The largest dry bulk shipowner in the US does not rule out an exit from the US market

On April 1, Genco Shipping (referred to as "Genco"), the largest dry bulk carrier in the United States, said that if the United States implements the proposed fee policy for Chinese ships, the company may pass on the related costs to American exporters to bear the additional costs, and does not rule out the deployment of ships to other routes.

Genco CEO John Wobensmith said in an interview with Bloomberg that the company does not have ships built in the United States, but has a large number of Chinese-built vessels. If US President Donald Trump imposes additional fees on Chinese ships, the company has developed a comprehensive response plan.

Wobensmith's response is clear: either redeploy ships to other trade routes or pass the cost on to consumers. He noted that only 10 percent of Genco's revenue comes from the United States, with the remaining 90 percent coming from the rest of the world. The company has added a clause to the charter party to make it clear that any additional tolls or port charges will be borne by the end user.

He also bluntly said that US-made ships suitable for dry bulk transport "almost do not exist". While Genco fully supports the revitalization of the U.S. shipbuilding industry, it could take decades to restore shipyard capacity and develop a professional workforce.

Genco Shipping, headquartered in New York City, is the largest bulk carrier operator in the United States. Of the 42 ships it operates, 33 ships are built in Chinese shipyards: Dayang Shipbuilding (formerly New Ocean Shipbuilding, 9), Waigaoqiao Shipbuilding (8), Qingdao Yangfan (5), Dalian COSCO Shipping Kawasaki (3), Jiangsu Hantong (3), China Shipping Sumixi (2), Nantong COSCO Shipping Kawasaki (2) and Dalian Shipbuilding (1).

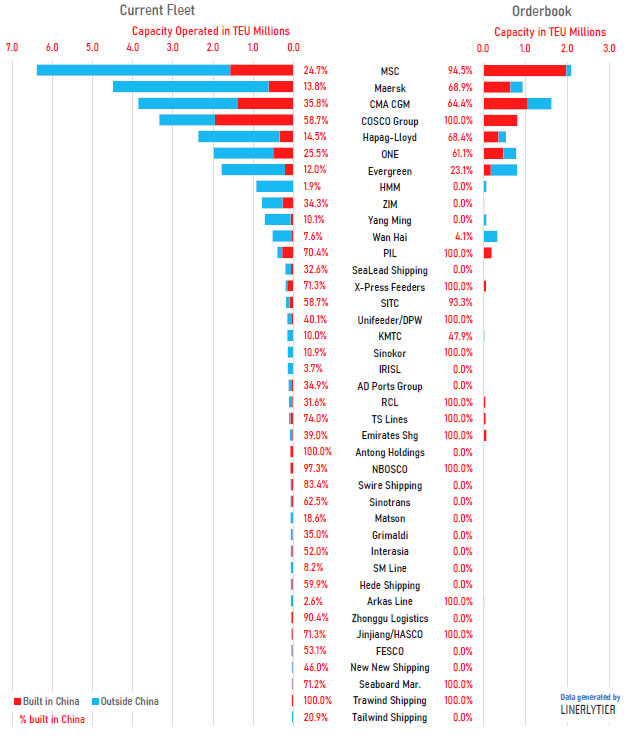

At present, among the world's top ten container shipping giants, China's shipbuilding accounts for a significant proportion. According to Linerlytica, five companies have more than 20 per cent of their existing fleets built in China. Specifically (from more to less) : Cosco Shipping (58.7%) CMA CGM Shipping (35.8%), Star Line (34.3%), ONE (25.5%), Mediterranean Shipping (24.7%), Hapal-Lloyd (14.5%), Maersk (13.8%), Evergreen Shipping (12%), Yangming Shipping (10.1%), HMM (1.9%).

In terms of new shipbuilding orders, all of COsco Shipping's new ships were built in Chinese yards, followed by Mediterranean Shipping (94.5%), Maersk (68.9%), Hapag-Lloyd (68.4%), CMA CGM Lines (64.4%), ONE (61.1%) and Evergreen Shipping (23.1%). HMM, Yangming Shipping and Star Shipping have not placed orders at Chinese yards.

