Under the restriction of multiple factors, how does the shipping company choose the port of call?

With the Red Sea crisis causing detours and port congestion on the one hand, and the global fleet capacity growing on the other, how will liner companies choose to call ports? How will the route network be adjusted? Last week MDS Transmodal, a consultancy, offered some insight.

First, we understand the difference between a hub and spoke network and a direct service network. After the announcement of the "Gemini" alliance between Maersk and Hapag-Lloyd, the hub-and-spoke network is widely known, in the hub-and-spoke network, the trunk ship only calls at a few hub ports (hub), other ports by small boats to connect the hub port for cargo transfer, and some of the routes that are now heavily attached to the transfer port can be classified as such.

The direct connection network is both rain and rain, will be directly connected to some non-hub ports, such as previously, Maersk's Asia-Europe route will be connected to Ulsan, Gwangyang and other regional small gateway ports, if there is no direct service, these ports have to rely on Busan, Qingdao and even Shanghai and other ports.

MDS Transmodal said the Red Sea crisis has prompted liner companies to rethink their hub-and-spoke networks and add direct connection services to absorb excess capacity and reduce the impact of port congestion, as detailed below:

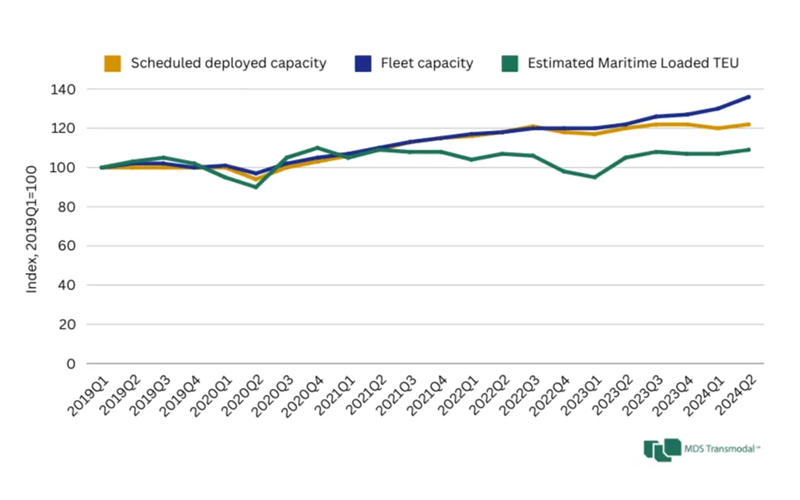

In the second quarter of 2024, global fleet capacity (that is, the capacity available to shipping companies) on ocean-going routes increased by 11.5% year on year, indicating that more new ships are coming to market, but at the same time, the capacity planned to be deployed by shipping companies increased by only 1.8%. As shown in the chart above, since the fourth quarter of 2022, shipping companies' fleet capacity has been growing faster than planned deployment, and the gap between the two has been widening.

The reason why there is such a gap is related to the design of the route. Fleet capacity is the total capacity that a shipping company can deploy, and the planned deployment is the capacity actually invested. For example, two ships with a total capacity of 2000TEU deployed on a weekly route can be converted into 52000TEU planned deployment capacity, but with three more ships, the total fleet capacity reaches 5000TEU, if the port of call becomes less and the turnover days become longer, the planned deployment capacity may not increase.

Over the past year, the longer and longer routes around the Cape of Good Hope, and the fewer ports of call, mean that shipping companies are more inclined to use the hub-and-spoke network, or to move to more direct services? The MDS Transmodal analysis compares changes in planned deployment capacity across different types of ocean routes.

