Trump's revival of the US shipping industry could trigger a new round of supply chain disruption

Trump's plan to revive the U.S. shipping industry could impose huge costs on shipping operators and trigger a new round of supply chain disruption around the world, according to several industry executives.

According to a draft executive order seen by Reuters on Thursday, the Trump administration plans to fund a Renaissance in the U.S. shipbuilding industry by imposing potentially high port fees on Chinese-made vessels and the fleets that own them.

"Policymakers must reconsider these damaging proposals and look for alternatives that support American industry," said Joe Kramek, CEO of WSC.

While the stated goal of Trump's plan is to revive America's flagging shipbuilding industry and weaken China's dominance in global shipping, the downbeat outlook from industry executives shows that Trump's policies can sometimes have unintended consequences that run counter to their stated goals.

In the short term, shipowners are likely to cut back on U.S. port calls to limit fees, executives said. A flood of extra cargo could clog those ports, making it difficult for imports to reach retailers and manufacturers and for exports to be loaded onto ships.

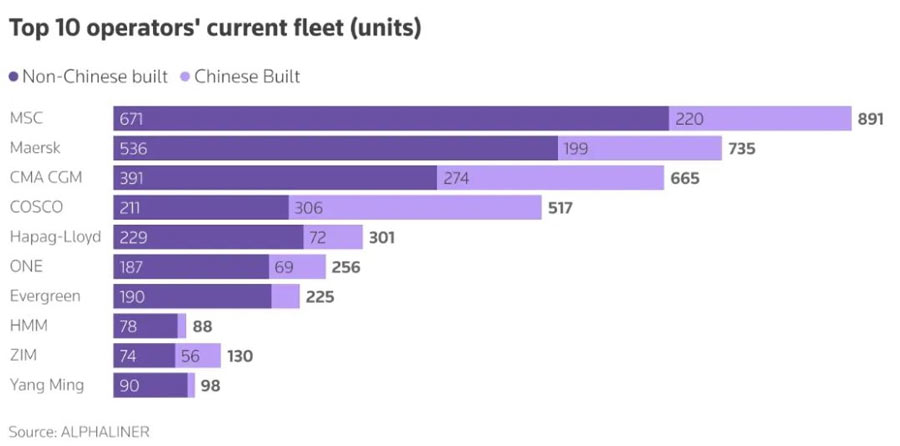

Trump's plan could also put pressure on companies to redeploy their global fleets to refocus non-Chinese-made ships on the U.S. market - something that could cost time and money, they said.

Soren Toft, CEO of MSC, the world's largest container shipping company, said at the TPM conference that MSC may skip smaller ports such as the Port of Oakland, California, to mitigate the impact. The Port of Auckland is an important gateway for fresh beef, dairy and almond exports.

Executives have warned that such moves could "overwhelm" the nation's largest port, repeating the disruptions to global trade flows caused by earlier outbreaks.

"It's hard for us and our partners to absorb all of this at once," Beth Rooney, director of the Port of New York and New Jersey, the largest on the U.S. East Coast, said of the potential surge in shipments.

"If there is a regulation, at least let it be forward-looking," Mr Toft said of the costs associated with Chinese-made ships.

At the same time, French container shipping company CMA CGM is expanding its fleet of U.S.-flagged American Presidential Steamships (APL) and exploring manufacturing vessels in the United States. "We are talking to several shipyards to see how long it will take and what it will cost," CMA CGM Chief Executive Rodolphe Saade said in an interview published on Friday.

Denmark's Maersk said on Friday it was too early to comment on new tariffs or fees as everything was changing too quickly and nothing had been decided.

According to a draft executive order seen by Reuters on Thursday, the Trump administration plans to fund a Renaissance in the U.S. shipbuilding industry by imposing potentially high port fees on Chinese-made vessels and the fleets that own them.

"Policymakers must reconsider these damaging proposals and look for alternatives that support American industry," said Joe Kramek, CEO of WSC.

While the stated goal of Trump's plan is to revive America's flagging shipbuilding industry and weaken China's dominance in global shipping, the downbeat outlook from industry executives shows that Trump's policies can sometimes have unintended consequences that run counter to their stated goals.

In the short term, shipowners are likely to cut back on U.S. port calls to limit fees, executives said. A flood of extra cargo could clog those ports, making it difficult for imports to reach retailers and manufacturers and for exports to be loaded onto ships.

Trump's plan could also put pressure on companies to redeploy their global fleets to refocus non-Chinese-made ships on the U.S. market - something that could cost time and money, they said.

Soren Toft, CEO of MSC, the world's largest container shipping company, said at the TPM conference that MSC may skip smaller ports such as the Port of Oakland, California, to mitigate the impact. The Port of Auckland is an important gateway for fresh beef, dairy and almond exports.

Executives have warned that such moves could "overwhelm" the nation's largest port, repeating the disruptions to global trade flows caused by earlier outbreaks.

"It's hard for us and our partners to absorb all of this at once," Beth Rooney, director of the Port of New York and New Jersey, the largest on the U.S. East Coast, said of the potential surge in shipments.

"If there is a regulation, at least let it be forward-looking," Mr Toft said of the costs associated with Chinese-made ships.

At the same time, French container shipping company CMA CGM is expanding its fleet of U.S.-flagged American Presidential Steamships (APL) and exploring manufacturing vessels in the United States. "We are talking to several shipyards to see how long it will take and what it will cost," CMA CGM Chief Executive Rodolphe Saade said in an interview published on Friday.

Denmark's Maersk said on Friday it was too early to comment on new tariffs or fees as everything was changing too quickly and nothing had been decided.