The container index has fallen by more than 40%, and shipping companies are constantly adjusting freight rates

Recently, the container freight rate, which hit a new high in the first half of the year, has been significantly loosened. On the one hand, a number of shipping giants began to reduce the quotation, the Asia-Europe route 40-foot container rate from about $9,000 in July to the current $8,000 below; On the other hand, the futures market also passed the signal of price loosening, and multiple contracts of container index (European line) futures fell collectively on the 8th.

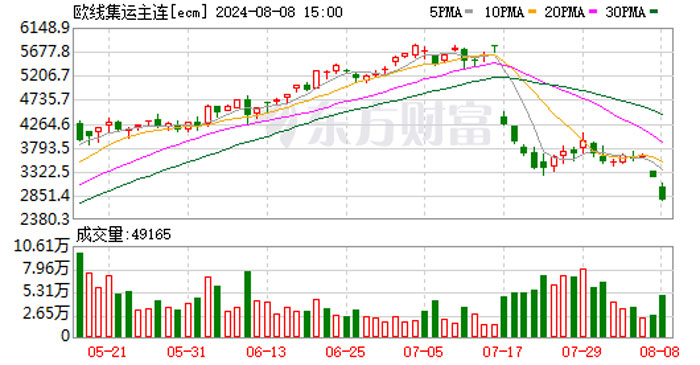

On August 8, the main futures contract of the Shanghai International Energy Trading Center's consolidated transportation index (European line) was at 2754.9 points, down more than 15%. In the past more than a month, the main futures contract of the container index (European line) has fallen from the previous high of 4763.6 points to the current 2800 points, which has fallen by more than 40%. As a result, shipping stocks also fell. Shanghai Shipping Exchange data show that on August 2, the Shanghai export container comprehensive freight index fell for four consecutive weeks, down more than 400 points from the recent high, a decline of more than 10%.

The freight index (European line) suddenly plunged

On August 8, the main futures contract of the container index (European line) plunged, and the intra-day decline once expanded to 15%.

Shanghai International Energy Trading Center listed on the consolidated transport index (European line) futures contracts fell collectively. As of the close, the main contract EC2412 was at 2,754.9 points, down 15.03%. EC2408 and EC2410 were down 0.40% and 7.77% respectively. EC2502, EC2504, EC2506 fell by about 10%. From the situation after the close of the 8th, EC2412 has a deep discount of nearly 20% compared with EC2410, which is significantly different from the off-peak season characteristics of the shipping market in the past.

Among them, the impact of weaker spot freight rates is particularly obvious. With the seasonal weakening of cargo volume and the increase of supply pressure of shipping companies, spot freight rates continued to adjust. The average price of wk32/33 is $8280 for large cabinets and $8180 for large cabinets, respectively, down $150 and $100 from the previous quarter.

Haitong Futures pointed out that the second drop in Maersk wk33 opening price also had an impact on market sentiment. The recent pace of price adjustment has accelerated, and the ship has dropped by 200-300 US dollars per round of price cuts. It is expected that the freight rate center will be further moved down in late August, and the frequency and amplitude of downward adjustment need to be observed later.

Huatai Futures pointed out that Asia-Europe route freight rates are usually higher in December than in October (only two exceptions in 2021 and 2022). Mainly because November and December are the small peak season for deliveries before the Chinese New Year, and these two months are the season for the signing and negotiation of the European offline one-year association, liner companies tend to actively regulate capacity prices. From the perspective of the supply side, in view of the monthly delivery of large container ships, it is expected that the supply pressure is large in December this year, but the shipping season and the liner company's year-end price may still exist, so the contract price in December should not be excessively lower than in October, there is a risk of narrowing the price gap.

The company's freight rate continues to fall far contract accelerated diving

From the spot index corresponding to futures, the Shanghai export container settlement Freight Index (SCFIS) has also been loosened recently. Europe and the United States West route freight rates have recently declined, the European route back 2.5%, the United States West route back more than 17%.

