Trump's attack on China's shipping and shipbuilding industries is bound to come back to bite him

When the US trade stick is once again swinging at the Chinese shipping industry, a precision strike affecting the global supply chain is evolving into a self-inflicted storm.

The Office of the United States Trade Representative (USTR) announced on February 21 that it intends to impose high U.S. port fees, about millions of dollars each time, on Chinese shipping companies, Chinese-built vessels, and operators of any fleet that includes at least one Chinese-built vessel or has ordered a new vessel at a Chinese shipyard.

The provisions include a cap on fees for Chinese ships entering U.S. ports on a single voyage, or $1,000 per net ton of cargo carried; Chinese-built ships will be charged up to US $1.5 million (over 50% of the fleet), US $750,000 (25%-50%) or US $500,000 (0%-25%) per voyage, depending on the proportion of Chinese-built ships in the fleet; For operators ordering Chinese ships, if the order of Chinese shipbuilding accounted for more than 50%, a single voyage fee of $1 million; 25%-50% charge $750,000; 0% to 25% charge $500,000.

USTR will hold a hearing before the International Trade Commission on March 24, 2025, and the public can apply to attend by March 10 and submit written comments by March 24. It will be up to US President Donald Trump to decide whether to proceed with the plan. The proposed measures, if passed, would be the second time the United States has used Section 301 to impose restrictions on Chinese industries, following tariffs imposed on China in 2018.

Data Perspective: The influence of Chinese shipbuilding

It is worth noting that Chinese-made vessels have a high share in the hands of global shipowners. In the face of absolute power, if the United States and this move by the United States may lead to higher freight costs, ultimately borne by the United States importers and the American people.

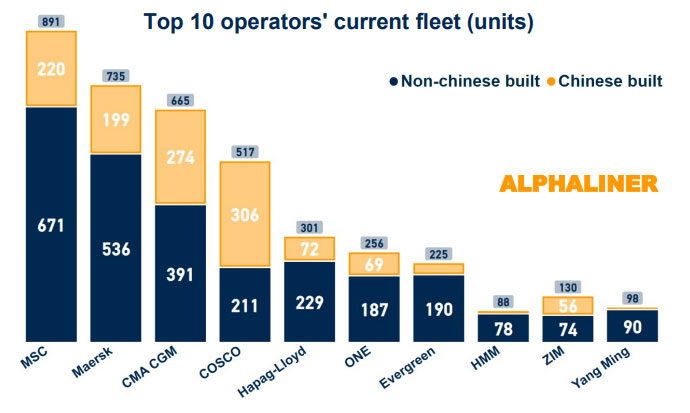

In the case of container ships, shipping data and consulting firm Alphaliner recently analyzed the fleets of the world's top 10 container shipping companies.

Sixty percent (306 vessels) of COSCO Shipping Lines (including OOCL) are built by Chinese shipyards.

Proportionately, nearly 50 per cent of the ships under Star Line are Chinese-built.

It is worth mentioning that the world's top three container shipping companies have a large number of ships built for Chinese shipyards.

Take CMA CGM, France's largest container line, which has 274 ships in its fleet built in Chinese shipyards.

MSC, the world's largest container shipping company, also has 220 ships built in China, while Maersk has nearly 200 ships built in China.

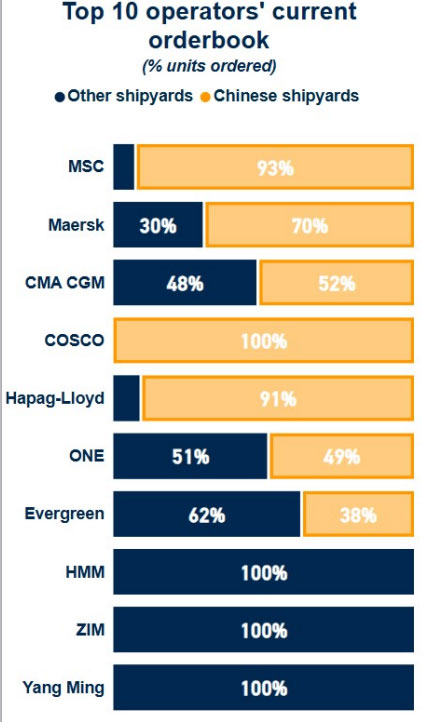

In the past two years, the global container shipping industry has set off a wave of new ship construction, if we look at the new ship orders of various shipping companies, we can see that the world's top 7 container shipping companies have ordered a large number of new ships in Chinese shipyards.

