Flight cancellations and general rate increases (GRI) have failed to stem the fall in Asia-Nordic freight rates, with less than 95% of cabins utilised during the low season after the Lunar New Year.

On Friday, Asia-Northern Europe freight rates fell 16% (from Jan. 29, the week before the holiday) to $1,805 per TEU, according to the Shanghai Container Freight Index.

According to a report published by Linerlytica, the number of suspensions so far has not kept pace with the decline in freight volumes in most Far East regions.

"Despite speculative rate increases announced by Hapag-Lloyd over the weekend to $2,500 /TEU and $4,100/40ft effective March 1, market resistance is strong, capacity utilization remains below 95%, and the post-holiday blank voyage schedule mostly ends this week," the report added.

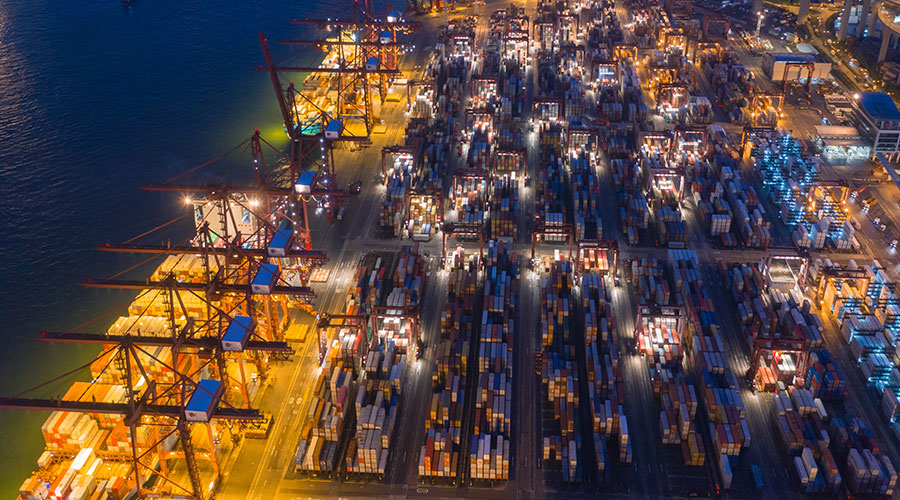

The post-Lunar New Year slowdown in North Asia has helped ease congestion at ports in China and South Korea, with vessel capacity at berthing halving from a recent peak of more than 1.2m TEUs in January.

Over the past two weeks, 30 to 60 per cent of China's regular port capacity has come to a standstill and ship activity has slowed sharply, allowing ports to recover from recent high volumes.

Rates on the Asia-Mediterranean route fared better, falling 5% from pre-yuan to $3,036 / TEU. This is attributed to niche shipping companies shifting capacity from the Mediterranean route to the Red Sea route to meet route demand.

Trans-pacific freight rates, which averaged $3,932 per 40 feet (Shanghai to the West Coast of the United States) and $5,490 per 40 feet (Shanghai to the East Coast of the United States) on Friday, will also be under pressure.

"While carriers have submitted GRI for March 1, with prices ranging from $1,000 to $3,000 per 40 feet, they will face familiar headwinds after failing to secure any increases in mid-February, as capacity returns in large numbers across all alliances after the February shutdown plan is lifted," Linerlytica said.