In the spot market, a number of shipping giants have recently begun to reduce the price of container freight. According to the data provided by some freight forwarders, the freight rate of large containers from Shanghai to Rotterdam dropped from a high of $9,000 in July to $7,900 in mid-August. Maersk reduced the freight rate of wk34 Europort twice, and further reduced the freight rate to Rotterdam bulk container to 7,300 US dollars. The second downgrades again put more pressure on the co-cabin MSC.

Haitong futures shipping researchers pointed out that weak economic data in Europe and the United States triggered fears of market recession, resulting in weaker demand for consolidated shipping, superimposed pressure on new ship delivery, and strong bearish sentiment in the consolidated shipping market. linerlytica, a shipping consultancy, believes that US recession fears are dominating the shipping market, with rates falling sharply on US-West routes, while rates are relatively strong on Northern European routes due to Red Sea detachings, port congestion and capacity constraints.

Zhonghui futures analyst Wu Mingnear believes that overall, the overall market sentiment is weak, the spot continues to fall, the macro recession trading expectations are amplified, superposition Maersk's recent continuous reduction in freight rates, the Middle East geopolitical factors "do not" also lead to the resumption of flight expectations, it is expected that the disk will be mainly weak in shock performance. On the technical side, the far month contract is still dominated by the idea of selling on a high. The short-term 2412 contract focuses on the weekly 20-day line support, and once it falls below the high probability, it will further open the space for a downward correction.

However, some freight forwarders have received news that based on market mechanism considerations, the current five major shipping companies in the world plan to increase the freight rate of the West and East routes of the United States by 9%-15% from August 15, with a high probability of an increase of $1,000.

Pay attention to the changing geopolitical situation

For the freight rate trend in the next stage, it is recommended to pay attention to three major marginal changes.

Container ship circumnavigation: Special attention is paid to whether the traffic volume of the Suez Canal, the Bab el-Mandeb Strait and the Gulf of Aden remains low, and whether the traffic volume of the Cape of Good Hope remains high, which directly affects the efficiency and cost of the route.

The geopolitical situation in the Middle East: Geopolitical uncertainty may affect Red Sea navigation, which in turn affects the global shipping layout and freight rates. If the situation eases, shipping companies need time to adjust routes, which will indirectly affect market supply and demand.

Capacity supply pressure: In the near term (until the second week of September), capacity supply pressure is expected to be low, as some of the new capacity is offset by detours and port congestion. However, it is necessary to pay attention to the actual situation of subsequent capacity delivery and its impact on freight rates.

In general. Institutional analysis believes that the recent overall sentiment of the shipping market is weak, and macro recession trading expectations are amplified. Subsequent attention should be paid to the status quo of container ships' circumnavigation, the geopolitical situation in the Middle East and the marginal changes in the delivery of shipping capacity. From the quotation of the shipping company, the freight center is expected to further decline from late August to early September.

On August 8, the main futures contract of the Shanghai International Energy Trading Center's consolidated transportation index (European line) was at 2754.9 points, down more than 15%. In the past more than a month, the main futures contract of the container index (European line) has fallen from the previous high of 4763.6 points to the current 2800 points, which has fallen by more than 40%. As a result, shipping stocks also fell. Shanghai Shipping Exchange data show that on August 2, the Shanghai export container comprehensive freight index fell for four consecutive weeks, down more than 400 points from the recent high, a decline of more than 10%.

The freight index (European line) suddenly plunged

On August 8, the main futures contract of the container index (European line) plunged, and the intra-day decline once expanded to 15%.

Shanghai International Energy Trading Center listed on the consolidated transport index (European line) futures contracts fell collectively. As of the close, the main contract EC2412 was at 2,754.9 points, down 15.03%. EC2408 and EC2410 were down 0.40% and 7.77% respectively. EC2502, EC2504, EC2506 fell by about 10%. From the situation after the close of the 8th, EC2412 has a deep discount of nearly 20% compared with EC2410, which is significantly different from the off-peak season characteristics of the shipping market in the past.

Among them, the impact of weaker spot freight rates is particularly obvious. With the seasonal weakening of cargo volume and the increase of supply pressure of shipping companies, spot freight rates continued to adjust. The average price of wk32/33 is $8280 for large cabinets and $8180 for large cabinets, respectively, down $150 and $100 from the previous quarter.