In addition, Clarkson research data also shows that the three companies held orders, Chinese construction accounted for more than 50%, of which Mediterranean companies held orders, the proportion of Chinese-built vessels as high as 92%. This also means that if the measures come into effect, liner companies will most likely face the same operational choices.

According to Clarkson Research, the overall figure shows that Chinese-made vessels now account for 23% of the global fleet.

According to data released by the Ministry of Industry and Information Technology on January 16, in 2024, China's shipbuilding completed 48.18 million deadweight tons, an increase of 13.8%; The new orders were 11305 million DWT, up 58.8% year on year; By the end of December 2024, hand-held orders stood at 208.72 million DWT, an increase of 49.7% year-on-year. In 2024, China's shipbuilding completions, new orders and hand-held orders will account for 55.7%, 74.1% and 63.1% of the global total in deadweight tons, and 50.3%, 68.2% and 55.4% in revised gross tons, respectively. The three major shipbuilding indicators have ranked first in the world for 15 consecutive years.

In addition, according to the China Industry News, Wang Dongbo, deputy secretary-general of the China Shipbuilding Industry Association, told the China Industry News reporter that "the number of new orders in 2024 has broken through a historical high, accounting for 74.1% of the world market share, which indicates that more than 70% of the ships built in the world in the next period of time are made in China."

By undermining the multilateral trading system, the US is hurting itself

China's Ministry of Commerce responded on February 23, 2025, saying that the US investigation conclusions "violate WTO rules," stressing that China has clarified its position through multiple rounds of communication, pointing out that the proposed US measures "harm others and harm themselves." A Commerce Ministry spokesman said:

- The US has already been ruled in violation of its Section 301 tariffs on China by the WTO, and this investigation further undermines the multilateral trading system.

- The proposed measures will increase the cost of shipping in the United States, increase inflationary pressures, and hurt the interests of American ports, shippers and workers, and there is opposition in the United States.

- The development of relevant industries in China is based on market principles and fair competition, and has always maintained the stability of the global industrial chain.

Peter Sand, chief analyst at Xeneta, said that if the Trangu government pushes through the policy, it may lead to further inflation through the supply chain cost transfer, saying: "The US side wants to crack down on China, but in the end it will be the US importers who pay the bill." Chinese shipbuilding accounted for 61% of new ship orders globally, and 43% of international ship calls at U.S. ports involved "China-linked" vessels (Clarkson data). If shipping companies cannot absorb the new costs, they will inevitably pass them on to shippers in the form of higher freight rates and port surcharges. The National Retail Federation (NRF) warned that the move could raise the price of imported goods by 5 to 10 per cent, adding to already high inflationary pressures.

The Act mandates that US exports be carried by US-owned vessels, but the reality is that the US merchant fleet is only 0.4% of the world's size, and the cost of local shipbuilding is 2-3 times that of China (source: Clarkson). Forcing the use of high-priced US ships will directly push up logistics costs for exports such as agricultural products and energy. Liquefied petroleum gas (LPG), for example, accounts for 45 percent of global exports and could lose its price advantage to Middle Eastern competitors if shipping costs increase by 20 percent. This would lead to a "self-destruct wall" of US export competitiveness.

In addition, if the bill is implemented, liner companies may reduce their reliance on US ports, and instead transit through neighboring ports such as Canada and Mexico, resulting in the marginalization of the US hub status.

Long-term paradox: Protectionism fails to revive the US shipbuilding industry

Although the bill attempts to revive the domestic shipping industry by subsidizing American ships (up to $1 million in discounts per voyage), the reality is difficult to overcome, starting with the shipbuilding capacity gap: U.S. shipyars hold only 0.1% of the world's orders, and the delivery cycle is as long as 5-7 years, unable to meet short-term demand. Second, the US shipbuilding cost disadvantage is unsolved: it costs about $250 million to build a very large container ship in the US, while China only costs $160 million (Clarkson data). Clarkson research said that the 301 investigation in the United States began during Biden's inauguration, and the current delivery cycle of major shipyards is generally long, and some ship delivery times even exceed the term of the current U.S. government Trump. So whether or how much impact it will have on the new shipbuilding market remains to be seen.