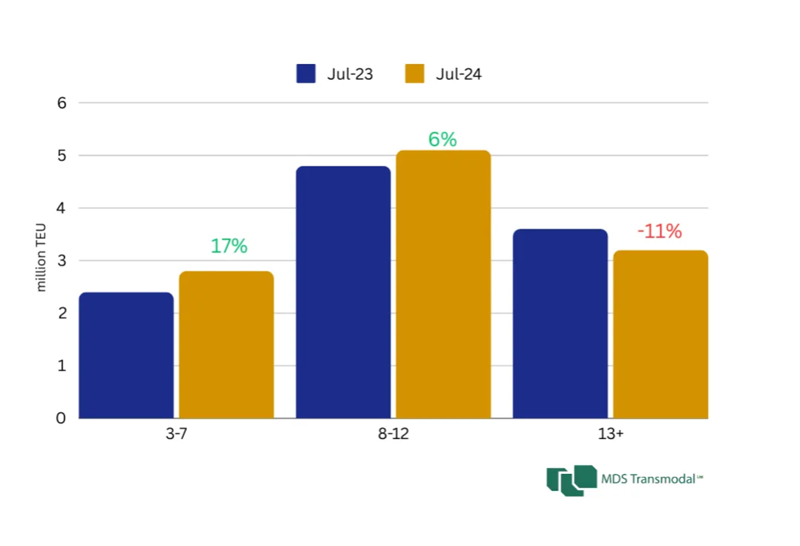

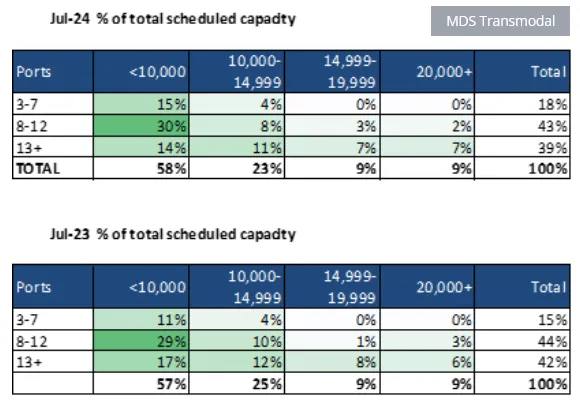

On routes connecting three to seven ports, planned capacity increased by 17%, from 2.4 million TEU to 2.8 million TEU, and the share of total capacity increased from 22% to 25%;

On routes calling 8-12 ports, planned capacity increased by 6%, from 4.8 million TEU to 5.1 million TEU, and the share of total capacity increased from 44% to 46%;

On routes with more than 13 ports, planned capacity fell 11 per cent, from 3.6 million TEU to 3.2 million TEU, and from 33 per cent to 29 per cent of total capacity.

