Despite the seasonal slowdown, Asian freight rates remain high

According to the latest Data and analysis from WorldACD Market Data, despite the usual seasonal decline in global air cargo spot prices in early January, their prices are still up more than 20% compared to the same period last year. In the second week of 2025 (Week 2, January 6-12), relatively high freight rates from the Asia Pacific region and the Middle East and South Asia (MESA) continued to support average prices.

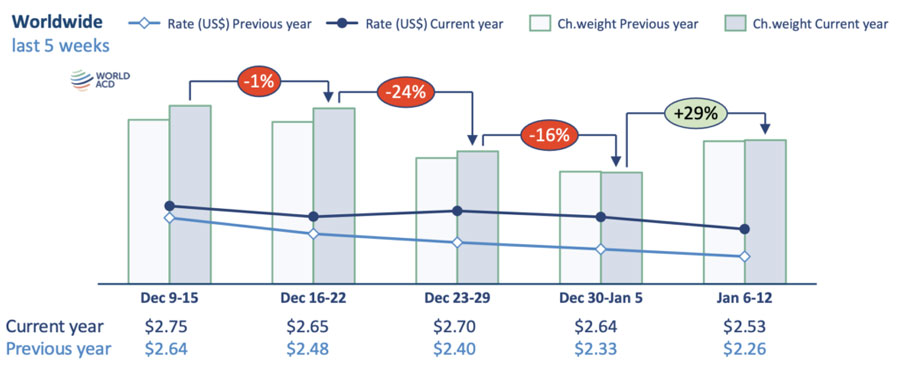

Although the global average spot price decreased (-3%) compared to the previous week to $2.76 per kg (week-on-week, or week-on-week), it was still up 22% compared to the same period last year. Similarly, based on more than 500,000 weekly trades covered by WorldACD data, the global market-wide average spot and contract price mix declined slightly (-4%, week-on-week) to $2.53, but is still up 12% compared to the same period last year.

Freight rates from the Pacific region to the United States fell

The average spot price in the Asia-Pacific region fell by -5 per cent in Week 2 to US $3.81 per kg, down from the peak of US $4.75 in Week 49 but 27 per cent higher than in Week 2 last year. In the last two weeks of 2024, APAC to US demand and spot prices remained surprisingly firm, ending the year with an average APAC to US price of $6.41 per kg, specifically China to US $6.04. After a -24% drop in Asia-Pacific tonnage to the United States in Week 1, it recovered by 14% in week 2. But spot prices continued to slide, falling in the second week to $5.39 per kg from Asia-Pacific to the US and $4.25 from China to the US - although these spot prices were still up year-on-year, by 37 per cent and 10 per cent respectively.

Decreased tonnage on Asia Pacific to Europe routes

Freight volumes from the Asia-Pacific region to Europe were very active for most of 2024, including most of the fourth quarter, but began to decline sharply from mid-December. In fact, in the first week of 2025 (Week 1), the billable weight is down -40% from the level of Week 49 in 2024. Although they rebounded in Week 2 (+26%), cargo volumes are still nearly 25% below their mid-December highs. Accordingly, spot freight rates from Asia Pacific to Europe fell back from above $5 per kg in mid-December to around $4.30 in Week 52 and Week 1, but rebounded by $4.59 in Week 2 - a +42% increase compared to the same period last year. Week 2, South Korea ($5.25; +14%, week-on-week), Hong Kong ($5.20; +1%, week on week) and Japan ($5.05; Spot freight rates to Europe were all over $5 / kg (+18%, week on week), while freight rates from China to Europe rebounded (+13%, week on week) to $4.48 / kg.

MESA rates are still high but falling

MESA freight rates, which were high throughout 2024 due to disruptions in the region's seaborne supply chain, have declined in the past three months and continue to decline in 2025. The MESA region's market-wide average freight rate for Week 1 and Week 2 declined further by -4% compared to the previous two weeks (2Wo2W), but was still up +36% year-over-year. The average spot freight rate for MESA to Europe in Week 2 was $2.60 per kg, down about -20% compared to levels in early November (Week 45), but still up +65% year on year. Spot freight rates from Bangladesh to Europe, which rose above $5 per kg in September, have been falling every week for the past 10 weeks, from $4.92 per kg in week 45 of the year to $3.25 in week 2. But it is still up +35% year-on-year.

Nevertheless, air freight prices and demand from the MESA region are likely to remain high for the time being. Shipping sources such as Lloyd's Daily reported that the current fragile ceasefire in Gaza has not changed the current threat assessment for shipping in the Red Sea, and shipping companies will not be prepared to disrupt the global supply chain by changing routes unless there is conclusive evidence that the Houthi threat has diminished.