Russia, US Agree to End Ukraine Conflict What is the impact on the shipping market?

According to Xinhua News Agency, on February 18, the first meeting of the Russia-US Riyadh negotiations ended. On the Russian side of the Riyadh talks are Foreign Minister Sergei Lavrov and presidential aide Sergei Ushakov. On the U.S. side, Secretary of State Marco Rubio, National Security Adviser Robert Waltz and Special Presidential envoy to the Middle East Robert Witcoff participated in the talks. Saudi Foreign Minister Saud al-Faisal was also at the meeting.

Ushakov said separate teams of Russian and US negotiators would begin contacts on Ukraine at an appropriate time.

He added that the decision to engage with the United States on Ukraine would ultimately fall to Russian President Vladimir Putin. For any meeting between Trump and Putin, "the two delegations need to work closely together."

Us State Department spokeswoman Tammy Bruce said after the talks in Riyadh that the US and Russian delegations had agreed to "address difficult issues in the bilateral relationship and take necessary steps to normalise the operations of their respective diplomatic missions".

He said the two sides also agreed to appoint a high-level team to lead negotiations on Ukraine and "work together to bring the conflict in Ukraine to an end as soon as possible in a durable, sustainable and mutually acceptable manner."

The Russo-Ukrainian war severely disrupted shipping

Over the past two years, the Russian-Ukrainian war has had an undeniable long-term impact on seaborne trade. The conflict in the Black Sea region has reshaped trade routes, affected transport contracts, especially economically, and led to a sharp rise in the cost of Marine insurance. In terms of trade routes, the war has disrupted activity in the region's busy ports, forcing transport activities to shift to longer and more expensive alternative routes, making it particularly difficult to move key products such as food and energy.

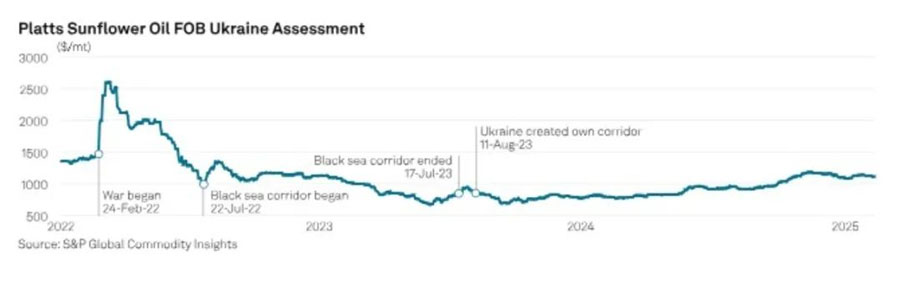

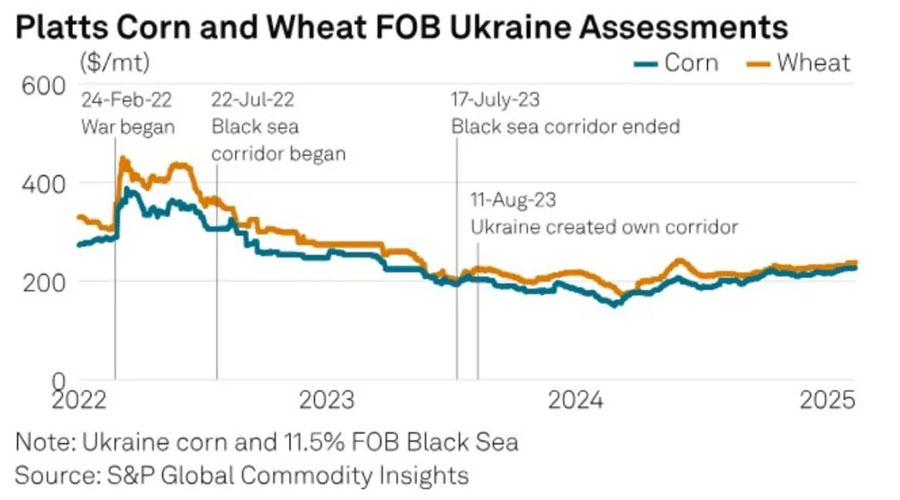

In this context, the Food Corridor Agreement was signed in Istanbul on July 22, 2022, under the mediation of Turkey and the United Nations. The agreement aims to establish a safe sea trade corridor in the Black Sea and effectively restart food shipments in Ukrainian ports. According to the agreement, the ports of Odessa, Chernomosk and Pivdenny were reopened, with Turkey responsible for ensuring the security of the corridor. Although seaborne trade was unable to return to pre-war levels, it continued through newly opened routes.

Freight and insurance costs may fall sharply

Insurance costs are also likely to fall, as traders currently only insure goods after they have passed through the Bosphorus, which is cheaper than in the Black Sea region. A corn trader said the original war risk surcharge (AWRP) was about 0.75 per cent of the value of the vessel, while it is now between 0.9 per cent and 1.6 per cent depending on the insurer.

One freight analyst added: "If the conflict eases, insurance premiums could fluctuate; However, a significant adjustment in premiums will require more than the expected peace agreement."

