Gemini officially operated, the shipping alliance entered the stage of hegemony

On February 1, the Gemini Alliance formed by Maersk and Hapag-Lloyd officially began operations, which also marks the consolidation market alliance into the four-way competition stage.

The stable development of the Ocean Alliance, the ambitious Gemini Alliance, the Premier Alliance that seems to have no choice, and the Mediterranean Shipping (MSC) that "the scale of one enterprise matches one alliance" will reshape the new pattern of the consolidation market alliance.

Large scale difference

At present, most of the top ten liner companies in the world are members of the alliance.

Ocean Alliance was established in 2017 and its members include COSCO Shipping Lines, Orient Overseas, CMA CGM and Evergreen Shipping. THE Gemini Alliance was formed in January 2024 by Maersk, a former 2M member, and Hapag-Lloyd, a former THE Alliance. THE Premier Alliance was formed in September 2024 by Ocean Network Shipping (ONE), HMM and Yangming Shipping of the former The Alliance.

MSC and Star Line, which do not participate in the alliance's operations, either operate independently through their own extensive network of routes or work with the alliance for cabin changes.

In terms of scale, the total capacity of the members of the Ocean Alliance exceeds 8.97 million TEU, of which 3.8 million TEU and 330 ships are operated by the alliance, and 41 routes are operated by the alliance, covering 8 markets such as Far East-Northwest Europe, Far East-Mediterranean, Far East-Southwest America, Far East-Northwest America, Far East-East United States Gulf, Trans-Atlantic, Far East-Middle East and Far East-Red Sea. At the same time, it also swaps seats with ONE on transatlantic routes.

It can be said that the ocean Alliance is the alliance with the largest share of capacity and the widest coverage in the current consolidation market.

Maersk and Hapag-Lloyd both said the alliance aims to provide a fast, flexible and connected maritime transport network with an on-time rate of more than 90 percent once fully operational. It is expected that in June 2025, all ships of the Gemini Alliance will operate according to the new schedule.

Ranked first in the global capacity ranking, MSC, after the end of the 2M alliance cooperation, will independently operate the route network, mainly due to its nearly 6.4 million TEU, 887 ships capacity, can be described as "an enterprise scale equal to an alliance".

In contrast, Premier Alliance is the smallest, with a total member capacity of only 3.59 million TEU, and the alliance's operating capacity will be lower. The main routes of the alliance include Asia-Europe, Asia-North America and Trans-Pacific routes, while there is a space exchange with MSC on the Asia-Europe route.

Decisive battle of two battlefields

If the competition between the alliances is compared to a war, from the product lists released by the alliances, the most tense war is the Asia-Europe route and the trans-Pacific route. These two trade corridors are the most significant scale advantages of super large container ships, the alliance has the most investment in large ships, and are also the most affected by trade policies, geopolitics and other routes.

It is understood that Ocean Alliance provides seven route services in the Far East-Northwest Europe market, with 100 vessels and a weekly capacity of more than 120,000 TEU. It serves four routes in the Asian-Mediterranean market with 54 vessels and a weekly capacity of nearly 50,000 TEU. It serves 22 routes in the trans-Pacific market with 194 vessels and a weekly capacity of nearly 200,000 TEU. In addition, eight routes are available in the transatlantic, Far East-Middle East, Far East-Red Sea and other markets.

On the Asia-Europe route, MSC restarted Swan route. Previously, when the 2M alliance was operating, the route was suspended for a long time, and MSC launched it as an independent route, connecting China with Belgium, the Netherlands, Luxembourg, Poland and the Baltic States. In addition, MSC has relaunched the AE1/Shogun Loop, which was previously permanently discontinued, and rebranded as the Asian-Mediterranean Dragon Route, with the deployment of five 9,000 to 14,400 TEU vessels.

On the Trans-Pacific route, MSC resumed and upgraded the Asia-America East Liberty route, adding direct service to Philadelphia, USA. At the same time, the Mustang route was adjusted to cancel the call in Long Beach, and the new call in Seattle, Vancouver and Portland.