Genco CEO John Wobensmith said in an interview with Bloomberg that the company does not have ships built in the United States, but has a large number of Chinese-built vessels. If US President Donald Trump imposes additional fees on Chinese ships, the company has developed a comprehensive response plan.

Wobensmith's response is clear: either redeploy ships to other trade routes or pass the cost on to consumers. He noted that only 10 percent of Genco's revenue comes from the United States, with the remaining 90 percent coming from the rest of the world. The company has added a clause to the charter party to make it clear that any additional tolls or port charges will be borne by the end user.

He also bluntly said that US-made ships suitable for dry bulk transport "almost do not exist". While Genco fully supports the revitalization of the U.S. shipbuilding industry, it could take decades to restore shipyard capacity and develop a professional workforce.

Genco Shipping, headquartered in New York City, is the largest bulk carrier operator in the United States. Of the 42 ships it operates, 33 ships are built in Chinese shipyards: Dayang Shipbuilding (formerly New Ocean Shipbuilding, 9), Waigaoqiao Shipbuilding (8), Qingdao Yangfan (5), Dalian COSCO Shipping Kawasaki (3), Jiangsu Hantong (3), China Shipping Sumixi (2), Nantong COSCO Shipping Kawasaki (2) and Dalian Shipbuilding (1).

At present, among the world's top ten container shipping giants, China's shipbuilding accounts for a significant proportion. According to Linerlytica, five companies have more than 20 per cent of their existing fleets built in China. Specifically (from more to less) : Cosco Shipping (58.7%) CMA CGM Shipping (35.8%), Star Line (34.3%), ONE (25.5%), Mediterranean Shipping (24.7%), Hapal-Lloyd (14.5%), Maersk (13.8%), Evergreen Shipping (12%), Yangming Shipping (10.1%), HMM (1.9%).

In terms of new shipbuilding orders, all of COsco Shipping's new ships were built in Chinese yards, followed by Mediterranean Shipping (94.5%), Maersk (68.9%), Hapag-Lloyd (68.4%), CMA CGM Lines (64.4%), ONE (61.1%) and Evergreen Shipping (23.1%). HMM, Yangming Shipping and Star Shipping have not placed orders at Chinese yards.

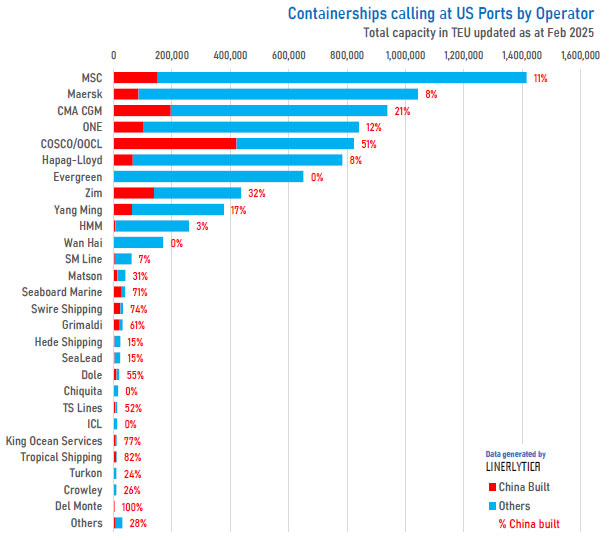

Linerlytica concluded that Chinese construction accounted for 17 percent of the container ships operating at U.S. ports. It is worth noting that the proportion of Chinese-made vessels in the fleet of shipping companies in China's Taiwan region is the lowest in the industry. Specifically, Evergreen Shipping and Wan Hai Shipping operate 100% of their fleets on U.S. routes that are not Chinese-built, while Yangming Shipping has 17% of its fleet on U.S. routes built in China.