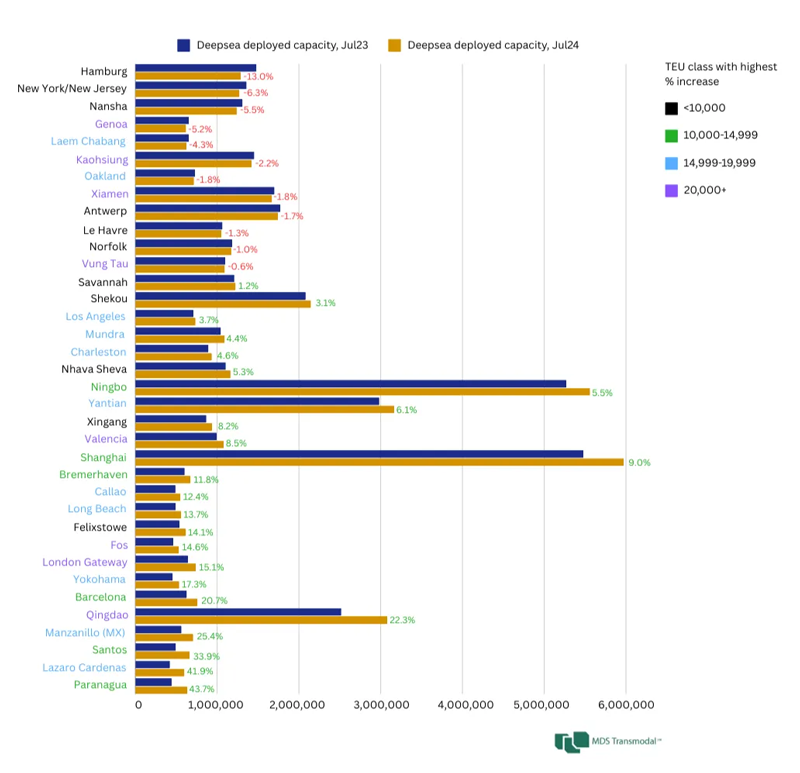

In addition, ship types are also changing, with trends in ship deployment showing that hub-and-spoke networks are being scaled back or suspended (as hub-and-spoke networks use larger ships more). Compared with larger ships, ships below 15,000 TEU account for a larger proportion of routes with fewer ports of call, and the average capacity of ships deployed on some recently opened direct routes is below 10,000 TEU.

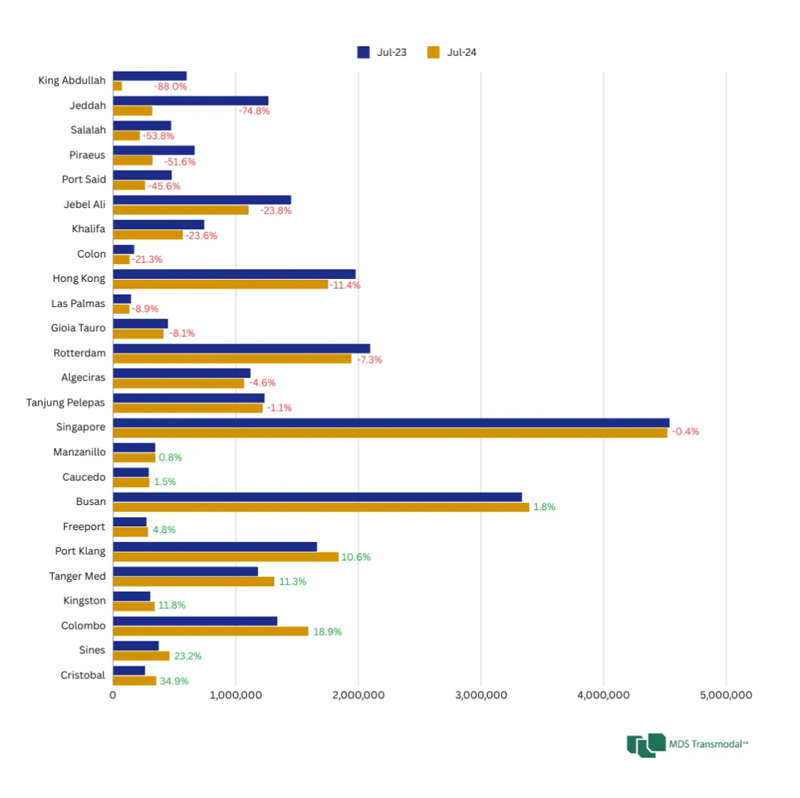

Combined with the changes in the docking capacity of the transshipment port and the gateway port, it shows that in order to adapt to the Red Sea crisis, the liner industry prefers to use flexible small boats to fly directly to the gateway port, while reducing the docking port and providing more direct and efficient services. This change absorbs a lot of capacity and avoids blocking in some large transshipment ports, but also brings a burden to some large gateway ports.

