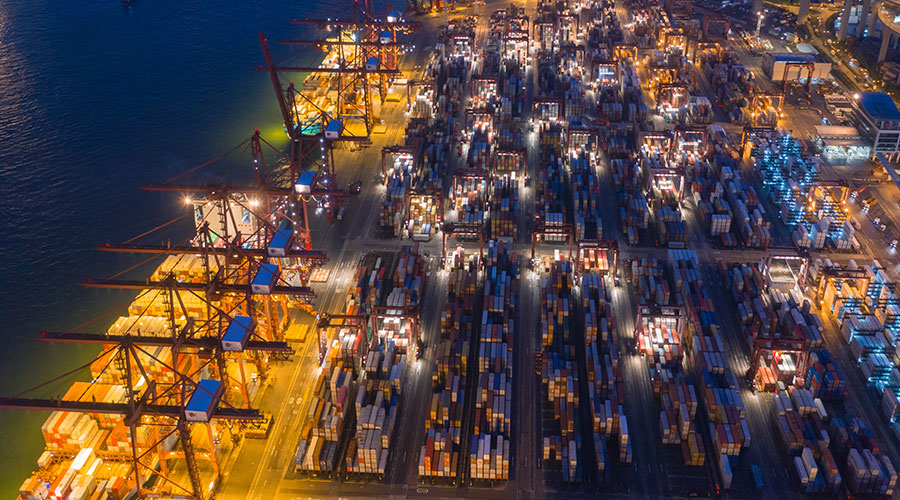

The space is tight and the container booking volume has soared by nearly 300%

The tariff war between China and the United States has hit the pause button, bringing a glimmer of "breathing space" to the long-tense trans-Pacific container shipping market. Since the two countries announced in Geneva on May 12 the cancellation of reciprocal and retaliatory tariffs and the suspension of the 24% tariff for 90 days, the market has responded promptly: freight rates have risen, booking space has picked up, and there has been a surge in shipments.

Ben Tracy, vice president of strategic business development at Vizion, said this is directly related to the suspension of tariffs.

Meanwhile, Hapag-Lloyd also disclosed during its first-quarter earnings call that the company's booking volume for its China-Us routes increased by 50% quarter-on-quarter at the beginning of this week, far exceeding the market's inertial fluctuation range. Hapag-lloyd's CEO Rolf Habben Jansen pointed out in an interview: "With the easing of Sino-US trade relations, we expect the volume of goods between the two sides to increase further. The situation in the past few days has confirmed this trend."

In response to the "cabin rush" caused by the sharp increase in demand during the window period, many liner companies promptly raised the GRI (Comprehensive Rate Increase Surcharge). It is rumored online that the FAK (basic freight rate) for the West Coast of the United States route is reported to be $3,000- $3,200 per FEU, and for the East Coast of the United States, it is even approaching $4,200 per FEU. More strikingly, the GRI rate, which began on June 1st, has been predicted to be as high as $2,000 to $3,000, recreating the "diamond-class" cabin prices during the pandemic - $7,500 on the US West Coast and $8,500 on the US East Coast.

Market insiders say that considering the average voyage period of the China-Us route is 22 days, although the 24% tariff between China and the US has been suspended for 90 days, the actual shipping window is extremely limited. Based on the effective time of the US customs clearance, the current round of reciprocal tariffs will be suspended for 90 days, starting from May 14th. Considering the voyage factor, goods destined for the West Coast of the United States must leave the port by the end of July at the latest, while those destined for the East Coast of the United States must be dispatched by mid-July. In other words, the actual operational shipping cycle is only a little over two months left.

Most analysts believe that spot freight rates will rise in the short term and may lead to the early arrival of the traditional peak season in the third quarter.

Peter Sand, the chief analyst of Xeneta, said: "Usually the third quarter is the peak season for the Marine container market. But if enterprises want to complete imports as soon as possible before the tariff changes, the peak season this year may start earlier."

However, he also cautioned that although the current tariff has been reduced from 145% to 30%, this rate is still not low. For many products with lower profit margins, the import cost remains relatively high. The recovery of demand for some low value-added goods may be relatively slow, and the overall demand for sea transportation will still be somewhat restrained.

He also pointed out that considering many enterprises have reduced their procurement pace from China after the US announced a significant tax increase in early April, it is not easy to restore supply chains and production capacity in a short period of time. "It will still take some time for enterprises to resume procurement and production in China."

