates

The ongoing supply-demand imbalance in 2024 caused dynamic load factor to rise to 63% in November, the highest level in more than 30 months. Dynamic load factor is Xeneta's measure of capacity utilization based on cargo volume and cargo weight, as well as available capacity.

This level of demand strengthens carriers' negotiating position and has kept global spot air cargo prices above seasonal prices (valid for more than a month) since late November 2023.

This trend is particularly evident in the Asian outbound market. Spot freight rates in Northeast Asia rose modestly in November as carriers adjusted capacity to accommodate surging freight demand. Spot freight to Europe rose 13 per cent month-on-month to $5.09 per kg, while spot freight to North America rose 5 per cent to $5.20 per kg.

In addition, spot prices in Southeast Asia were mixed, with European spot prices flat at $4.15 per kg and North American spot prices falling -3% to $6.05 per kg. The latter decline was due to lower trading volumes after spot prices exceeded last year's peak season levels since the end of May 2024.

At the same time, freight rates in the transatlantic market have increased even more dramatically as freight capacity has shifted elsewhere at the end of the peak summer passenger season. Spot freight rates from Europe to North America rose 46 per cent quarter-on-quarter to $2.72 per kg, compared with a 9 per cent rise in the same period last year.

Similarly, freight rates from Europe to Latin America increased by 23 percent to $4.58 per kilogram. In Brazil, a five-day embargo imposed at Sao Paulo, South America's largest cargo airport, in early November, combined with digital customs delays across the country caused by a strike at Brazilian Customs since November 26, could lead to further increases in air spot freight rates in December. Shippers may resort to air freight to avoid delays in customs clearance.

"Personally, I think the air cargo industry should be proud that it has avoided the 'peak' because that is the basis for achieving greater market stability." I hope this will allow everyone to welcome the Christmas and New Year holidays they deserve with a sense of satisfaction, allowing them to relax and spend quality time with family and friends, "said Niall van de Wouw.

"In 2024, the industry has shown maturity. We'll have to wait and see if that can be sustained when the market goes down, but I don't think that's happening yet."