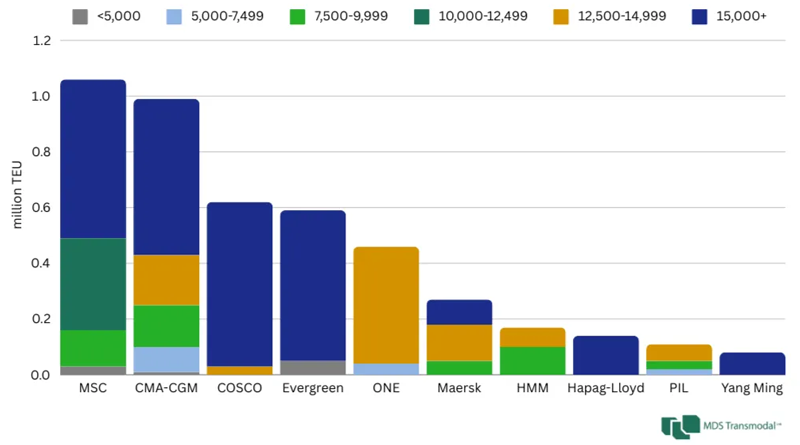

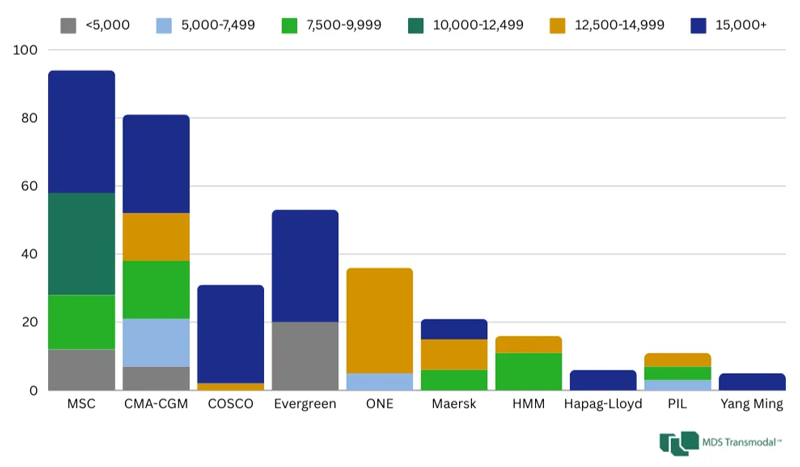

After the Red Sea crisis, this capacity will be released again, and how the shipping companies will choose to call ports, from the existing order structure of the shipping companies can be seen. Among the top 10 liner companies, MSC is particularly special, with 62% of its orders for new ships under 12,500TEU, and the total capacity accounts for about half of the total order capacity, which indicates that MSC may pay more attention to providing flexible and flexible services after flying alone. In the most stable ocean alliance, the orders of CMA, COSCO Shipping and Evergreen are dominated by ships of more than 15,000 TEU. Various shipping companies struggling in the liner industry have already made some preliminary plans.

First, we understand the difference between a hub and spoke network and a direct service network. After the announcement of the "Gemini" alliance between Maersk and Hapag-Lloyd, the hub-and-spoke network is widely known, in the hub-and-spoke network, the trunk ship only calls at a few hub ports (hub), other ports by small boats to connect the hub port for cargo transfer, and some of the routes that are now heavily attached to the transfer port can be classified as such.

The direct connection network is both rain and rain, will be directly connected to some non-hub ports, such as previously, Maersk's Asia-Europe route will be connected to Ulsan, Gwangyang and other regional small gateway ports, if there is no direct service, these ports have to rely on Busan, Qingdao and even Shanghai and other ports.

MDS Transmodal said the Red Sea crisis has prompted liner companies to rethink their hub-and-spoke networks and add direct connection services to absorb excess capacity and reduce the impact of port congestion, as detailed below:

In the second quarter of 2024, global fleet capacity (that is, the capacity available to shipping companies) on ocean-going routes increased by 11.5% year on year, indicating that more new ships are coming to market, but at the same time, the capacity planned to be deployed by shipping companies increased by only 1.8%. As shown in the chart above, since the fourth quarter of 2022, shipping companies' fleet capacity has been growing faster than planned deployment, and the gap between the two has been widening.