Judah Levine, the chief analyst of Freightos, pointed out that the current minimum tariff of 30% is already higher than the maximum tariff level set for some goods during Trump's first term. Even so, according to the data released by the National Retail Federation of the United States, when facing at least 20% tariffs on China in March, American importers still chose to stock up in advance. The import volume from March to April was 11% higher than that of the same period in 2024.

He further pointed out that once demand rebounds rapidly, the market will face the pressure of tight shipping space and equipment shortages, and an increase in freight rates will be almost inevitable. "This will lead to a large number of ships and containers arriving at US ports in the coming weeks, which may cause congestion and delays at the source and destination."

Although short-term demand may be boosted, analysts generally believe that the softening of Trans-Pacific freight rates over the past few months is still difficult to be completely reversed. The root cause lies in Trump's high unpredictability of trade policies.

Against the backdrop of intensified competition among shipping alliances and continuous growth in capacity, even if the peak season arrives earlier, freight rates are unlikely to return to last year's peak level. Levine pointed out that the current freight rates have dropped by more than 30% compared with the same period last year, and some of the demand has also been met through the previous rush transportation.

Ben Tracy, vice president of strategic business development at Vizion, said this is directly related to the suspension of tariffs.

Meanwhile, Hapag-Lloyd also disclosed during its first-quarter earnings call that the company's booking volume for its China-Us routes increased by 50% quarter-on-quarter at the beginning of this week, far exceeding the market's inertial fluctuation range. Hapag-lloyd's CEO Rolf Habben Jansen pointed out in an interview: "With the easing of Sino-US trade relations, we expect the volume of goods between the two sides to increase further. The situation in the past few days has confirmed this trend."

In response to the "cabin rush" caused by the sharp increase in demand during the window period, many liner companies promptly raised the GRI (Comprehensive Rate Increase Surcharge). It is rumored online that the FAK (basic freight rate) for the West Coast of the United States route is reported to be $3,000- $3,200 per FEU, and for the East Coast of the United States, it is even approaching $4,200 per FEU. More strikingly, the GRI rate, which began on June 1st, has been predicted to be as high as $2,000 to $3,000, recreating the "diamond-class" cabin prices during the pandemic - $7,500 on the US West Coast and $8,500 on the US East Coast.

Market insiders say that considering the average voyage period of the China-Us route is 22 days, although the 24% tariff between China and the US has been suspended for 90 days, the actual shipping window is extremely limited. Based on the effective time of the US customs clearance, the current round of reciprocal tariffs will be suspended for 90 days, starting from May 14th. Considering the voyage factor, goods destined for the West Coast of the United States must leave the port by the end of July at the latest, while those destined for the East Coast of the United States must be dispatched by mid-July. In other words, the actual operational shipping cycle is only a little over two months left.

Most analysts believe that spot freight rates will rise in the short term and may lead to the early arrival of the traditional peak season in the third quarter.

Peter Sand, the chief analyst of Xeneta, said: "Usually the third quarter is the peak season for the Marine container market. But if enterprises want to complete imports as soon as possible before the tariff changes, the peak season this year may start earlier."

However, he also cautioned that although the current tariff has been reduced from 145% to 30%, this rate is still not low. For many products with lower profit margins, the import cost remains relatively high. The recovery of demand for some low value-added goods may be relatively slow, and the overall demand for sea transportation will still be somewhat restrained.

He also pointed out that considering many enterprises have reduced their procurement pace from China after the US announced a significant tax increase in early April, it is not easy to restore supply chains and production capacity in a short period of time. "It will still take some time for enterprises to resume procurement and production in China."

Judah Levine, the chief analyst of Freightos, pointed out that the current minimum tariff of 30% is already higher than the maximum tariff level set for some goods during Trump's first term. Even so, according to the data released by the National Retail Federation of the United States, when facing at least 20% tariffs on China in March, American importers still chose to stock up in advance. The import volume from March to April was 11% higher than that of the same period in 2024.

He further pointed out that once demand rebounds rapidly, the market will face the pressure of tight shipping space and equipment shortages, and an increase in freight rates will be almost inevitable. "This will lead to a large number of ships and containers arriving at US ports in the coming weeks, which may cause congestion and delays at the source and destination."

Although short-term demand may be boosted, analysts generally believe that the softening of Trans-Pacific freight rates over the past few months is still difficult to be completely reversed. The root cause lies in Trump's high unpredictability of trade policies.

Against the backdrop of intensified competition among shipping alliances and continuous growth in capacity, even if the peak season arrives earlier, freight rates are unlikely to return to last year's peak level. Levine pointed out that the current freight rates have dropped by more than 30% compared with the same period last year, and some of the demand has also been met through the previous rush transportation.