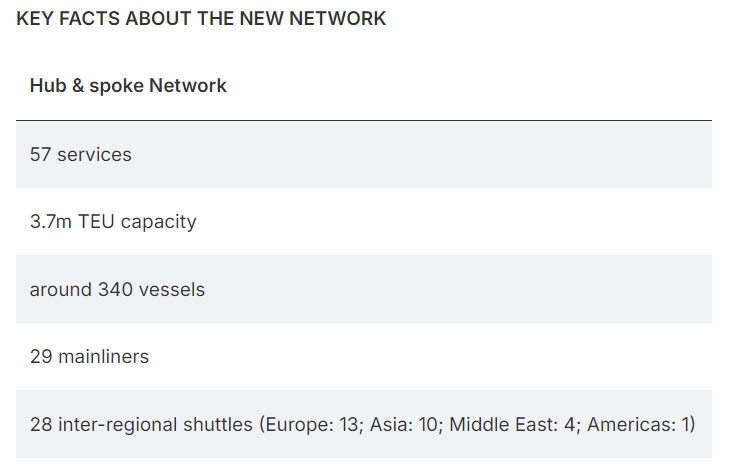

The route layout of the Gemini Alliance is more interesting, and its special hub-and-spoke network has laid out many shuttle express lines in addition to the main line operation, which provides a wider network coverage while meeting the efficiency of the main line operation.

In terms of trunk lines, the Gemini Alliance offers seven Asia-Europe routes, mainly connecting China with northwestern Europe. At the same time, it offers nine trans-Pacific routes, mainly covering major ports in China, the West and East coasts of North America. In terms of shuttle lines, it provides 13 shuttle lines in Asia, 6 in Northern Europe, 6 in the Mediterranean region, and also provides shuttle lines in the Middle East, North America and other places.

Premier Alliance offers six Asia-Northern Europe routes, four Asia-Mediterranean routes, seven Asia-Pacific Southwest routes, four Asia-Pacific Northwest routes, and three Asia-U.S. East Coast routes, but the number and frequency of routes lags behind its competitors.

It is worth noting that in terms of average ship capacity, both Ocean Alliance and MSC are at 13,200 TEU, higher than the other two alliances, the Gemini Alliance at 12,400 TEU and the Premier Alliance at 11,900 TEU.

Look beyond the league

The new alliance structure has a profound impact on the market, but also contains opportunities, especially those with large ships and independent operating lines, most typically star Line. In addition, in addition to the highly competitive backbone routes, liner companies with advantageous routes, such as ONE, will also get more opportunities.

In the current ship structure of Star Line, 20% of the ships are 15,100 to 18,000 TEU ships, which accounts for the highest proportion among the top ten liner companies.

In addition, Star Line will continue to independently operate two Pacific Southwest routes, ZEX and ZX2, which have a good reputation in the field of cross-border e-commerce and high service quality.

ONE is not only the most important member of the Premier Alliance, but also participates in the space exchange with MSC through the alliance. In addition, ONE has partnered with Ocean Alliance to launch ships on three transatlantic routes.

Other mid-sized liner companies worth watching outside the alliance include Wan Hai Line and PIL. In the past two years, the two companies have changed their conservative style and started to order large ships under the background of the good market, and may also look forward to more cooperation with the alliance.

The new pattern of alliance in the consolidation market has been formed, the market competition is becoming more intense, and the on-off and off-again between alliance members will be more frequent, but how to change still depends on the market, and it is expected that the alliance competition can bring about the improvement of service quality.

The stable development of the Ocean Alliance, the ambitious Gemini Alliance, the Premier Alliance that seems to have no choice, and the Mediterranean Shipping (MSC) that "the scale of one enterprise matches one alliance" will reshape the new pattern of the consolidation market alliance.

Large scale difference

At present, most of the top ten liner companies in the world are members of the alliance.

Ocean Alliance was established in 2017 and its members include COSCO Shipping Lines, Orient Overseas, CMA CGM and Evergreen Shipping. THE Gemini Alliance was formed in January 2024 by Maersk, a former 2M member, and Hapag-Lloyd, a former THE Alliance. THE Premier Alliance was formed in September 2024 by Ocean Network Shipping (ONE), HMM and Yangming Shipping of the former The Alliance.

MSC and Star Line, which do not participate in the alliance's operations, either operate independently through their own extensive network of routes or work with the alliance for cabin changes.

In terms of scale, the total capacity of the members of the Ocean Alliance exceeds 8.97 million TEU, of which 3.8 million TEU and 330 ships are operated by the alliance, and 41 routes are operated by the alliance, covering 8 markets such as Far East-Northwest Europe, Far East-Mediterranean, Far East-Southwest America, Far East-Northwest America, Far East-East United States Gulf, Trans-Atlantic, Far East-Middle East and Far East-Red Sea. At the same time, it also swaps seats with ONE on transatlantic routes.

It can be said that the ocean Alliance is the alliance with the largest share of capacity and the widest coverage in the current consolidation market.