Haitong Futures pointed out that the second drop in Maersk wk33 opening price also had an impact on market sentiment. The recent pace of price adjustment has accelerated, and the ship has dropped by 200-300 US dollars per round of price cuts. It is expected that the freight rate center will be further moved down in late August, and the frequency and amplitude of downward adjustment need to be observed later.

Huatai Futures pointed out that Asia-Europe route freight rates are usually higher in December than in October (only two exceptions in 2021 and 2022). Mainly because November and December are the small peak season for deliveries before the Chinese New Year, and these two months are the season for the signing and negotiation of the European offline one-year association, liner companies tend to actively regulate capacity prices. From the perspective of the supply side, in view of the monthly delivery of large container ships, it is expected that the supply pressure is large in December this year, but the shipping season and the liner company's year-end price may still exist, so the contract price in December should not be excessively lower than in October, there is a risk of narrowing the price gap.

The company's freight rate continues to fall far contract accelerated diving

From the spot index corresponding to futures, the Shanghai export container settlement Freight Index (SCFIS) has also been loosened recently. Europe and the United States West route freight rates have recently declined, the European route back 2.5%, the United States West route back more than 17%.

In the spot market, a number of shipping giants have recently begun to reduce the price of container freight. According to the data provided by some freight forwarders, the freight rate of large containers from Shanghai to Rotterdam dropped from a high of $9,000 in July to $7,900 in mid-August. Maersk reduced the freight rate of wk34 Europort twice, and further reduced the freight rate to Rotterdam bulk container to 7,300 US dollars. The second downgrades again put more pressure on the co-cabin MSC.

Haitong futures shipping researchers pointed out that weak economic data in Europe and the United States triggered fears of market recession, resulting in weaker demand for consolidated shipping, superimposed pressure on new ship delivery, and strong bearish sentiment in the consolidated shipping market. linerlytica, a shipping consultancy, believes that US recession fears are dominating the shipping market, with rates falling sharply on US-West routes, while rates are relatively strong on Northern European routes due to Red Sea detachings, port congestion and capacity constraints.

Zhonghui futures analyst Wu Mingnear believes that overall, the overall market sentiment is weak, the spot continues to fall, the macro recession trading expectations are amplified, superposition Maersk's recent continuous reduction in freight rates, the Middle East geopolitical factors "do not" also lead to the resumption of flight expectations, it is expected that the disk will be mainly weak in shock performance. On the technical side, the far month contract is still dominated by the idea of selling on a high. The short-term 2412 contract focuses on the weekly 20-day line support, and once it falls below the high probability, it will further open the space for a downward correction.

However, some freight forwarders have received news that based on market mechanism considerations, the current five major shipping companies in the world plan to increase the freight rate of the West and East routes of the United States by 9%-15% from August 15, with a high probability of an increase of $1,000.

Pay attention to the changing geopolitical situation

For the freight rate trend in the next stage, it is recommended to pay attention to three major marginal changes.

Container ship circumnavigation: Special attention is paid to whether the traffic volume of the Suez Canal, the Bab el-Mandeb Strait and the Gulf of Aden remains low, and whether the traffic volume of the Cape of Good Hope remains high, which directly affects the efficiency and cost of the route.

The geopolitical situation in the Middle East: Geopolitical uncertainty may affect Red Sea navigation, which in turn affects the global shipping layout and freight rates. If the situation eases, shipping companies need time to adjust routes, which will indirectly affect market supply and demand.

Capacity supply pressure: In the near term (until the second week of September), capacity supply pressure is expected to be low, as some of the new capacity is offset by detours and port congestion. However, it is necessary to pay attention to the actual situation of subsequent capacity delivery and its impact on freight rates.

In general. Institutional analysis believes that the recent overall sentiment of the shipping market is weak, and macro recession trading expectations are amplified. Subsequent attention should be paid to the status quo of container ships' circumnavigation, the geopolitical situation in the Middle East and the marginal changes in the delivery of shipping capacity. From the quotation of the shipping company, the freight center is expected to further decline from late August to early September.