Analyst: The bulk carrier dividend has passed, and the future income has declined sharply

In 2025, the dry bulk market may not be able to continue this year's strong performance. Maritime Strategies International (MSI), a UK-based consultancy, expects the average dry bulk carrier's earnings to fall by as much as 19% by 2025, as new ship deliveries outpace incremental trade volumes.

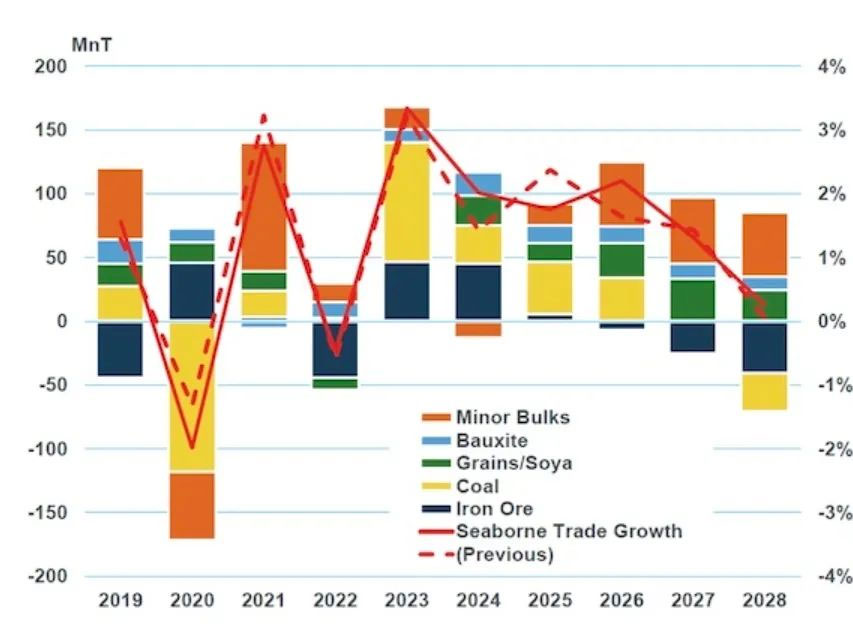

The supporting factors of the market in 2024 May be difficult to reproduce next year, and the industry is about to usher in a new "storm". MSI Dry bulk market research director Will Fray pointed out that the fate of the dry bulk market in 2024 is largely influenced by a combination of Chinese stockpiling activity and disruption in trade patterns, which masks broader underlying weakness in commodity consumption. With Chinese coal and iron ore inventories already near record levels and underlying global consumption drivers remaining weak, it is difficult to see much improvement in freight volume growth in 2025.

"It is difficult to see a similar positive change in the market today," Will Fray said. He explained that MSI analyzed the relationship between the volume of trade and the demand for shipping capacity and found that there will be an oversupply situation in 2025.

According to MSI's forecast, 36 million DWT will be added to the global fleet in 2025, and 240 million tonnes of cargo will be needed to absorb this additional capacity if trade patterns remain unchanged in 2024. But in reality, less than 100 million tons of additional cargo is expected in 2025.

Although MSI expects ship dismantling to double in 2025 from 4 million DWT this year, the impact on freight rates will be limited. Will Fray noted that dismantling is still not happening fast enough to offset the impact of new capacity.

