Veson Nautical: Market Forecast for Q2 2025

Veson Nautical, the world's leading provider of maritime services, has released its latest market outlook for the tanker, container, dry bulk and natural gas segments in the second quarter of this year.

The report noted that geopolitical tensions in the Middle East and the resulting route diversions have disrupted the shipping market to varying degrees. The abrupt end of route diversions poses considerable downside risks to the shipping industry, while the prolonged delays resulting from diversions could provide significant upside potential. Sanctions add to the uncertainty, and any significant change will have a significant impact on the global economic outlook. At the same time, the proposed US tariff measures are also full of uncertainty, any countermeasures may affect the global shipping industry, and lead to the reduction of international trade and inflation continues to rise, the economic recovery of countries will also become a key factor affecting global demand.

Tanker market

With the volatility of oil prices, oil production changes, precautionary measures in the Red Sea, decision-making by Opec + countries, compliance by member countries, as well as China's continued economic growth and high crude oil imports and changes in refinery capacity, the tanker market is expected to remain volatile. While crude oil and refined product exports from Russia are likely to decrease, continued supply to Europe from other sources such as the Middle East, the United States and Latin America will maintain ton-mile demand and support freight rates going forward.

The data shows that tanker orders in 2024 are up 50% from 2023, but have slowed significantly so far in 2025. Although prices for new ships have stabilised, they remain high by historical standards. In addition, ongoing geopolitical uncertainty appears to be affecting current tanker ordering trends.

Range is the main driver of the recent strength of the tanker market. Eu and G7 sanctions on Russian oil imports and the re-planning of transport routes to avoid high-risk areas in the Red Sea have been positively affected. While there is no clear end in sight to these impacts, they pose a downside risk to tanker traffic.

Veson Nautical pointed out that in the coming year, China's oil demand and oil import demand rebound will help the tanker market recovery. The macroeconomic environment remains fragile, but some large economies are still grappling with slow GDP growth and interest rates are starting to fall, but consumers remain concerned about price pressures and the impact on disposable income.

Dry bulk carrier market

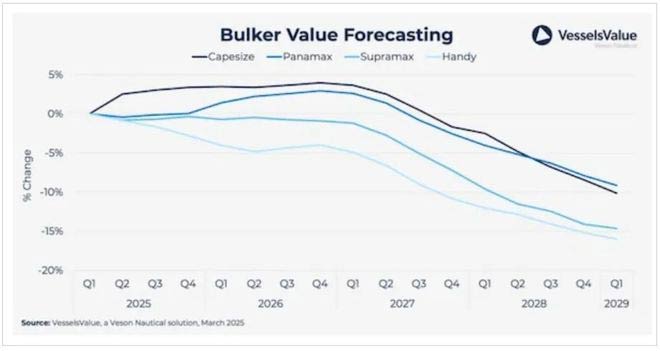

With very little order activity in recent years, supply growth for dry bulk carriers is expected to remain relatively low. However, with supply growth temporarily outpacing demand, this market balance is expected to moderate in 2025.

Although the dry bulk shipping sector has been less affected by the Red Sea diversion, many shipowners are still choosing longer routes around the Cape of Good Hope. This detour resulted in an approximately 1% increase in dry bulk tonnage miles, which had a positive impact on freight rates in 2024 and will continue to do so in 2025.

Consolidated market

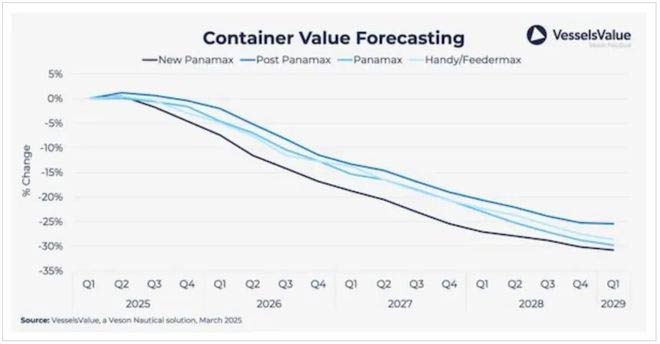

It is calculated that the ton-mile demand growth for container shipping in 2024 is expected to be 17.1%, mainly due to high activity in total volume and longer voyage due to the diversion of the Red Sea. According to Veson Nautical's analysis, the growth in demand for container shipping between 2025 and 2028 will be modest.

An increase in cargo volume and distance travelled often leads to an increase in freight rates. Container ships are travelling 1.5 per cent faster on average compared to 2023, but the agency expects average speeds to decline over the forecast period due to a gloomier outlook and stricter environmental regulations. As more and more vessels enter the market, it is expected that the freight rate of this type of vessel will decline steadily in 2025.

Given the high ordering activity in recent years, net fleet growth is expected to reach 8.2% between 2025 and 2028. Panamax container ships have been the hottest order type in the past few years, but the recent ordering trend has shifted to very large container ships, mainly because the ships are usually traded on the Asia-Europe route, which is most affected by the channel adjustment. At present, container ship orders account for 29.6% of the total fleet. In addition, ship breaking activity in this area has been relatively low, but it is expected to increase in the future.

