Due to tariffs, orders have been cancelled, with a total of 360,000 TEUs of transport capacity cancelled

Container liner companies are implementing voyage cancellations on a larger scale than they did at the beginning of the COVID-19 pandemic five years ago. Due to the increase in tariffs, some trade has become unprofitable. American importers are canceling or suspending orders on a large scale, forcing shipping companies to take more aggressive measures to suspend navigation.

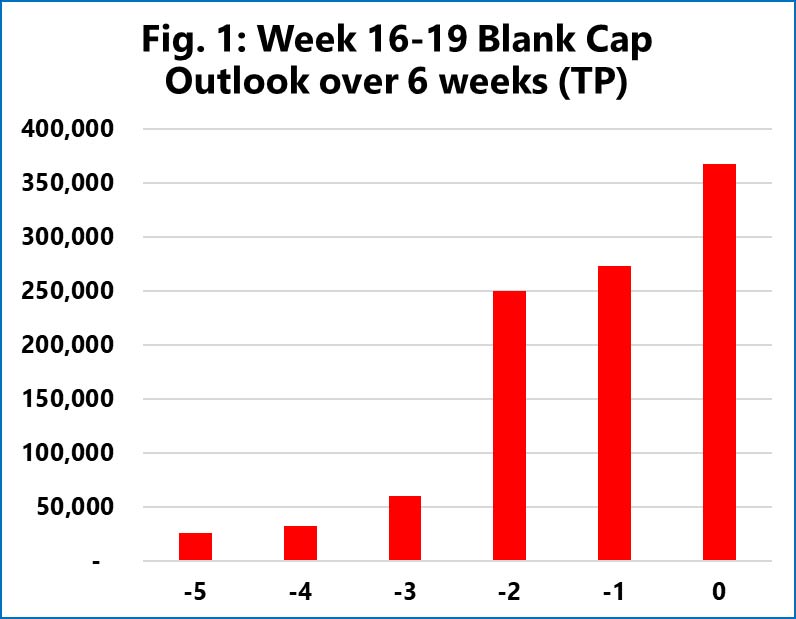

According to the latest report from Sea-Intelligence, a Danish maritime data analysis company, during the 16th to 19th weeks (mid-April to early May), the cumulative cancelled capacity has soared to 367,800 TEUs, a fivefold increase compared to three weeks ago. The planned capacity of the Asia-North America West Coast route has decreased by 12% compared to six weeks ago, while the decline of the Asia-North America East Coast route is even greater, reaching 14%. Some ships even left the port with "empty cabins".

The Port of Long Beach and the Port of Los Angeles in California are the two ports with the largest throughput in the United States. According to the Global Times, based on the forecast data of the Port of Los Angeles, the port's throughput dropped by 43% year-on-year in the first week of May this year, while the cargo volume of the Port of Long Beach may plummet by 20% in the second half of the year.

Alan Murphy, the chief executive of Sea-Intelligence, said the surge in cancelled voyages in the past two weeks was "shocking", indicating that the decline in demand next month could be even more severe. Murphy said that based on the analysis of the actual reduction in capacity, "Shipping companies currently expect container demand in the 18th week to be 28% lower than expected, while the cargo volume of the Asia-North America East Coast route in the 19th week may be 42% lower than expected."

Freight forwarders said that the booking volume from Southeast Asia to the United States performed better than that on the China route. This might be due to the fact that the high tariffs imposed by the United States on goods from Vietnam and Cambodia were suspended for 90 days. According to data from Vizion, a shipping visualization service provider, and Dun & Bradstreet, an analytics firm, since March 31, weekly booking volumes for China's exports have plummeted by 37%, while booking volumes for imports in Southeast Asia have risen by 10%.

Earlier this month, US retailers significantly lowered their import expectations for the second quarter and the second half of the year, warning that from May to August, the year-on-year decline in monthly imports would exceed 20%.

Many shipping giants are cutting capacity to cope with the demand winter

Although shipping companies have not directly suspended operations, they have dynamically adjusted their capacity deployment by canceling voyages or skipping ports.

After tariffs led to a decline in freight demand, shipping companies further reduced the capacity of routes to the United States. Recently, the Premier Alliance, a container alliance composed of three Asian shipping giants, Ocean Network Shipping (ONE), HMM and Yang Ming Marine Transport, has decided to suspend the Trans-Pacific cargo route to the United States that was originally scheduled to be opened next month.