A peace deal could open new markets and strengthen existing ones for Ukrainian grain, which has been restricted by the war. "Without the military risk, we can expand into a wider range of end markets, into areas that were previously too expensive or risky to enter," said one sunflower oil trader.

However, Ukraine faces a huge challenge if exports are to resume. With 32 percent of arable land lost in Ukraine's Dnieper, Zaporozhy, Kherson and Donetsk regions, once major producers of wheat, corn and sunflower, these areas are now polluted, mined and uncultivable.

Ukraine's maize production has been reduced by 17.1 million tons since 2021 and is expected to be 25 million tons in the 2024-25 market year. Wheat and sunflower seed production fell by 10.6 million tons and 4.5 million tons, respectively. It is worth noting that from 2021 to 2024-25, sunflower oil production increased by 1.2 million tons, as more sunflower seeds were converted to oil, mainly due to the higher profitability of sunflower oil compared to grain and easier transportation.

The dynamics of FOB and CIF transactions

The removal of the risk of war could favor a return to the FOB model, which grew significantly after the outbreak of war as importers became wary of FOB deals. "After the war broke out, fewer and fewer buyers were willing to buy on a FOB basis, which resulted in CIF transactions accounting for more than 90 per cent of Ukraine's exports, compared with about 30 per cent before the conflict," says one seller in Kiev.

Traders expect the FOB to CIF ratio could return to a more balanced state, with a 50-50 distribution expected, a change that will be driven by demand rather than trade barriers.

Ushakov said separate teams of Russian and US negotiators would begin contacts on Ukraine at an appropriate time.

He added that the decision to engage with the United States on Ukraine would ultimately fall to Russian President Vladimir Putin. For any meeting between Trump and Putin, "the two delegations need to work closely together."

Us State Department spokeswoman Tammy Bruce said after the talks in Riyadh that the US and Russian delegations had agreed to "address difficult issues in the bilateral relationship and take necessary steps to normalise the operations of their respective diplomatic missions".

He said the two sides also agreed to appoint a high-level team to lead negotiations on Ukraine and "work together to bring the conflict in Ukraine to an end as soon as possible in a durable, sustainable and mutually acceptable manner."

The Russo-Ukrainian war severely disrupted shipping

Over the past two years, the Russian-Ukrainian war has had an undeniable long-term impact on seaborne trade. The conflict in the Black Sea region has reshaped trade routes, affected transport contracts, especially economically, and led to a sharp rise in the cost of Marine insurance. In terms of trade routes, the war has disrupted activity in the region's busy ports, forcing transport activities to shift to longer and more expensive alternative routes, making it particularly difficult to move key products such as food and energy.

In this context, the Food Corridor Agreement was signed in Istanbul on July 22, 2022, under the mediation of Turkey and the United Nations. The agreement aims to establish a safe sea trade corridor in the Black Sea and effectively restart food shipments in Ukrainian ports. According to the agreement, the ports of Odessa, Chernomosk and Pivdenny were reopened, with Turkey responsible for ensuring the security of the corridor. Although seaborne trade was unable to return to pre-war levels, it continued through newly opened routes.

Freight and insurance costs may fall sharply

Insurance costs are also likely to fall, as traders currently only insure goods after they have passed through the Bosphorus, which is cheaper than in the Black Sea region. A corn trader said the original war risk surcharge (AWRP) was about 0.75 per cent of the value of the vessel, while it is now between 0.9 per cent and 1.6 per cent depending on the insurer.

One freight analyst added: "If the conflict eases, insurance premiums could fluctuate; However, a significant adjustment in premiums will require more than the expected peace agreement."

A peace deal could open new markets and strengthen existing ones for Ukrainian grain, which has been restricted by the war. "Without the military risk, we can expand into a wider range of end markets, into areas that were previously too expensive or risky to enter," said one sunflower oil trader.

However, Ukraine faces a huge challenge if exports are to resume. With 32 percent of arable land lost in Ukraine's Dnieper, Zaporozhy, Kherson and Donetsk regions, once major producers of wheat, corn and sunflower, these areas are now polluted, mined and uncultivable.

Ukraine's maize production has been reduced by 17.1 million tons since 2021 and is expected to be 25 million tons in the 2024-25 market year. Wheat and sunflower seed production fell by 10.6 million tons and 4.5 million tons, respectively. It is worth noting that from 2021 to 2024-25, sunflower oil production increased by 1.2 million tons, as more sunflower seeds were converted to oil, mainly due to the higher profitability of sunflower oil compared to grain and easier transportation.

The dynamics of FOB and CIF transactions

The removal of the risk of war could favor a return to the FOB model, which grew significantly after the outbreak of war as importers became wary of FOB deals. "After the war broke out, fewer and fewer buyers were willing to buy on a FOB basis, which resulted in CIF transactions accounting for more than 90 per cent of Ukraine's exports, compared with about 30 per cent before the conflict," says one seller in Kiev.

Traders expect the FOB to CIF ratio could return to a more balanced state, with a 50-50 distribution expected, a change that will be driven by demand rather than trade barriers.