Energy transportation market

Veson Nautical noted that liquefied petroleum gas (LPG) production in the United States will grow steadily over the forecast period. Production increased by 5.9% in 2024 and is expected to grow by another 5.4% in 2025. In the coming years, several natural gas production projects will support further growth of LPG.

LPG demand in the Asia-Pacific region continues to grow, with imports increasing by about 11% in 2024. Shipments from the United States to China grew 37 percent, positively impacting global ton-mile demand.

The efficiency of coasters vessels and small liquefied gas vessels is expected to decrease slightly due to increased extreme weather. However, overcapacity and weak demand remain, causing major concerns for the petrochemical industry, with chemical companies showing few signs of recovery.

The report noted that geopolitical tensions in the Middle East and the resulting route diversions have disrupted the shipping market to varying degrees. The abrupt end of route diversions poses considerable downside risks to the shipping industry, while the prolonged delays resulting from diversions could provide significant upside potential. Sanctions add to the uncertainty, and any significant change will have a significant impact on the global economic outlook. At the same time, the proposed US tariff measures are also full of uncertainty, any countermeasures may affect the global shipping industry, and lead to the reduction of international trade and inflation continues to rise, the economic recovery of countries will also become a key factor affecting global demand.

Tanker market

With the volatility of oil prices, oil production changes, precautionary measures in the Red Sea, decision-making by Opec + countries, compliance by member countries, as well as China's continued economic growth and high crude oil imports and changes in refinery capacity, the tanker market is expected to remain volatile. While crude oil and refined product exports from Russia are likely to decrease, continued supply to Europe from other sources such as the Middle East, the United States and Latin America will maintain ton-mile demand and support freight rates going forward.

The data shows that tanker orders in 2024 are up 50% from 2023, but have slowed significantly so far in 2025. Although prices for new ships have stabilised, they remain high by historical standards. In addition, ongoing geopolitical uncertainty appears to be affecting current tanker ordering trends.

Range is the main driver of the recent strength of the tanker market. Eu and G7 sanctions on Russian oil imports and the re-planning of transport routes to avoid high-risk areas in the Red Sea have been positively affected. While there is no clear end in sight to these impacts, they pose a downside risk to tanker traffic.

Veson Nautical pointed out that in the coming year, China's oil demand and oil import demand rebound will help the tanker market recovery. The macroeconomic environment remains fragile, but some large economies are still grappling with slow GDP growth and interest rates are starting to fall, but consumers remain concerned about price pressures and the impact on disposable income.

Dry bulk carrier market

With very little order activity in recent years, supply growth for dry bulk carriers is expected to remain relatively low. However, with supply growth temporarily outpacing demand, this market balance is expected to moderate in 2025.

Although the dry bulk shipping sector has been less affected by the Red Sea diversion, many shipowners are still choosing longer routes around the Cape of Good Hope. This detour resulted in an approximately 1% increase in dry bulk tonnage miles, which had a positive impact on freight rates in 2024 and will continue to do so in 2025.

Consolidated market

It is calculated that the ton-mile demand growth for container shipping in 2024 is expected to be 17.1%, mainly due to high activity in total volume and longer voyage due to the diversion of the Red Sea. According to Veson Nautical's analysis, the growth in demand for container shipping between 2025 and 2028 will be modest.

An increase in cargo volume and distance travelled often leads to an increase in freight rates. Container ships are travelling 1.5 per cent faster on average compared to 2023, but the agency expects average speeds to decline over the forecast period due to a gloomier outlook and stricter environmental regulations. As more and more vessels enter the market, it is expected that the freight rate of this type of vessel will decline steadily in 2025.

Given the high ordering activity in recent years, net fleet growth is expected to reach 8.2% between 2025 and 2028. Panamax container ships have been the hottest order type in the past few years, but the recent ordering trend has shifted to very large container ships, mainly because the ships are usually traded on the Asia-Europe route, which is most affected by the channel adjustment. At present, container ship orders account for 29.6% of the total fleet. In addition, ship breaking activity in this area has been relatively low, but it is expected to increase in the future.

Energy transportation market

Veson Nautical noted that liquefied petroleum gas (LPG) production in the United States will grow steadily over the forecast period. Production increased by 5.9% in 2024 and is expected to grow by another 5.4% in 2025. In the coming years, several natural gas production projects will support further growth of LPG.

LPG demand in the Asia-Pacific region continues to grow, with imports increasing by about 11% in 2024. Shipments from the United States to China grew 37 percent, positively impacting global ton-mile demand.

The efficiency of coasters vessels and small liquefied gas vessels is expected to decrease slightly due to increased extreme weather. However, overcapacity and weak demand remain, causing major concerns for the petrochemical industry, with chemical companies showing few signs of recovery.