It is reported that the Ocean Alliance, which consists of COSCO, CMA CGM, Evergreen Marine (EMC) and OOCL, will cancel three routes to Los Angeles at the end of April. ZIM, a non-ocean alliance shipping company, has also issued a notice, deciding to directly suspend the above routes for two months.

The HBB route operated by Evergreen Marine (affiliated with the Ocean Alliance) has cancelled voyages to Los Angeles and Oakland for four consecutive weeks, reducing capacity by 8,000 to 12,000 TEUs per week. This route is affiliated with Ocean Alliance, and its Busan Port call service covers the South Korean market. The latest data shows that since the Trump administration announced reciprocal tariffs, South Korea's exports in the first 20 days of April decreased by 5% year-on-year.

The influence is not limited to the Chinese market. Recently, due to the continuous political and economic pressure exerted by US President Trump on Venezuela, Maersk and CMA CGM announced that they would cease the jointly operated Ceiba Express route starting from this month.

This shipping route originally connected several ports such as the Port of Everglades in Florida, the United States, Kingston in Jamaica, La Guaira in Venezuela, and the Port of Santo Tomas de Castilla. Originally, two CMA CGM container ships and one Maersk container ship were deployed, with a turnaround time of three weeks.

An executive of an independent US shipping company said that although no further cancellations of Chinese booking volumes have been seen yet, as shipping companies prepare for low freight volumes, the number of calls at Chinese ports may decrease. "We haven't seen an increase in booking cancellations yet, but the market remains weak," he told Business Daily. "In the short term, shipping companies may integrate their services on Chinese routes."

Amid the wave of shipping suspensions, North American freight rates are under pressure against the trend

The suspension of shipping by shipping companies means that the capacity on the routes will be reduced accordingly. According to the usual pattern, this helps to raise the current freight rate. However, the freight rates on the North American route are declining.

The latest Shanghai Export Container Comprehensive Freight Index released by the Shanghai Shipping Exchange shows that on April 11th, the market freight rates (ocean freight and ocean surcharges) from Shanghai Port to the West Coast of the United States and the base port of the East Coast of the United States were $2,202 /FEU and $3,226 /FEU respectively, down 4.8% and 2.4% from the previous period.

In contrast, during the same period, the freight rate from Shanghai Port to the Mediterranean was $2,144 per TEU, an increase of 5.7% compared to the previous period. The market freight rate to Australia and New Zealand was $890 per TEU, an increase of 6.1% compared to the previous period. The market freight rate to South America was $1,566 per TEU, an increase of 9.1% compared to the previous period.

The report points out that in the short term, the "tariff friction" has already begun to have a certain impact on the transportation market of the China-Us route. Some goods have had their shipping plans cancelled, and the booking of space in the spot market has decreased significantly, with prices adjusted slightly. A 2024 study by Haberkorn et al. revealed that after the United States imposed tariffs on China from 2018 to 2019, for every 1% increase in tariffs, trade volume would decline by 1% one year after the tariffs were implemented, demonstrating the high sensitivity of trade to tariffs.

According to the latest report from Sea-Intelligence, a Danish maritime data analysis company, during the 16th to 19th weeks (mid-April to early May), the cumulative cancelled capacity has soared to 367,800 TEUs, a fivefold increase compared to three weeks ago. The planned capacity of the Asia-North America West Coast route has decreased by 12% compared to six weeks ago, while the decline of the Asia-North America East Coast route is even greater, reaching 14%. Some ships even left the port with "empty cabins".

The Port of Long Beach and the Port of Los Angeles in California are the two ports with the largest throughput in the United States. According to the Global Times, based on the forecast data of the Port of Los Angeles, the port's throughput dropped by 43% year-on-year in the first week of May this year, while the cargo volume of the Port of Long Beach may plummet by 20% in the second half of the year.

Alan Murphy, the chief executive of Sea-Intelligence, said the surge in cancelled voyages in the past two weeks was "shocking", indicating that the decline in demand next month could be even more severe. Murphy said that based on the analysis of the actual reduction in capacity, "Shipping companies currently expect container demand in the 18th week to be 28% lower than expected, while the cargo volume of the Asia-North America East Coast route in the 19th week may be 42% lower than expected."