Maersk and Hapag-Lloyd both said the alliance aims to provide a fast, flexible and connected maritime transport network with an on-time rate of more than 90 percent once fully operational. It is expected that in June 2025, all ships of the Gemini Alliance will operate according to the new schedule.

Ranked first in the global capacity ranking, MSC, after the end of the 2M alliance cooperation, will independently operate the route network, mainly due to its nearly 6.4 million TEU, 887 ships capacity, can be described as "an enterprise scale equal to an alliance".

In contrast, Premier Alliance is the smallest, with a total member capacity of only 3.59 million TEU, and the alliance's operating capacity will be lower. The main routes of the alliance include Asia-Europe, Asia-North America and Trans-Pacific routes, while there is a space exchange with MSC on the Asia-Europe route.

Decisive battle of two battlefields

If the competition between the alliances is compared to a war, from the product lists released by the alliances, the most tense war is the Asia-Europe route and the trans-Pacific route. These two trade corridors are the most significant scale advantages of super large container ships, the alliance has the most investment in large ships, and are also the most affected by trade policies, geopolitics and other routes.

It is understood that Ocean Alliance provides seven route services in the Far East-Northwest Europe market, with 100 vessels and a weekly capacity of more than 120,000 TEU. It serves four routes in the Asian-Mediterranean market with 54 vessels and a weekly capacity of nearly 50,000 TEU. It serves 22 routes in the trans-Pacific market with 194 vessels and a weekly capacity of nearly 200,000 TEU. In addition, eight routes are available in the transatlantic, Far East-Middle East, Far East-Red Sea and other markets.

On the Asia-Europe route, MSC restarted Swan route. Previously, when the 2M alliance was operating, the route was suspended for a long time, and MSC launched it as an independent route, connecting China with Belgium, the Netherlands, Luxembourg, Poland and the Baltic States. In addition, MSC has relaunched the AE1/Shogun Loop, which was previously permanently discontinued, and rebranded as the Asian-Mediterranean Dragon Route, with the deployment of five 9,000 to 14,400 TEU vessels.

On the Trans-Pacific route, MSC resumed and upgraded the Asia-America East Liberty route, adding direct service to Philadelphia, USA. At the same time, the Mustang route was adjusted to cancel the call in Long Beach, and the new call in Seattle, Vancouver and Portland.

The route layout of the Gemini Alliance is more interesting, and its special hub-and-spoke network has laid out many shuttle express lines in addition to the main line operation, which provides a wider network coverage while meeting the efficiency of the main line operation.

In terms of trunk lines, the Gemini Alliance offers seven Asia-Europe routes, mainly connecting China with northwestern Europe. At the same time, it offers nine trans-Pacific routes, mainly covering major ports in China, the West and East coasts of North America. In terms of shuttle lines, it provides 13 shuttle lines in Asia, 6 in Northern Europe, 6 in the Mediterranean region, and also provides shuttle lines in the Middle East, North America and other places.

Premier Alliance offers six Asia-Northern Europe routes, four Asia-Mediterranean routes, seven Asia-Pacific Southwest routes, four Asia-Pacific Northwest routes, and three Asia-U.S. East Coast routes, but the number and frequency of routes lags behind its competitors.

It is worth noting that in terms of average ship capacity, both Ocean Alliance and MSC are at 13,200 TEU, higher than the other two alliances, the Gemini Alliance at 12,400 TEU and the Premier Alliance at 11,900 TEU.

Look beyond the league

The new alliance structure has a profound impact on the market, but also contains opportunities, especially those with large ships and independent operating lines, most typically star Line. In addition, in addition to the highly competitive backbone routes, liner companies with advantageous routes, such as ONE, will also get more opportunities.

In the current ship structure of Star Line, 20% of the ships are 15,100 to 18,000 TEU ships, which accounts for the highest proportion among the top ten liner companies.

In addition, Star Line will continue to independently operate two Pacific Southwest routes, ZEX and ZX2, which have a good reputation in the field of cross-border e-commerce and high service quality.

ONE is not only the most important member of the Premier Alliance, but also participates in the space exchange with MSC through the alliance. In addition, ONE has partnered with Ocean Alliance to launch ships on three transatlantic routes.

Other mid-sized liner companies worth watching outside the alliance include Wan Hai Line and PIL. In the past two years, the two companies have changed their conservative style and started to order large ships under the background of the good market, and may also look forward to more cooperation with the alliance.

The new pattern of alliance in the consolidation market has been formed, the market competition is becoming more intense, and the on-off and off-again between alliance members will be more frequent, but how to change still depends on the market, and it is expected that the alliance competition can bring about the improvement of service quality.