The reason why there is such a gap is related to the design of the route. Fleet capacity is the total capacity that a shipping company can deploy, and the planned deployment is the capacity actually invested. For example, two ships with a total capacity of 2000TEU deployed on a weekly route can be converted into 52000TEU planned deployment capacity, but with three more ships, the total fleet capacity reaches 5000TEU, if the port of call becomes less and the turnover days become longer, the planned deployment capacity may not increase.

Over the past year, the longer and longer routes around the Cape of Good Hope, and the fewer ports of call, mean that shipping companies are more inclined to use the hub-and-spoke network, or to move to more direct services? The MDS Transmodal analysis compares changes in planned deployment capacity across different types of ocean routes.

On routes connecting three to seven ports, planned capacity increased by 17%, from 2.4 million TEU to 2.8 million TEU, and the share of total capacity increased from 22% to 25%;

On routes calling 8-12 ports, planned capacity increased by 6%, from 4.8 million TEU to 5.1 million TEU, and the share of total capacity increased from 44% to 46%;

On routes with more than 13 ports, planned capacity fell 11 per cent, from 3.6 million TEU to 3.2 million TEU, and from 33 per cent to 29 per cent of total capacity.

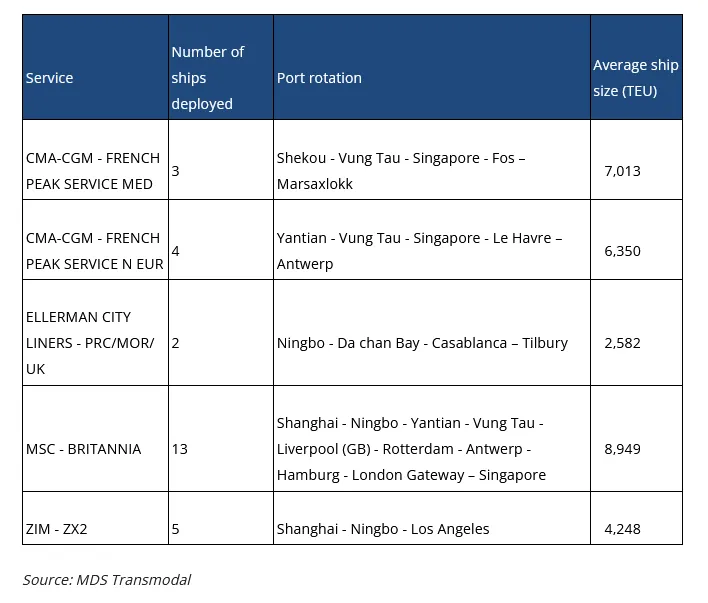

Some direct routes have been opened recently

In addition, ship types are also changing, with trends in ship deployment showing that hub-and-spoke networks are being scaled back or suspended (as hub-and-spoke networks use larger ships more). Compared with larger ships, ships below 15,000 TEU account for a larger proportion of routes with fewer ports of call, and the average capacity of ships deployed on some recently opened direct routes is below 10,000 TEU.

Combined with the changes in the docking capacity of the transshipment port and the gateway port, it shows that in order to adapt to the Red Sea crisis, the liner industry prefers to use flexible small boats to fly directly to the gateway port, while reducing the docking port and providing more direct and efficient services. This change absorbs a lot of capacity and avoids blocking in some large transshipment ports, but also brings a burden to some large gateway ports.

After the Red Sea crisis, this capacity will be released again, and how the shipping companies will choose to call ports, from the existing order structure of the shipping companies can be seen. Among the top 10 liner companies, MSC is particularly special, with 62% of its orders for new ships under 12,500TEU, and the total capacity accounts for about half of the total order capacity, which indicates that MSC may pay more attention to providing flexible and flexible services after flying alone. In the most stable ocean alliance, the orders of CMA, COSCO Shipping and Evergreen are dominated by ships of more than 15,000 TEU. Various shipping companies struggling in the liner industry have already made some preliminary plans.