In addition, Clarkson also said that if the policy is eventually implemented, it may cause some orders to spill over to shipyards outside of China in Asia, such as South Korea. India's shipbuilding industry has recently released a series of initiatives, but compared with the high tone of news slogans, it is necessary to pay attention to the actual progress of Indian shipyards. According to Clarkson Research statistics, India's current new ship deliveries are only 50,000-100,000 revised tons/year, which is only the level of China's shipbuilding in the 1970s and 1980s.

Hans-Christian Olesen, CEO of Danish dry bulk giant Ultrabulk, said: "Such legislation will only distort the market, force ships to reroute inefficient routes, increase carbon emissions and logistics time, and ultimately harm the global economy."

The unbearable weight of globalised supply chains

If the US 301 investigation bill is passed, it will be another "precision explosion" to the global shipping system after the tariff war. However, in the highly connected shipping ecosystem, sanctions against China amount to a "double-edged sword" - US companies will be forced to swallow the bitter fruit of soaring costs, blocked exports and higher inflation. As the Financial Times commented: "Trump's success in reshaping seaborne trade could mean a structural rupture in global supply chains; If it fails, it will only increase the costs to an already fragile global trading system, and American companies and consumers will bear higher costs." In this game, there are no winners, only costs.

The Office of the United States Trade Representative (USTR) announced on February 21 that it intends to impose high U.S. port fees, about millions of dollars each time, on Chinese shipping companies, Chinese-built vessels, and operators of any fleet that includes at least one Chinese-built vessel or has ordered a new vessel at a Chinese shipyard.

The provisions include a cap on fees for Chinese ships entering U.S. ports on a single voyage, or $1,000 per net ton of cargo carried; Chinese-built ships will be charged up to US $1.5 million (over 50% of the fleet), US $750,000 (25%-50%) or US $500,000 (0%-25%) per voyage, depending on the proportion of Chinese-built ships in the fleet; For operators ordering Chinese ships, if the order of Chinese shipbuilding accounted for more than 50%, a single voyage fee of $1 million; 25%-50% charge $750,000; 0% to 25% charge $500,000.

USTR will hold a hearing before the International Trade Commission on March 24, 2025, and the public can apply to attend by March 10 and submit written comments by March 24. It will be up to US President Donald Trump to decide whether to proceed with the plan. The proposed measures, if passed, would be the second time the United States has used Section 301 to impose restrictions on Chinese industries, following tariffs imposed on China in 2018.

Data Perspective: The influence of Chinese shipbuilding

It is worth noting that Chinese-made vessels have a high share in the hands of global shipowners. In the face of absolute power, if the United States and this move by the United States may lead to higher freight costs, ultimately borne by the United States importers and the American people.

In the case of container ships, shipping data and consulting firm Alphaliner recently analyzed the fleets of the world's top 10 container shipping companies.

Sixty percent (306 vessels) of COSCO Shipping Lines (including OOCL) are built by Chinese shipyards.

Proportionately, nearly 50 per cent of the ships under Star Line are Chinese-built.

It is worth mentioning that the world's top three container shipping companies have a large number of ships built for Chinese shipyards.

Take CMA CGM, France's largest container line, which has 274 ships in its fleet built in Chinese shipyards.

MSC, the world's largest container shipping company, also has 220 ships built in China, while Maersk has nearly 200 ships built in China.

In the past two years, the global container shipping industry has set off a wave of new ship construction, if we look at the new ship orders of various shipping companies, we can see that the world's top 7 container shipping companies have ordered a large number of new ships in Chinese shipyards.

In addition, Clarkson research data also shows that the three companies held orders, Chinese construction accounted for more than 50%, of which Mediterranean companies held orders, the proportion of Chinese-built vessels as high as 92%. This also means that if the measures come into effect, liner companies will most likely face the same operational choices.

According to Clarkson Research, the overall figure shows that Chinese-made vessels now account for 23% of the global fleet.

According to data released by the Ministry of Industry and Information Technology on January 16, in 2024, China's shipbuilding completed 48.18 million deadweight tons, an increase of 13.8%; The new orders were 11305 million DWT, up 58.8% year on year; By the end of December 2024, hand-held orders stood at 208.72 million DWT, an increase of 49.7% year-on-year. In 2024, China's shipbuilding completions, new orders and hand-held orders will account for 55.7%, 74.1% and 63.1% of the global total in deadweight tons, and 50.3%, 68.2% and 55.4% in revised gross tons, respectively. The three major shipbuilding indicators have ranked first in the world for 15 consecutive years.