Freight forwarders said that the booking volume from Southeast Asia to the United States performed better than that on the China route. This might be due to the fact that the high tariffs imposed by the United States on goods from Vietnam and Cambodia were suspended for 90 days. According to data from Vizion, a shipping visualization service provider, and Dun & Bradstreet, an analytics firm, since March 31, weekly booking volumes for China's exports have plummeted by 37%, while booking volumes for imports in Southeast Asia have risen by 10%.

Earlier this month, US retailers significantly lowered their import expectations for the second quarter and the second half of the year, warning that from May to August, the year-on-year decline in monthly imports would exceed 20%.

Many shipping giants are cutting capacity to cope with the demand winter

Although shipping companies have not directly suspended operations, they have dynamically adjusted their capacity deployment by canceling voyages or skipping ports.

After tariffs led to a decline in freight demand, shipping companies further reduced the capacity of routes to the United States. Recently, the Premier Alliance, a container alliance composed of three Asian shipping giants, Ocean Network Shipping (ONE), HMM and Yang Ming Marine Transport, has decided to suspend the Trans-Pacific cargo route to the United States that was originally scheduled to be opened next month.

It is reported that the Ocean Alliance, which consists of COSCO, CMA CGM, Evergreen Marine (EMC) and OOCL, will cancel three routes to Los Angeles at the end of April. ZIM, a non-ocean alliance shipping company, has also issued a notice, deciding to directly suspend the above routes for two months.

The HBB route operated by Evergreen Marine (affiliated with the Ocean Alliance) has cancelled voyages to Los Angeles and Oakland for four consecutive weeks, reducing capacity by 8,000 to 12,000 TEUs per week. This route is affiliated with Ocean Alliance, and its Busan Port call service covers the South Korean market. The latest data shows that since the Trump administration announced reciprocal tariffs, South Korea's exports in the first 20 days of April decreased by 5% year-on-year.

The influence is not limited to the Chinese market. Recently, due to the continuous political and economic pressure exerted by US President Trump on Venezuela, Maersk and CMA CGM announced that they would cease the jointly operated Ceiba Express route starting from this month.

This shipping route originally connected several ports such as the Port of Everglades in Florida, the United States, Kingston in Jamaica, La Guaira in Venezuela, and the Port of Santo Tomas de Castilla. Originally, two CMA CGM container ships and one Maersk container ship were deployed, with a turnaround time of three weeks.

An executive of an independent US shipping company said that although no further cancellations of Chinese booking volumes have been seen yet, as shipping companies prepare for low freight volumes, the number of calls at Chinese ports may decrease. "We haven't seen an increase in booking cancellations yet, but the market remains weak," he told Business Daily. "In the short term, shipping companies may integrate their services on Chinese routes."

Amid the wave of shipping suspensions, North American freight rates are under pressure against the trend

The suspension of shipping by shipping companies means that the capacity on the routes will be reduced accordingly. According to the usual pattern, this helps to raise the current freight rate. However, the freight rates on the North American route are declining.

The latest Shanghai Export Container Comprehensive Freight Index released by the Shanghai Shipping Exchange shows that on April 11th, the market freight rates (ocean freight and ocean surcharges) from Shanghai Port to the West Coast of the United States and the base port of the East Coast of the United States were $2,202 /FEU and $3,226 /FEU respectively, down 4.8% and 2.4% from the previous period.

In contrast, during the same period, the freight rate from Shanghai Port to the Mediterranean was $2,144 per TEU, an increase of 5.7% compared to the previous period. The market freight rate to Australia and New Zealand was $890 per TEU, an increase of 6.1% compared to the previous period. The market freight rate to South America was $1,566 per TEU, an increase of 9.1% compared to the previous period.

The report points out that in the short term, the "tariff friction" has already begun to have a certain impact on the transportation market of the China-Us route. Some goods have had their shipping plans cancelled, and the booking of space in the spot market has decreased significantly, with prices adjusted slightly. A 2024 study by Haberkorn et al. revealed that after the United States imposed tariffs on China from 2018 to 2019, for every 1% increase in tariffs, trade volume would decline by 1% one year after the tariffs were implemented, demonstrating the high sensitivity of trade to tariffs.