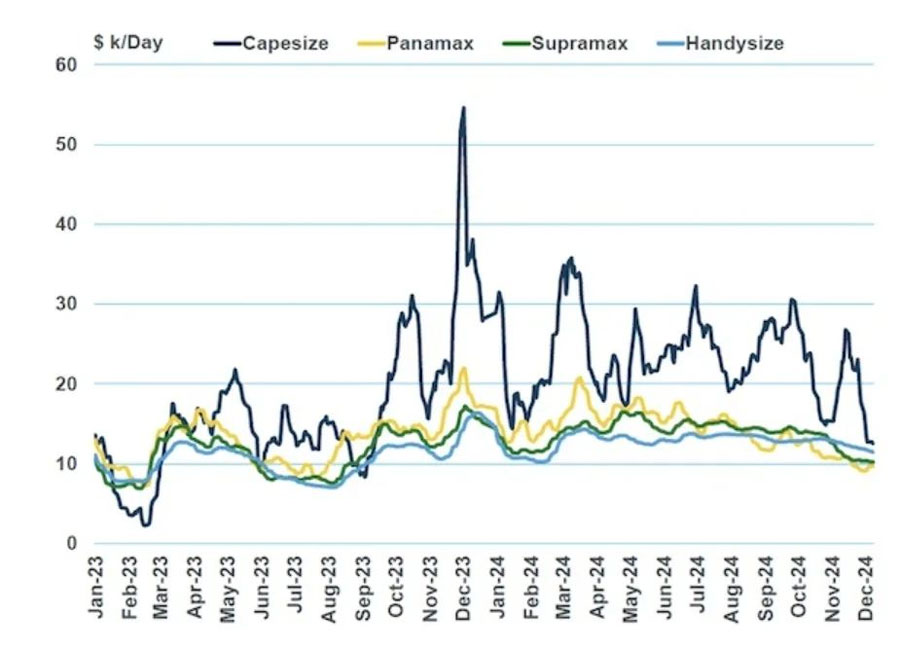

In terms of earnings, MSI forecasts a decline in regular daily rental yields across all ship types. Among them, the one-year daily rental of capesize vessels is expected to fall 19% to $20,400 / day; Daily rates for Panamax, ultraportable and handy-size vessels fell by around 15% to $14,300, $13,600 and $11,100, respectively.

Despite the weak freight rate expectations, ship asset prices have remained firm, in part because new building prices remain high. Will Fray said that in this context, small shipping companies are holding off on the pace of ship purchases, while large dry bulk companies are taking advantage of the trend to sign capesize ship orders through overall deals, showing greater market adaptability.

Will Fray pointed out that the shipbuilding market is still active, and shipyards in China are restarting capacity and even new shipyards are being built to meet market demand.

At present, Will Fray believes that the direct impact of these policies on the bulk market is not yet obvious, but does not rule out that there will be a certain early reaction in the market due to the impact of tariff rhetoric in the short term.

The supporting factors of the market in 2024 May be difficult to reproduce next year, and the industry is about to usher in a new "storm". MSI Dry bulk market research director Will Fray pointed out that the fate of the dry bulk market in 2024 is largely influenced by a combination of Chinese stockpiling activity and disruption in trade patterns, which masks broader underlying weakness in commodity consumption. With Chinese coal and iron ore inventories already near record levels and underlying global consumption drivers remaining weak, it is difficult to see much improvement in freight volume growth in 2025.

"It is difficult to see a similar positive change in the market today," Will Fray said. He explained that MSI analyzed the relationship between the volume of trade and the demand for shipping capacity and found that there will be an oversupply situation in 2025.

According to MSI's forecast, 36 million DWT will be added to the global fleet in 2025, and 240 million tonnes of cargo will be needed to absorb this additional capacity if trade patterns remain unchanged in 2024. But in reality, less than 100 million tons of additional cargo is expected in 2025.

Although MSI expects ship dismantling to double in 2025 from 4 million DWT this year, the impact on freight rates will be limited. Will Fray noted that dismantling is still not happening fast enough to offset the impact of new capacity.

In terms of earnings, MSI forecasts a decline in regular daily rental yields across all ship types. Among them, the one-year daily rental of capesize vessels is expected to fall 19% to $20,400 / day; Daily rates for Panamax, ultraportable and handy-size vessels fell by around 15% to $14,300, $13,600 and $11,100, respectively.

Despite the weak freight rate expectations, ship asset prices have remained firm, in part because new building prices remain high. Will Fray said that in this context, small shipping companies are holding off on the pace of ship purchases, while large dry bulk companies are taking advantage of the trend to sign capesize ship orders through overall deals, showing greater market adaptability.

Will Fray pointed out that the shipbuilding market is still active, and shipyards in China are restarting capacity and even new shipyards are being built to meet market demand.

At present, Will Fray believes that the direct impact of these policies on the bulk market is not yet obvious, but does not rule out that there will be a certain early reaction in the market due to the impact of tariff rhetoric in the short term.