In addition, according to the China Industry News, Wang Dongbo, deputy secretary-general of the China Shipbuilding Industry Association, told the China Industry News reporter that "the number of new orders in 2024 has broken through a historical high, accounting for 74.1% of the world market share, which indicates that more than 70% of the ships built in the world in the next period of time are made in China."

By undermining the multilateral trading system, the US is hurting itself

China's Ministry of Commerce responded on February 23, 2025, saying that the US investigation conclusions "violate WTO rules," stressing that China has clarified its position through multiple rounds of communication, pointing out that the proposed US measures "harm others and harm themselves." A Commerce Ministry spokesman said:

- The US has already been ruled in violation of its Section 301 tariffs on China by the WTO, and this investigation further undermines the multilateral trading system.

- The proposed measures will increase the cost of shipping in the United States, increase inflationary pressures, and hurt the interests of American ports, shippers and workers, and there is opposition in the United States.

- The development of relevant industries in China is based on market principles and fair competition, and has always maintained the stability of the global industrial chain.

Peter Sand, chief analyst at Xeneta, said that if the Trangu government pushes through the policy, it may lead to further inflation through the supply chain cost transfer, saying: "The US side wants to crack down on China, but in the end it will be the US importers who pay the bill." Chinese shipbuilding accounted for 61% of new ship orders globally, and 43% of international ship calls at U.S. ports involved "China-linked" vessels (Clarkson data). If shipping companies cannot absorb the new costs, they will inevitably pass them on to shippers in the form of higher freight rates and port surcharges. The National Retail Federation (NRF) warned that the move could raise the price of imported goods by 5 to 10 per cent, adding to already high inflationary pressures.

The Act mandates that US exports be carried by US-owned vessels, but the reality is that the US merchant fleet is only 0.4% of the world's size, and the cost of local shipbuilding is 2-3 times that of China (source: Clarkson). Forcing the use of high-priced US ships will directly push up logistics costs for exports such as agricultural products and energy. Liquefied petroleum gas (LPG), for example, accounts for 45 percent of global exports and could lose its price advantage to Middle Eastern competitors if shipping costs increase by 20 percent. This would lead to a "self-destruct wall" of US export competitiveness.

In addition, if the bill is implemented, liner companies may reduce their reliance on US ports, and instead transit through neighboring ports such as Canada and Mexico, resulting in the marginalization of the US hub status.

Long-term paradox: Protectionism fails to revive the US shipbuilding industry

Although the bill attempts to revive the domestic shipping industry by subsidizing American ships (up to $1 million in discounts per voyage), the reality is difficult to overcome, starting with the shipbuilding capacity gap: U.S. shipyars hold only 0.1% of the world's orders, and the delivery cycle is as long as 5-7 years, unable to meet short-term demand. Second, the US shipbuilding cost disadvantage is unsolved: it costs about $250 million to build a very large container ship in the US, while China only costs $160 million (Clarkson data). Clarkson research said that the 301 investigation in the United States began during Biden's inauguration, and the current delivery cycle of major shipyards is generally long, and some ship delivery times even exceed the term of the current U.S. government Trump. So whether or how much impact it will have on the new shipbuilding market remains to be seen.

In addition, Clarkson also said that if the policy is eventually implemented, it may cause some orders to spill over to shipyards outside of China in Asia, such as South Korea. India's shipbuilding industry has recently released a series of initiatives, but compared with the high tone of news slogans, it is necessary to pay attention to the actual progress of Indian shipyards. According to Clarkson Research statistics, India's current new ship deliveries are only 50,000-100,000 revised tons/year, which is only the level of China's shipbuilding in the 1970s and 1980s.

Hans-Christian Olesen, CEO of Danish dry bulk giant Ultrabulk, said: "Such legislation will only distort the market, force ships to reroute inefficient routes, increase carbon emissions and logistics time, and ultimately harm the global economy."

The unbearable weight of globalised supply chains

If the US 301 investigation bill is passed, it will be another "precision explosion" to the global shipping system after the tariff war. However, in the highly connected shipping ecosystem, sanctions against China amount to a "double-edged sword" - US companies will be forced to swallow the bitter fruit of soaring costs, blocked exports and higher inflation. As the Financial Times commented: "Trump's success in reshaping seaborne trade could mean a structural rupture in global supply chains; If it fails, it will only increase the costs to an already fragile global trading system, and American companies and consumers will bear higher costs." In this game, there are no winners, only costs.